Form 656 B, Offer in Compromise Instructions 2024

What is the IRS Form 656 B?

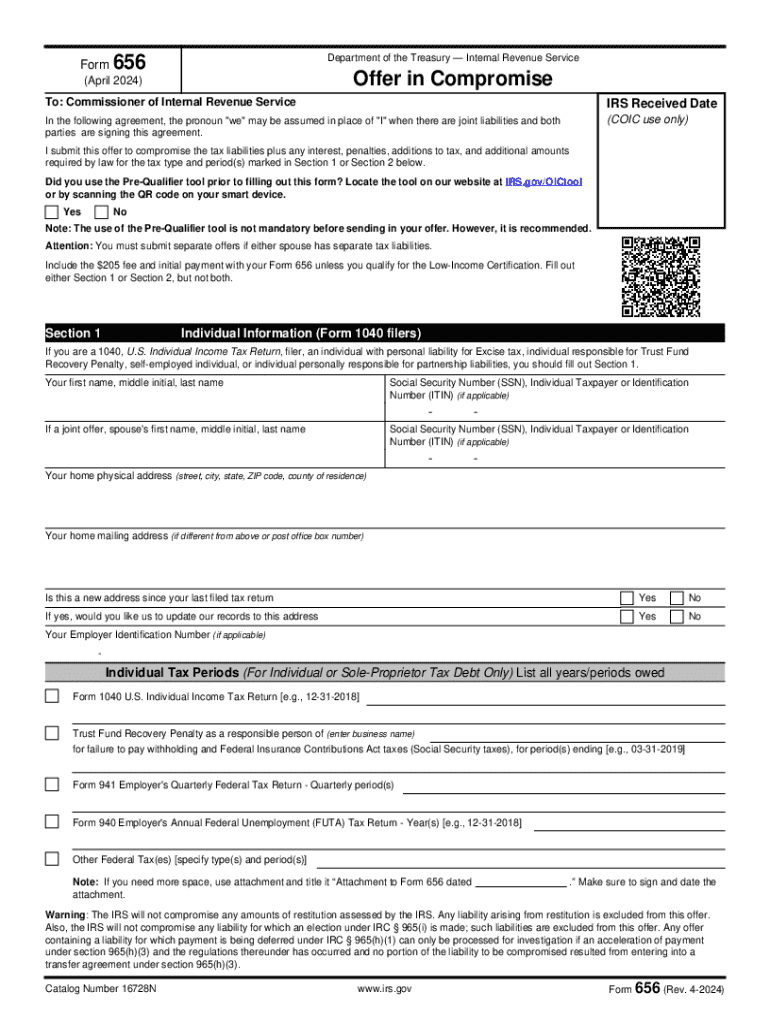

The IRS Form 656 B is an official document used to submit an Offer in Compromise (OIC) to the Internal Revenue Service. This form allows taxpayers to propose a settlement for their tax liabilities for less than the full amount owed. The OIC program is designed for individuals who may be unable to pay their tax debts in full or for whom paying the full amount would create a financial hardship. Understanding the purpose and function of Form 656 B is essential for anyone considering this option for tax debt resolution.

Steps to Complete the IRS Form 656 B

Completing the IRS Form 656 B involves several important steps to ensure accuracy and compliance. Here’s a detailed outline:

- Begin by gathering all necessary financial documentation, including income statements, bank statements, and any other relevant financial information.

- Fill out the taxpayer information section with your name, Social Security number, and address.

- Indicate the type of tax debt you are addressing and the amount owed.

- Complete the Offer in Compromise section, specifying your offer amount and the reason for your request.

- Sign and date the form, ensuring all information is accurate and complete.

Review the form thoroughly before submission to avoid any delays in processing.

Required Documents for IRS Form 656 B

When submitting the IRS Form 656 B, certain documents must accompany the form to support your Offer in Compromise. These documents include:

- Proof of income, such as recent pay stubs or tax returns.

- Bank statements that reflect your financial status.

- A completed Form 433-A (OIC) or Form 433-B (OIC), which provides detailed financial information.

- Any additional documentation that supports your claim of financial hardship.

Providing complete and accurate documentation is crucial for the IRS to evaluate your offer effectively.

Eligibility Criteria for IRS Form 656 B

To qualify for submitting an Offer in Compromise using Form 656 B, certain eligibility criteria must be met. These include:

- You must have filed all required tax returns for the previous five years.

- You cannot be in an open bankruptcy proceeding.

- Your offer must be based on your ability to pay, taking into account your financial situation.

- The IRS must determine that accepting your offer is in the best interest of both parties.

Understanding these criteria helps ensure that your application is viable and increases the likelihood of acceptance.

How to Obtain the IRS Form 656 B

The IRS Form 656 B can be obtained directly from the IRS website. It is available as a fillable PDF, which allows you to complete the form electronically. Additionally, you can request a paper version by contacting the IRS or visiting a local IRS office. Ensure you have the most current version of the form to avoid any issues during submission.

Filing Methods for IRS Form 656 B

There are several methods for submitting the IRS Form 656 B, including:

- Online submission through the IRS website, if you are using an electronic version.

- Mailing the completed form and supporting documents to the appropriate IRS address as specified in the form instructions.

- In-person submission at a local IRS office, which may provide immediate feedback on your application.

Choosing the right filing method can impact the processing time of your offer.

Quick guide on how to complete form 656 b offer in compromise instructions

Effortlessly prepare Form 656 B, Offer In Compromise Instructions on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to quickly create, modify, and eSign your documents without delays. Manage Form 656 B, Offer In Compromise Instructions on any device using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

How to modify and eSign Form 656 B, Offer In Compromise Instructions effortlessly

- Locate Form 656 B, Offer In Compromise Instructions and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with specific tools provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to distribute your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 656 B, Offer In Compromise Instructions to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 b offer in compromise instructions

Create this form in 5 minutes!

How to create an eSignature for the form 656 b offer in compromise instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 656?

IRS Form 656 is a form used to apply for an Offer in Compromise with the IRS. This form allows taxpayers to settle their tax debts for less than the full amount owed. Understanding how to properly fill out IRS Form 656 can signNowly impact your ability to negotiate with the IRS.

-

How can airSlate SignNow help with IRS Form 656?

airSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 656. With our easy-to-use interface, you can ensure that your form is completed accurately and submitted on time, reducing the risk of errors that could delay your application.

-

Is there a cost associated with using airSlate SignNow for IRS Form 656?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our cost-effective solutions ensure that you can manage your IRS Form 656 submissions without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for IRS Form 656 processing?

airSlate SignNow offers features such as document templates, real-time tracking, and secure cloud storage for IRS Form 656. These features streamline the process, making it easier for you to manage your tax documents efficiently and securely.

-

Can I integrate airSlate SignNow with other software for IRS Form 656?

Absolutely! airSlate SignNow integrates with various software applications, allowing you to streamline your workflow when handling IRS Form 656. This integration capability enhances productivity by connecting your existing tools with our eSigning solution.

-

What are the benefits of using airSlate SignNow for IRS Form 656?

Using airSlate SignNow for IRS Form 656 offers numerous benefits, including faster processing times and enhanced security. Our platform ensures that your sensitive tax information is protected while allowing you to complete your forms quickly and efficiently.

-

How secure is airSlate SignNow when handling IRS Form 656?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your IRS Form 656 and other documents. You can trust that your information is safe with us, allowing you to focus on your tax negotiations without worry.

Get more for Form 656 B, Offer In Compromise Instructions

- Nyc statement of undistributed paychecks form

- Lactation consultants winter springs fl form

- Dss 5251 icpc financial medical plan info dhhs state nc form

- Imm 5604 sample form

- General medical and surgical form

- Pension application form

- Montana secretary of state business forms 01a

- Hr confidentiality agreement template form

Find out other Form 656 B, Offer In Compromise Instructions

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT