Form 656 Rev 4 Internal Revenue Service 2020

What is the Form 656 Rev 4 Internal Revenue Service

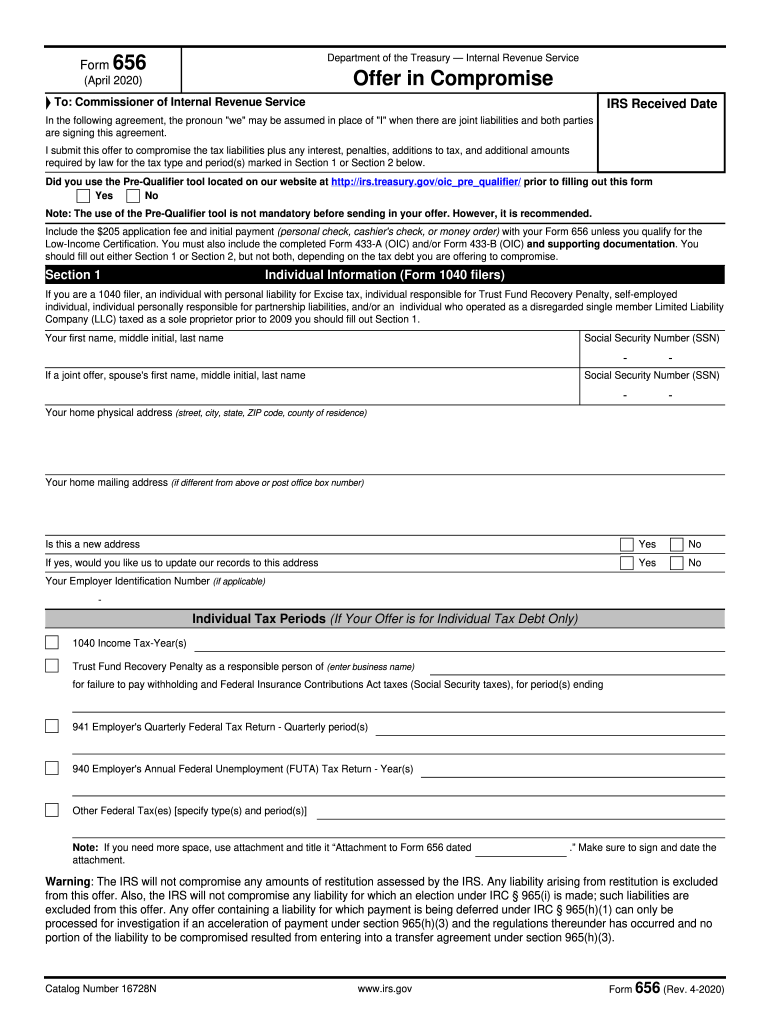

The Form 656, also known as the Offer in Compromise, is a document used by taxpayers to settle their tax debts with the Internal Revenue Service (IRS) for less than the full amount owed. This form allows individuals who are unable to pay their tax liabilities in full to propose a settlement based on their financial situation. The IRS reviews these offers to determine if they are acceptable based on the taxpayer's ability to pay, income, expenses, and asset equity.

How to use the Form 656 Rev 4 Internal Revenue Service

Using the Form 656 involves several steps. Taxpayers must first complete the form accurately, providing detailed financial information, including income, expenses, and assets. It is essential to ensure that all information is truthful and complete, as inaccuracies may lead to rejection of the offer. After completing the form, taxpayers must submit it to the IRS along with the required application fee and any necessary supporting documentation that substantiates their financial claims.

Steps to complete the Form 656 Rev 4 Internal Revenue Service

Completing the Form 656 requires careful attention to detail. Here are the steps to follow:

- Obtain the latest version of the Form 656 from the IRS website.

- Fill out the taxpayer information section, including name, address, and Social Security number.

- Provide a detailed account of your financial situation, including income, expenses, and assets.

- Choose the type of offer you are submitting: Lump Sum Cash or Periodic Payment.

- Include the required application fee and any supporting documentation.

- Review the form for accuracy before submission.

- Mail the completed form to the appropriate IRS address based on your location.

Eligibility Criteria

To qualify for submitting the Form 656, taxpayers must meet specific eligibility criteria set by the IRS. Generally, individuals must demonstrate an inability to pay their tax debt in full and must not be in an open bankruptcy proceeding. Additionally, all tax returns must be filed, and any estimated tax payments must be current. The IRS evaluates each offer based on the taxpayer's financial situation, including income, expenses, and asset equity.

Required Documents

Submitting the Form 656 requires several supporting documents to substantiate the information provided. Taxpayers should include:

- Proof of income, such as pay stubs or bank statements.

- A detailed list of monthly expenses.

- Documentation of assets, including real estate and vehicles.

- Tax returns for the previous three years.

Providing comprehensive documentation helps the IRS assess the offer accurately and expedites the review process.

Form Submission Methods (Online / Mail / In-Person)

The Form 656 can be submitted to the IRS by mail. Currently, the IRS does not offer an online submission option for this form. Taxpayers should ensure they send the form to the correct address based on their location and the type of tax liability. It is advisable to use a trackable mailing method to confirm receipt by the IRS. In-person submissions are generally not accepted for this form.

Quick guide on how to complete form 656 rev 4 2020 internal revenue service

Access Form 656 Rev 4 Internal Revenue Service effortlessly on any gadget

Web-based document management has become increasingly popular with businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to draft, modify, and eSign your documents promptly without delays. Handle Form 656 Rev 4 Internal Revenue Service on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to alter and eSign Form 656 Rev 4 Internal Revenue Service without any hassle

- Find Form 656 Rev 4 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tiresome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 656 Rev 4 Internal Revenue Service while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 rev 4 2020 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 656 rev 4 2020 internal revenue service

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2020 form 656?

The 2020 form 656 is a crucial document used for Offer in Compromise requests with the IRS. This form allows taxpayers to settle their tax debts for less than the full amount owed. Understanding how to complete and submit the 2020 form 656 is essential for individuals seeking financial relief from the IRS.

-

How can airSlate SignNow help with the 2020 form 656?

AirSlate SignNow facilitates the eSigning and sending of important documents, including the 2020 form 656. With our platform, users can securely sign the form and share it with tax professionals or submit it directly to the IRS. This streamlines the process and ensures all signatures are legally binding.

-

What are the pricing options for airSlate SignNow related to the 2020 form 656?

AirSlate SignNow offers competitive pricing plans tailored to different business needs. Whether you’re a solo entrepreneur or a larger business, you can find a plan that fits your budget while efficiently managing processes like signing the 2020 form 656. Check our website for detailed pricing information and special offers.

-

Are there any features specifically for handling the 2020 form 656?

Yes, airSlate SignNow includes specific features that simplify the management of the 2020 form 656. These include templates for quick access, secure cloud storage, and the ability to capture signatures remotely. Our platform ensures that users can efficiently navigate the complexities of IRS forms.

-

Can I integrate airSlate SignNow with other software for the 2020 form 656?

Absolutely! AirSlate SignNow integrates seamlessly with numerous applications, enhancing your workflow for managing forms like the 2020 form 656. By connecting it with CRM systems or document management tools, you can streamline the entire process from sending to signing.

-

What are the benefits of using airSlate SignNow for the 2020 form 656?

Using airSlate SignNow for your 2020 form 656 submissions offers several benefits. It enhances security with encrypted signatures, saves time with automated processes, and provides easy access to signed documents from anywhere. These features make it an ideal solution for both individuals and businesses.

-

Is airSlate SignNow compliant with IRS regulations for the 2020 form 656?

Yes, airSlate SignNow is compliant with all IRS regulations regarding electronic signatures, including for the 2020 form 656. This means you can confidently use our platform for legally binding eSignatures, ensuring your submissions meet all necessary compliance standards.

Get more for Form 656 Rev 4 Internal Revenue Service

Find out other Form 656 Rev 4 Internal Revenue Service

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast