Irs Form 2106 Ez 2016

What is the IRS Form 2106 EZ

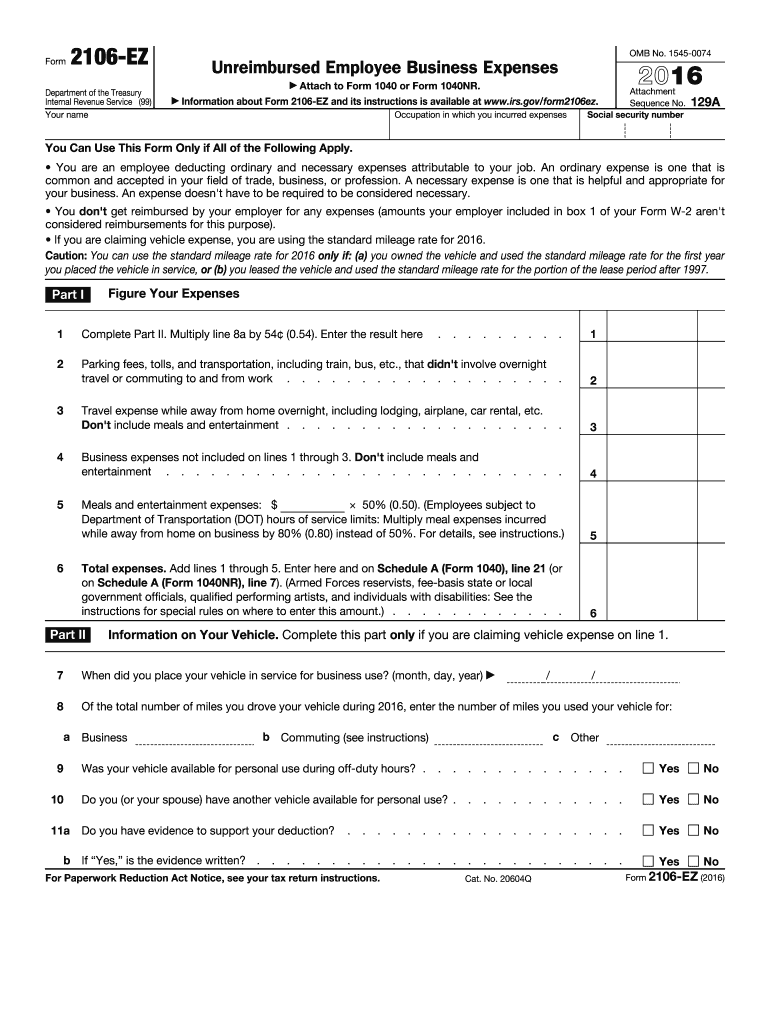

The IRS Form 2106 EZ is a simplified version of the standard Form 2106, used by employees to claim unreimbursed business expenses. This form is specifically designed for employees who do not receive reimbursement from their employers for business-related costs. It allows taxpayers to deduct expenses such as travel, meals, and entertainment that are necessary for their job. The form is particularly beneficial for individuals who have straightforward expense claims and prefer a streamlined process for reporting their deductions.

How to use the IRS Form 2106 EZ

Using the IRS Form 2106 EZ involves a few straightforward steps. First, gather all relevant documentation related to your business expenses, such as receipts and invoices. Next, accurately fill out the form by entering your personal information and detailing your expenses in the appropriate sections. The form allows you to summarize your costs without needing to provide extensive documentation, making it easier to complete. After filling out the form, ensure that you review it for accuracy before submitting it with your tax return.

Steps to complete the IRS Form 2106 EZ

Completing the IRS Form 2106 EZ requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including receipts for business expenses.

- Enter your name, Social Security number, and other personal information at the top of the form.

- List your unreimbursed business expenses in the designated sections, categorizing them as needed.

- Calculate the total amount of your expenses and enter this figure on the form.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the IRS Form 2106 EZ

The IRS Form 2106 EZ is legally recognized as a valid document for claiming business expense deductions. To ensure compliance, it is essential to follow IRS guidelines when completing the form. This includes accurately reporting all eligible expenses and maintaining proper documentation to support your claims. Failure to comply with IRS regulations may result in penalties or disallowance of deductions, so it is crucial to understand the legal implications of using this form.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 2106 EZ align with the general tax return deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns by April 15 of each year. If you require additional time, you may file for an extension, which typically grants you until October 15 to submit your return. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the IRS Form 2106 EZ, you will need several key documents:

- Receipts for all unreimbursed business expenses.

- Your employer's reimbursement policy, if applicable.

- Any relevant tax documents, such as W-2 forms.

Having these documents on hand will facilitate a smoother filing process and help ensure that your claims are accurate and complete.

Quick guide on how to complete 2016 irs form 2106 ez

Complete Irs Form 2106 Ez effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and eSign your documents promptly without delays. Manage Irs Form 2106 Ez on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Irs Form 2106 Ez with ease

- Obtain Irs Form 2106 Ez and click Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with features that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, and errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Form 2106 Ez and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs form 2106 ez

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs form 2106 ez

How to make an eSignature for your 2016 Irs Form 2106 Ez online

How to generate an electronic signature for the 2016 Irs Form 2106 Ez in Google Chrome

How to make an electronic signature for signing the 2016 Irs Form 2106 Ez in Gmail

How to make an electronic signature for the 2016 Irs Form 2106 Ez right from your mobile device

How to generate an eSignature for the 2016 Irs Form 2106 Ez on iOS devices

How to generate an eSignature for the 2016 Irs Form 2106 Ez on Android

People also ask

-

What is the Irs Form 2106 Ez and how is it used?

The Irs Form 2106 Ez is a simplified version of the IRS Form 2106, designed for employees who want to claim unreimbursed business expenses. This form allows you to deduct specific costs related to your job, such as travel and supplies, directly on your tax return. Utilizing airSlate SignNow can simplify the process of signing and submitting your Irs Form 2106 Ez electronically.

-

How can airSlate SignNow help me with my Irs Form 2106 Ez?

AirSlate SignNow streamlines the process of filling out and signing your Irs Form 2106 Ez by providing an easy-to-use interface for electronic signatures. You can quickly send the form to yourself or others for signing, ensuring that you meet all deadlines. With airSlate SignNow, managing your tax documents becomes hassle-free.

-

Is there a cost associated with using airSlate SignNow for the Irs Form 2106 Ez?

Yes, airSlate SignNow offers various pricing plans, including a free trial and subscription options that cater to different business needs. The cost-effectiveness of airSlate SignNow makes it an ideal choice for individuals and businesses needing to manage forms like the Irs Form 2106 Ez without breaking the bank.

-

What features does airSlate SignNow offer for managing the Irs Form 2106 Ez?

AirSlate SignNow includes features such as customizable templates, real-time tracking of document status, and secure storage for your Irs Form 2106 Ez. These functionalities ensure that your documents are organized, accessible, and compliant with IRS regulations, enhancing your overall workflow.

-

Can I integrate airSlate SignNow with other applications for the Irs Form 2106 Ez?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily import or export your Irs Form 2106 Ez and other documents, making it convenient to manage your business expenses.

-

What are the benefits of using airSlate SignNow for the Irs Form 2106 Ez?

Using airSlate SignNow for your Irs Form 2106 Ez provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. The ability to eSign documents reduces the time spent on manual signatures, allowing you to focus on your business, while also ensuring compliance with IRS standards.

-

Is airSlate SignNow secure for handling sensitive documents like the Irs Form 2106 Ez?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance measures to protect your sensitive documents. When managing your Irs Form 2106 Ez, you can trust that your information is safe and secure against unauthorized access.

Get more for Irs Form 2106 Ez

- Tx land gift deed form

- Joint tenancy warranty deedpdffillercom form

- Idaho residential real estate sales disclosure statement form

- Kansas general power of attorney for care and custody of child or children form

- New tenant welcome card form

- Boat bill of sale ny form

- Real contract kansas form

- Nevada articles of incorporation for domestic nonprofit corporation form

Find out other Irs Form 2106 Ez

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT