Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax under Section 6033e Irs 2014

What is the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

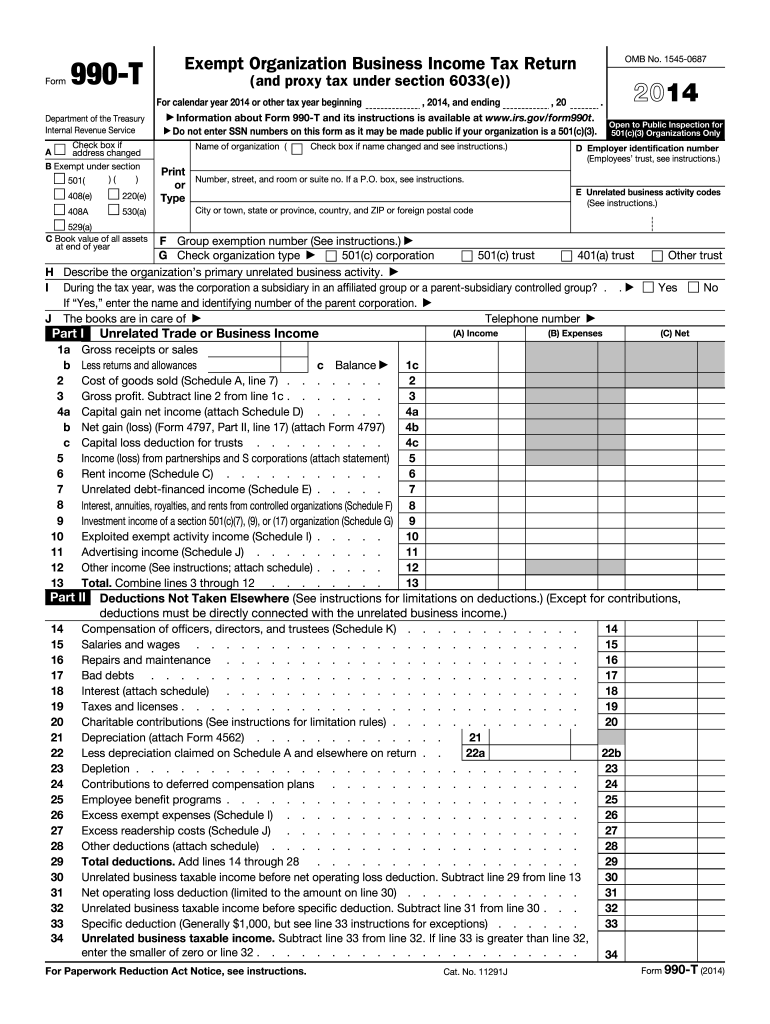

The Form 990 T Exempt Organization Business Income Tax Return is a tax form used by tax-exempt organizations to report unrelated business income. This form is essential for organizations that engage in business activities not directly related to their exempt purpose. Under Section 6033(e) of the Internal Revenue Code, organizations must also report proxy tax, which is a tax on certain lobbying expenditures. The form helps ensure compliance with IRS regulations and provides transparency regarding the financial activities of exempt organizations.

How to use the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

Using the Form 990 T involves several steps. First, organizations must determine if they have any unrelated business income that meets the reporting threshold. If so, they should gather necessary financial records, including income statements and expense reports. The form requires detailed information about the sources of income and related expenses. Organizations can complete the form electronically, which simplifies the filing process and enhances accuracy. It is important to ensure that all information is accurate and complete to avoid penalties.

Steps to complete the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

Completing the Form 990 T involves the following steps:

- Determine if the organization has unrelated business income.

- Gather financial records, including income and expenses related to the business activities.

- Fill out the form, providing details about income sources and expenses.

- Calculate any proxy tax owed based on lobbying expenditures.

- Review the completed form for accuracy and completeness.

- File the form electronically or via mail by the due date.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 T. Generally, the form is due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is typically due by May 15. If additional time is needed, organizations can file for an extension, which grants an additional six months for submission. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Legal use of the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

The legal use of the Form 990 T is crucial for maintaining compliance with IRS regulations. Tax-exempt organizations must accurately report any unrelated business income to avoid jeopardizing their tax-exempt status. Failure to file the form or inaccuracies can lead to penalties, including fines and loss of tax-exempt status. It is important for organizations to understand their obligations under Section 6033(e) regarding proxy taxes and ensure they meet all legal requirements when filing the form.

Key elements of the Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

Key elements of the Form 990 T include sections for reporting various types of income, such as gross receipts from unrelated business activities and expenses directly related to those activities. The form also requires organizations to report any proxy taxes owed due to lobbying expenditures. Additionally, organizations must provide information about their tax-exempt status and any changes in their operations that may affect their tax obligations. Understanding these elements is essential for accurate reporting and compliance.

Quick guide on how to complete 2014 form 990 t exempt organization business income tax return and proxy tax under section 6033e irs

Effortlessly prepare Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to conveniently find the right form and securely store it online. airSlate SignNow equips you with all the tools you need to create, amend, and electronically sign your documents quickly without delays. Manage Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and electronically sign Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs with ease

- Find Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to finalize your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes requiring new document copies. airSlate SignNow handles all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 990 t exempt organization business income tax return and proxy tax under section 6033e irs

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 990 t exempt organization business income tax return and proxy tax under section 6033e irs

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 990 T Exempt Organization Business Income Tax Return and Proxy Tax Under Section 6033e IRS?

Form 990 T is a tax return for exempt organizations that report unrelated business income. This form assesses the tax owed by the organization, which is crucial for compliance with IRS regulations. Understanding how this form works is essential for non-profits engaged in business activities.

-

How can airSlate SignNow help in filing Form 990 T Exempt Organization Business Income Tax Return?

airSlate SignNow simplifies the process of preparing and submitting Form 990 T Exempt Organization Business Income Tax Return by allowing users to gather signatures electronically. With its user-friendly interface, organizations can ensure timely filings while maintaining compliance with IRS requirements. This streamlines the tax filing process for exempt organizations.

-

What are the costs associated with using airSlate SignNow for filing Form 990 T?

airSlate SignNow offers cost-effective plans that cater to the needs of various organizations. Pricing is competitive, making it accessible for both small non-profits and larger entities. By investing in our solution, you can save time and reduce the hassle associated with filing Form 990 T Exempt Organization Business Income Tax Return.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features like customizable templates, electronic signatures, and document tracking that enhance the management of tax documents. These tools are particularly useful for handling Form 990 T Exempt Organization Business Income Tax Return, ensuring that all necessary information is captured efficiently. Our solution increases productivity and accuracy in document handling.

-

Are there any integrations available with airSlate SignNow for tax filing?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software to streamline the filing of Form 990 T Exempt Organization Business Income Tax Return. These integrations save time and enhance data accuracy by reducing the need for manual entry. Organizations can easily sync their tax data across platforms.

-

What benefits does airSlate SignNow provide for exempt organizations?

Using airSlate SignNow enables exempt organizations to efficiently manage their document workflows, particularly when dealing with Form 990 T Exempt Organization Business Income Tax Return. Benefits include quicker turnaround times, enhanced compliance, and improved document security. This allows organizations to focus more on their mission and less on clerical tasks.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents with encryption and secure access controls. When dealing with sensitive forms like Form 990 T Exempt Organization Business Income Tax Return, ensuring data safety is paramount. Our platform employs advanced security protocols to protect your information throughout the entire signing and filing process.

Get more for Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

- Revocation of general durable power of attorney indiana form

- Essential legal life documents for newlyweds indiana form

- Essential legal life documents for military personnel indiana form

- Essential legal life documents for new parents indiana form

- In attorney form

- Small business accounting package indiana form

- Company employment policies and procedures package indiana form

- Revocation of power of attorney for care of child or children indiana form

Find out other Form 990 T Exempt Organization Business Income Tax Return And Proxy Tax Under Section 6033e Irs

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure