Schedule D Form 1065 Capital Gains and Losses 2020

What is the Schedule D Form 1065 Capital Gains And Losses

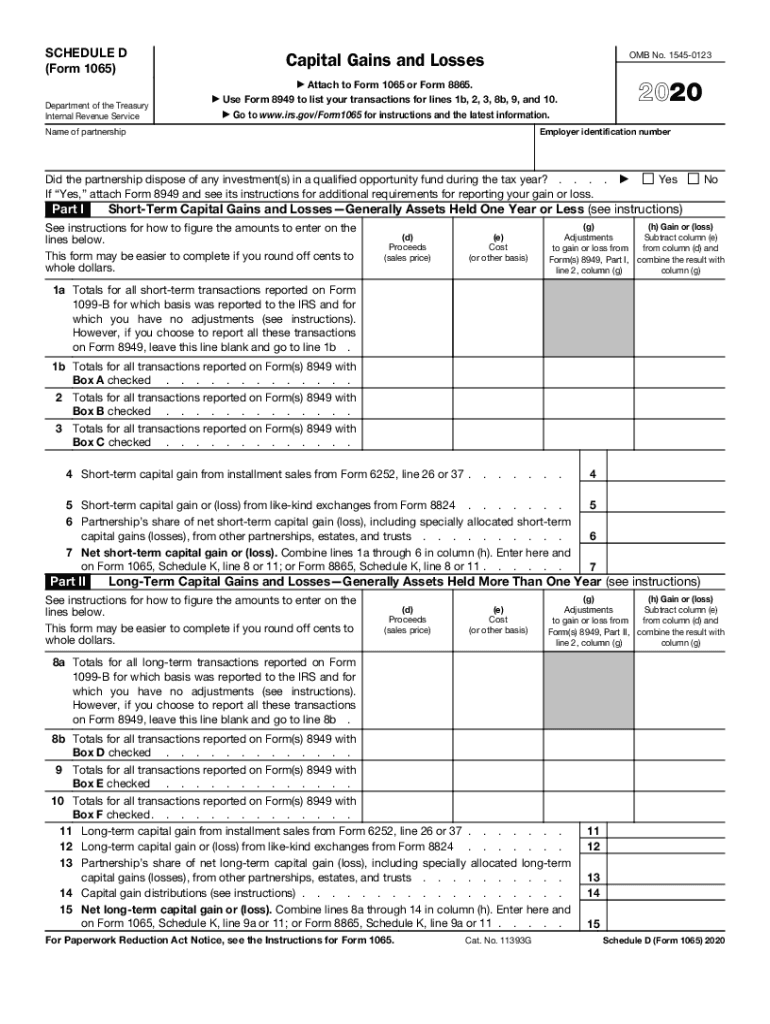

The Schedule D Form 1065 is a tax document used by partnerships to report capital gains and losses. This form is essential for calculating the overall gain or loss from the sale of capital assets, such as stocks, bonds, and real estate. It provides a detailed account of transactions that can affect the partnership's tax obligations. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule D Form 1065 Capital Gains And Losses

Using the Schedule D Form 1065 involves several steps. First, gather all relevant information about capital asset transactions throughout the tax year. This includes purchase and sale dates, amounts, and any associated costs. Next, complete the form by entering details of each transaction in the appropriate sections. It is important to categorize gains and losses correctly, distinguishing between short-term and long-term transactions. Finally, ensure that the completed form is submitted along with the partnership's tax return.

Steps to complete the Schedule D Form 1065 Capital Gains And Losses

Completing the Schedule D Form 1065 requires a systematic approach:

- Collect all necessary documentation regarding capital asset transactions.

- Determine the nature of each transaction (short-term or long-term).

- Fill out the form by entering details for each asset sold, including dates and amounts.

- Calculate total gains and losses, ensuring to apply any applicable deductions.

- Review the form for accuracy before submission.

Legal use of the Schedule D Form 1065 Capital Gains And Losses

The Schedule D Form 1065 must be completed in compliance with IRS regulations to ensure its legal validity. This includes accurately reporting all capital transactions and adhering to deadlines. The form serves as a legal document that can be reviewed by the IRS, so it is essential to maintain thorough records and documentation to support the reported figures. Using digital tools for eSignature can also enhance the legal standing of the document.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form 1065 align with the partnership's tax return due dates. Typically, partnerships must file their returns by the fifteenth day of the third month following the end of their fiscal year. For partnerships operating on a calendar year, this means the deadline is March fifteenth. It is important to be aware of these dates to avoid penalties and ensure timely submission.

Penalties for Non-Compliance

Failure to properly complete and file the Schedule D Form 1065 can result in significant penalties. The IRS may impose fines for inaccuracies or late submissions, which can add up quickly. Additionally, incorrect reporting of capital gains and losses can lead to further audits or complications in future tax filings. Ensuring compliance with all IRS requirements is essential to avoid these potential consequences.

Quick guide on how to complete 2020 schedule d form 1065 capital gains and losses

Complete Schedule D Form 1065 Capital Gains And Losses effortlessly on any device

Online document management has gained signNow traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can access the right forms and securely store them online. airSlate SignNow provides all the necessary tools to generate, alter, and eSign your documents quickly and without interruptions. Manage Schedule D Form 1065 Capital Gains And Losses on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Schedule D Form 1065 Capital Gains And Losses without hassle

- Obtain Schedule D Form 1065 Capital Gains And Losses and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Schedule D Form 1065 Capital Gains And Losses and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule d form 1065 capital gains and losses

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule d form 1065 capital gains and losses

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the federal tax schedule D form, and why is it important?

The federal tax schedule D form is used to report capital gains and losses from the sale of assets like stocks and bonds. It is crucial for taxpayers who have engaged in these transactions to ensure accurate reporting and compliance with IRS regulations. Understanding how to fill out the federal tax schedule D form can help you minimize your tax liability.

-

How can airSlate SignNow help me with my federal tax schedule D form?

AirSlate SignNow offers a seamless eSigning solution that allows you to send, sign, and manage documents, including the federal tax schedule D form, quickly and efficiently. Our platform simplifies the process, ensuring that you can complete your tax documents without stress or hassle. With airSlate SignNow, managing your federal tax schedule D form becomes a streamlined experience.

-

Is there a cost associated with using airSlate SignNow for the federal tax schedule D form?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs. We provide a cost-effective solution that allows you to eSign documents, including the federal tax schedule D form, without breaking the bank. Explore our pricing options to find the perfect fit for your requirements.

-

What features does airSlate SignNow provide for handling tax documents?

AirSlate SignNow offers a range of features designed to simplify the handling of tax documents like the federal tax schedule D form. Key features include customizable templates, secure signing options, and the ability to track document status in real-time. These capabilities ensure that you can efficiently manage your federal tax schedule D form and related documents.

-

Can I integrate airSlate SignNow with accounting software for my federal tax schedule D form?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing for easy management of your federal tax schedule D form alongside your other financial documents. These integrations streamline your workflow, helping you maintain organization and efficiency when handling tax forms.

-

How secure is my information when using airSlate SignNow for tax documents?

Security is a top priority for airSlate SignNow. When using our platform for your federal tax schedule D form, your data is protected with advanced encryption and compliance with industry standards. You can trust that your sensitive information will remain confidential and secure throughout the entire eSigning process.

-

Can I access my federal tax schedule D form from any device using airSlate SignNow?

Yes, airSlate SignNow is designed to be accessible on any device, including smartphones, tablets, and computers. This means you can conveniently manage your federal tax schedule D form wherever you are. Our cloud-based platform ensures that you have access to your documents anytime, enhancing your productivity.

Get more for Schedule D Form 1065 Capital Gains And Losses

- Mutual wills containing last will and testaments for man and woman living together not married with no children west virginia form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children west form

- Mutual wills or last will and testaments for man and woman living together not married with minor children west virginia form

- Non marital cohabitation living together agreement west virginia form

- Paternity law and procedure handbook west virginia form

- Bill of sale in connection with sale of business by individual or corporate seller west virginia form

- Office lease agreement west virginia form

- West virginia divorce online form

Find out other Schedule D Form 1065 Capital Gains And Losses

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed