656 Form 2012

What is the 656 Form

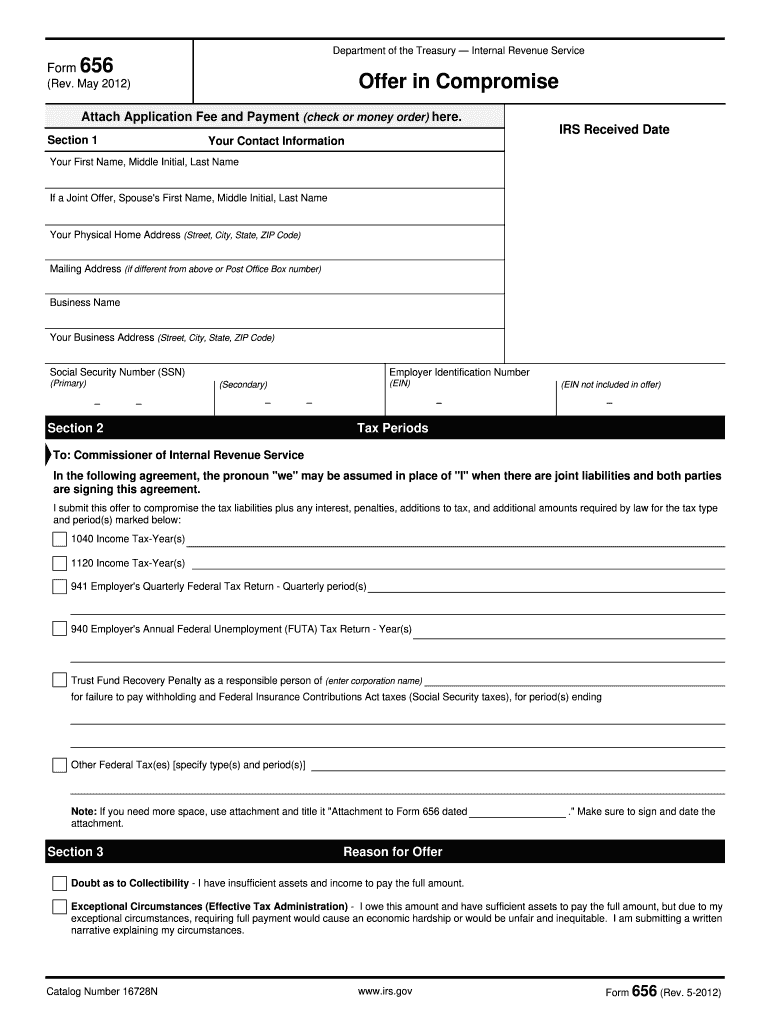

The 656 Form, also known as the Offer in Compromise, is a crucial document used by taxpayers in the United States to settle their tax debts with the Internal Revenue Service (IRS). This form allows individuals to propose a settlement amount that is less than the total tax owed. By submitting the 656 Form, taxpayers can seek relief from their tax liabilities based on their financial situation. The IRS reviews the application to determine whether the proposed offer is acceptable, considering factors such as income, expenses, and asset value.

How to use the 656 Form

Using the 656 Form involves several steps to ensure a successful submission. First, taxpayers must gather all necessary financial information, including income, expenses, and asset details. This information is essential for completing the form accurately. Next, individuals should fill out the form, providing all required details, including personal information and the proposed offer amount. Once completed, the form must be submitted to the IRS along with the appropriate payment for the application fee. It is important to keep copies of all documents submitted for personal records.

Steps to complete the 656 Form

Completing the 656 Form requires careful attention to detail. Here are the steps to follow:

- Gather financial documents, including income statements, bank statements, and expense records.

- Download the 656 Form from the IRS website or obtain a physical copy.

- Fill out the form, ensuring that all sections are completed accurately.

- Calculate your offer amount based on your financial situation.

- Include the appropriate application fee with your submission.

- Review the form for accuracy and completeness before sending it to the IRS.

Legal use of the 656 Form

The 656 Form is legally binding once it is accepted by the IRS. It is essential to understand that submitting this form does not guarantee acceptance. The IRS will evaluate the offer based on established guidelines and the taxpayer's financial circumstances. If the offer is accepted, the taxpayer will be required to adhere to the terms outlined in the agreement, including making the agreed-upon payments. Failure to comply with these terms may result in the reinstatement of the original tax liability.

Required Documents

When submitting the 656 Form, specific documents must accompany the application to support the proposed offer. These documents typically include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of monthly expenses, including bills and statements.

- Asset information, such as bank statements and property valuations.

- Any additional information that demonstrates financial hardship.

Filing Deadlines / Important Dates

Timeliness is critical when submitting the 656 Form. While there are no specific deadlines for submitting the form itself, taxpayers should be aware of any deadlines related to their tax liabilities. It is advisable to submit the form as soon as possible if facing financial difficulties. Additionally, the IRS may have specific timelines for responding to offers, typically within a few months. Keeping track of these timelines can help ensure compliance and facilitate a smoother resolution process.

Quick guide on how to complete 656 2012 form

Complete 656 Form effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct template and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 656 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign 656 Form with ease

- Find 656 Form and then click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Adjust and eSign 656 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 656 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 656 2012 form

The way to create an electronic signature for a PDF file online

The way to create an electronic signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is the 656 Form used for?

The 656 Form is an essential document used by individuals applying for an immigration benefit or waiver in the United States. It is part of the process for seeking a fee waiver for certain immigration applications. By utilizing airSlate SignNow, you can easily fill out and eSign the 656 Form, streamlining your application process.

-

How does airSlate SignNow support the completion of the 656 Form?

airSlate SignNow offers a user-friendly interface that allows you to efficiently complete and eSign the 656 Form online. Our platform provides templates and guidance to help you accurately fill out the form and ensure you have all the necessary information submitted correctly. This simplifies the often complicated immigration paperwork process.

-

Is there a cost to use airSlate SignNow for the 656 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including options for individuals and businesses. You can choose a plan that suits your budget while gaining access to all the essential features needed to fill out and eSign the 656 Form. Our pricing is designed to be cost-effective for everyone.

-

Can I store my completed 656 Form on airSlate SignNow?

Absolutely! With airSlate SignNow, you can securely store your completed 656 Form and other documents in the cloud. This ensures that your important immigration paperwork is easily accessible whenever you need it, while also providing peace of mind regarding document security.

-

What features does airSlate SignNow offer for eSigning the 656 Form?

airSlate SignNow includes advanced eSigning features that allow you to electronically sign the 656 Form quickly and securely. You can also add text, dates, and other necessary fields, making it simple to customize the form to meet your specific requirements and ensuring a smooth signing experience.

-

Does airSlate SignNow integrate with other applications for the 656 Form?

Yes, airSlate SignNow offers integrations with various applications, such as Google Drive, Dropbox, and CRM systems, enhancing your workflow when working with the 656 Form. These integrations allow you to easily upload, manage, and share your documents, making it more efficient to handle your immigration paperwork.

-

What are the benefits of using airSlate SignNow for the 656 Form?

Using airSlate SignNow for the 656 Form offers numerous benefits, including time savings, ease of use, and enhanced document security. Our platform helps you complete and eSign the form quickly, reducing the stress associated with immigration applications. Additionally, the ability to track document status ensures you never miss an important deadline.

Get more for 656 Form

- Privacy statement the department of transport and main roads is collecting the information on this form

- Fillable online certificate of reinstatement or renewal fax form

- Pptc 155 e child general passport application for canadians under 16 years of age applying in canada or the usa form

- 14 cfr4761 dealers aircraft registration certificates form

- Form apply for a registration certificate as an eea qualified

- Form mv725 ampquotaffidavit for titling ampamp registering of trailers and

- Ignition interlockmissouri department of transportation form

- Cpr and first aid training request form sds 361 1212

Find out other 656 Form

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement