Irs Form F656 2011

What is the IRS Form F656

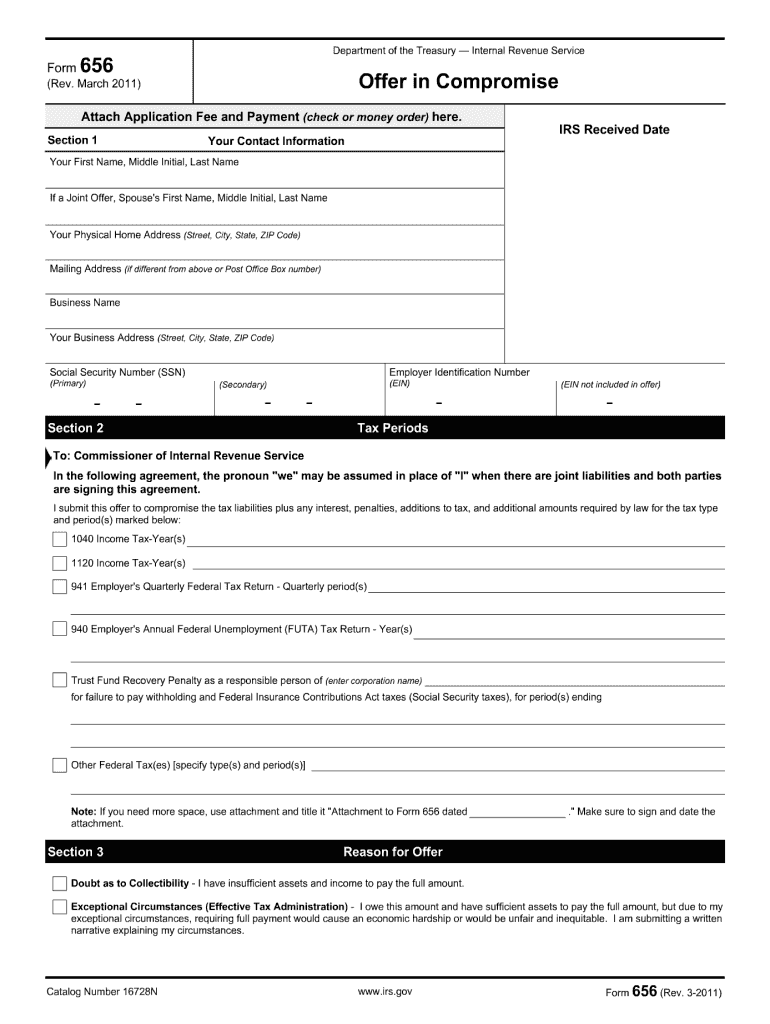

The IRS Form F656 is a specific tax form used for various purposes, including the documentation of certain tax-related requests or claims. This form is essential for taxpayers who need to communicate specific information to the IRS regarding their tax situation. Understanding the purpose and requirements of Form F656 is crucial for ensuring compliance with IRS regulations.

How to use the IRS Form F656

Using the IRS Form F656 involves completing the form accurately to convey the necessary information to the IRS. Taxpayers should first read the instructions provided with the form to understand the required fields. It is important to fill out all relevant sections, ensuring that all information is correct and up to date. After completing the form, taxpayers can submit it according to the guidelines provided by the IRS.

Steps to complete the IRS Form F656

Completing the IRS Form F656 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation related to your tax situation.

- Download the IRS Form F656 from the official IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Complete the specific sections relevant to your request or claim.

- Review the form for accuracy and completeness.

- Submit the form either electronically or by mail, following the IRS instructions.

Legal use of the IRS Form F656

The IRS Form F656 is legally binding when filled out and submitted according to IRS guidelines. It is important to ensure that the information provided is truthful and accurate, as providing false information can lead to penalties. Utilizing an electronic signature solution can enhance the legal validity of the form, ensuring compliance with eSignature regulations.

Key elements of the IRS Form F656

Key elements of the IRS Form F656 include:

- Personal identification information, such as name and Social Security number.

- Details regarding the specific tax issue or request being addressed.

- Signature and date, confirming the accuracy of the information provided.

- Any additional documentation that may be required to support the claim.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form F656 can vary based on the specific circumstances of the taxpayer. It is essential to be aware of any important dates related to tax filings to avoid penalties. Generally, forms should be submitted by the tax filing deadline, which is typically April fifteenth for individual taxpayers. However, certain situations may have different deadlines, so checking the IRS guidelines is advisable.

Quick guide on how to complete irs form f656 2011

Accomplish Irs Form F656 effortlessly on any device

Web-based document administration has become increasingly favored by both businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, as you can easily locate the right template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any delays. Manage Irs Form F656 from any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Irs Form F656 without hassle

- Locate Irs Form F656 and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Irs Form F656 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form f656 2011

Create this form in 5 minutes!

How to create an eSignature for the irs form f656 2011

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is IRS Form F656, and why might I need it?

IRS Form F656 is a document related to specific tax processes. You may need it if you are filing for a particular tax deduction or credit. Understanding the requirements for this form can help streamline your tax filing. Using airSlate SignNow ensures you can eSign and send your documents securely.

-

How can airSlate SignNow help with IRS Form F656?

airSlate SignNow offers a seamless way to electronically sign and send IRS Form F656. Our platform ensures that your documents are secure and easily retrievable. With our user-friendly interface, managing your tax forms becomes simpler and more efficient. By using our service, you can ensure compliance without the hassle.

-

Is there a cost associated with using airSlate SignNow for IRS Form F656?

Yes, airSlate SignNow offers various pricing plans depending on your needs. Our plans are designed to be cost-effective, giving you excellent value for the features you receive. You can choose a plan that fits your budget while ensuring you can manage IRS Form F656 efficiently. Check our website for the most current pricing details.

-

What features does airSlate SignNow offer for handling IRS Form F656?

airSlate SignNow includes features like customizable templates, cloud storage, and real-time tracking for documents, including IRS Form F656. The platform's ease of use allows you to quickly create, sign, and send forms. Additionally, integration with various third-party applications enhances your workflow. This ensures that managing your documents is straightforward and efficient.

-

Can I integrate airSlate SignNow with other software while working with IRS Form F656?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to handle IRS Form F656 alongside other digital tools. Whether it's CRM systems or project management apps, our integrations enhance your productivity. This interoperability streamlines your processes and saves you time while managing tax-related documents.

-

What are the benefits of using airSlate SignNow for IRS Form F656?

Using airSlate SignNow for IRS Form F656 offers numerous benefits, including improved efficiency and document security. It reduces the time spent on manual paperwork and allows for easy collaboration. Furthermore, eSigning ensures you remain compliant with IRS requirements while making the document management process smoother. You can signNowly improve your workflow and productivity.

-

Is it easy to get started with airSlate SignNow for IRS Form F656?

Yes, getting started with airSlate SignNow for IRS Form F656 is simple and intuitive. You can sign up and create your account within minutes. Our platform provides straightforward guidance and resources to help you manage your documents effectively. Once you're set up, you can start sending and signing forms right away.

Get more for Irs Form F656

- Revocation gift form

- Florida employment form 497303370

- Newly widowed individuals package florida form

- Florida employment letter form

- Employment employee personnel file package florida form

- Assignment of mortgage package florida form

- Assignment of lease package florida form

- Florida purchase agreement form

Find out other Irs Form F656

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast