Form 656 Rev 4 Offer in Compromise 2022

What is the Form 656 Rev 4 Offer In Compromise

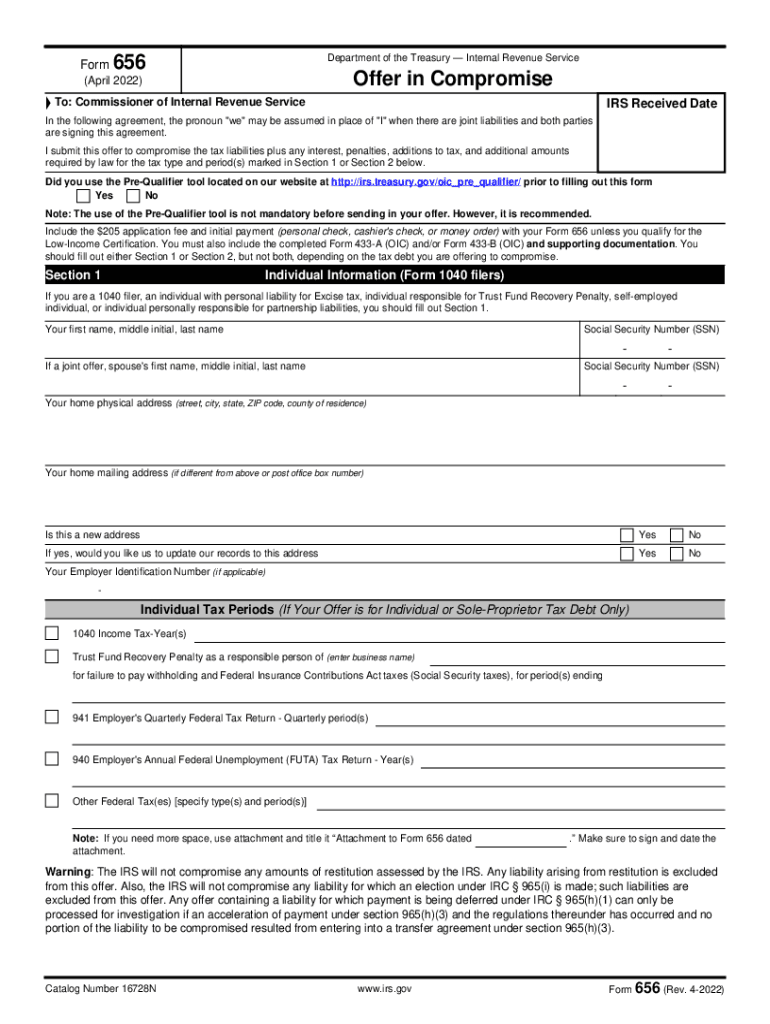

The Form 656 Rev 4 is an official document used by taxpayers to propose an Offer in Compromise (OIC) to the Internal Revenue Service (IRS). This form allows individuals who owe back taxes to settle their tax debts for less than the full amount owed. The OIC program is designed for taxpayers who demonstrate an inability to pay their full tax liabilities, making it a crucial tool for financial relief. By submitting this form, taxpayers can negotiate a manageable payment plan based on their financial situation.

Steps to complete the Form 656 Rev 4 Offer In Compromise

Completing the Form 656 Rev 4 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial information, including income, expenses, and assets. Next, fill out the form with your personal details, including your Social Security number and tax identification number. It is essential to provide a detailed account of your financial situation to support your offer. After completing the form, review it for accuracy, sign it, and attach any required documentation, such as the Form 433-A or 433-B, which detail your financial status. Finally, submit the form to the appropriate IRS address, and keep copies for your records.

Eligibility Criteria for the Form 656 Rev 4 Offer In Compromise

To qualify for an Offer in Compromise using the Form 656 Rev 4, taxpayers must meet specific eligibility criteria. The IRS evaluates offers based on the taxpayer's ability to pay, income, expenses, and asset equity. Generally, taxpayers must be current with all tax filings and payments to be considered. Additionally, individuals who are in an open bankruptcy proceeding are ineligible to submit an OIC. It is important to thoroughly assess your financial situation against these criteria before submitting the form to increase the likelihood of acceptance.

Required Documents for the Form 656 Rev 4 Offer In Compromise

When submitting the Form 656 Rev 4, certain documents are required to support your offer. These typically include the Form 433-A (OIC) for individuals or Form 433-B (OIC) for businesses, which provide a comprehensive overview of your financial condition. Additionally, you may need to submit recent pay stubs, bank statements, and any other documentation that reflects your income and expenses. Providing complete and accurate documentation is vital for the IRS to evaluate your offer effectively.

IRS Guidelines for the Form 656 Rev 4 Offer In Compromise

The IRS has established guidelines for submitting the Form 656 Rev 4, which include specific instructions for completing the form and the documentation required. Taxpayers must ensure that their offer is reasonable and based on their financial circumstances. The IRS will review the offer and may request additional information or clarification. Understanding these guidelines can help taxpayers navigate the process more effectively and improve their chances of acceptance.

Form Submission Methods for the Form 656 Rev 4 Offer In Compromise

The Form 656 Rev 4 can be submitted to the IRS through various methods. Taxpayers have the option to file the form by mail, ensuring that it is sent to the correct IRS address based on their state of residence. Currently, electronic submission of this form is not available, so it is crucial to follow postal guidelines carefully. Additionally, taxpayers may want to consider using certified mail for tracking purposes and to confirm receipt by the IRS.

Quick guide on how to complete form 656 rev 4 2021 offer in compromise

Complete Form 656 Rev 4 Offer In Compromise effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Handle Form 656 Rev 4 Offer In Compromise on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to alter and eSign Form 656 Rev 4 Offer In Compromise with ease

- Obtain Form 656 Rev 4 Offer In Compromise and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for providing your form: by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Alter and eSign Form 656 Rev 4 Offer In Compromise to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 656 rev 4 2021 offer in compromise

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 656?

AirSlate SignNow is a user-friendly electronic signature platform that enhances business workflows by enabling the seamless sending and signing of documents. With the power of 656, users can automate document processes, ensuring efficient handling of contracts and agreements.

-

How much does airSlate SignNow cost to use for 656 transactions?

The pricing for airSlate SignNow varies based on the chosen plan, allowing flexibility for different business needs. For those focused on a 656 volume of documents, the subscription tiers are designed to optimize cost-effectiveness while providing necessary features for managing eSignatures.

-

What features does airSlate SignNow offer for 656 users?

AirSlate SignNow provides a variety of features catering to 656 users, including document templates, in-person signing, and customizable workflows. These functionalities not only simplify the signing process but also improve document management efficiency.

-

Can I integrate airSlate SignNow with other tools for managing 656 transactions?

Yes, airSlate SignNow offers integrations with various software solutions that are essential for handling 656 interactions. You can easily connect it with CRM systems, cloud storage, and productivity tools to streamline your entire document workflow.

-

What benefits does airSlate SignNow provide for companies dealing with 656 documentation?

By utilizing airSlate SignNow, companies can benefit greatly through increased operational efficiency and reduced turnaround times for 656 documentation. The platform’s easy-to-use interface and advanced security measures ensure that your documents remain safe while expediting the signing process.

-

Is airSlate SignNow secure for handling sensitive 656 documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive 656 documents. The platform utilizes encryption and various authentication measures to safeguard all transactions, ensuring peace of mind for users.

-

How can airSlate SignNow help with compliance in 656 processes?

AirSlate SignNow supports compliance with various regulations and standards essential for 656 processes. By providing legally binding eSignatures and a comprehensive audit trail, users can maintain the necessary documentation for compliance purposes.

Get more for Form 656 Rev 4 Offer In Compromise

- Partial release of property from mortgage by individual holder kentucky form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy kentucky form

- Warranty deed for parents to child with reservation of life estate kentucky form

- Warranty deed for separate or joint property to joint tenancy kentucky form

- Warranty deed to separate property of one spouse to both spouses as joint tenants kentucky form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries kentucky form

- Warranty deed from limited partnership or llc is the grantor or grantee kentucky form

- Financing statement amendment 497308294 form

Find out other Form 656 Rev 4 Offer In Compromise

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document