SCHEDULE D Form 1065 Capital Gains and Course Hero 2022

Understanding the IRS Schedule D Form

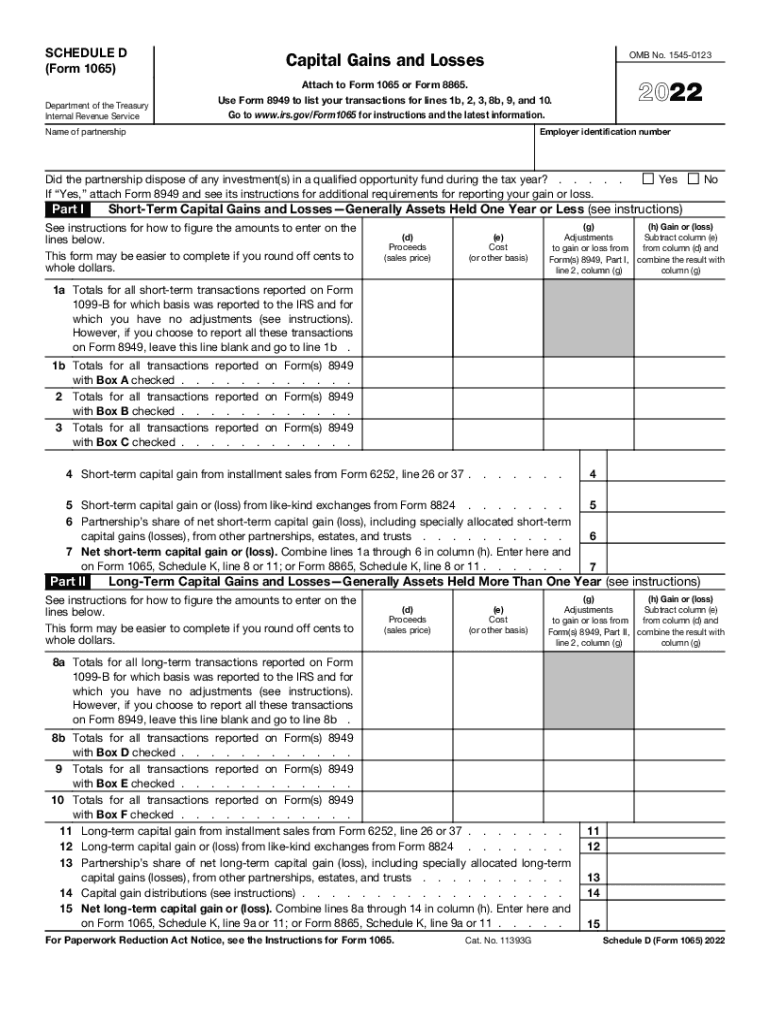

The IRS Schedule D form is essential for reporting capital gains and losses from the sale of assets. This form is used by individuals, partnerships, and corporations to calculate the tax owed on these gains. It is particularly important for taxpayers who have sold stocks, bonds, or real estate. The form helps in determining whether the gains are short-term or long-term, which influences the tax rate applied.

Steps to Complete the IRS Schedule D Form

Completing the IRS Schedule D form involves several key steps:

- Gather necessary documents, including records of asset purchases and sales.

- Determine the holding period for each asset to classify gains as short-term or long-term.

- Calculate total gains and losses for each category.

- Fill out the form accurately, ensuring all calculations are correct.

- Transfer the totals to your main tax return form.

Filing Deadlines for the IRS Schedule D Form

Taxpayers must file the IRS Schedule D form by the tax return deadline, which is typically April 15 for individuals. If you are unable to meet this deadline, you may file for an extension, but any taxes owed must still be paid by the original due date to avoid penalties.

Required Documents for the IRS Schedule D Form

To complete the IRS Schedule D form, you will need various documents, including:

- Records of all asset transactions, including purchase and sale dates.

- Documentation of any expenses related to the sale, such as commissions and fees.

- Previous tax returns, if applicable, to reference prior gains or losses.

IRS Guidelines for Schedule D

The IRS provides specific guidelines for filling out the Schedule D form. Taxpayers should refer to the IRS instructions for detailed information on how to report different types of transactions, including those involving inherited property or gifts. Understanding these guidelines is crucial for accurate reporting and compliance.

Penalties for Non-Compliance with the IRS Schedule D

Failing to accurately report capital gains and losses on the IRS Schedule D can result in significant penalties. The IRS may impose fines for underreporting income, which could include interest on unpaid taxes. It is essential to ensure that all information is complete and accurate to avoid these consequences.

Quick guide on how to complete schedule d form 1065 capital gains and course hero

Complete SCHEDULE D Form 1065 Capital Gains And Course Hero seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an excellent eco-friendly option compared to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without interruptions. Manage SCHEDULE D Form 1065 Capital Gains And Course Hero on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign SCHEDULE D Form 1065 Capital Gains And Course Hero effortlessly

- Obtain SCHEDULE D Form 1065 Capital Gains And Course Hero and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or mislaid files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign SCHEDULE D Form 1065 Capital Gains And Course Hero and guarantee excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule d form 1065 capital gains and course hero

Create this form in 5 minutes!

How to create an eSignature for the schedule d form 1065 capital gains and course hero

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow when using it for irs d?

airSlate SignNow offers a competitive pricing structure suitable for businesses looking for an irs d compliant solution. Plans are tiered, allowing you to choose one that fits your needs and budget, starting from a basic package to more advanced features. This flexibility ensures you only pay for what you need while maintaining access to irs d functionalities.

-

How does airSlate SignNow ensure compliance with irs d?

airSlate SignNow prioritizes compliance with regulations, including irs d standards. The platform incorporates secure eSignature technology and audit trails to guarantee that your signed documents meet the necessary legal requirements. This allows businesses to confidently handle their documentation related to irs d.

-

What features does airSlate SignNow offer for managing irs d documents?

The platform provides a range of features tailored for irs d document management, including customizable templates, real-time tracking, and mobile access. Users benefit from seamless collaboration tools that facilitate easy sharing and signing. These features contribute to a streamlined approach to handling irs d documents.

-

Can I integrate airSlate SignNow with other tools for irs d workflows?

Yes, airSlate SignNow supports numerous integrations with popular applications to enhance your irs d workflows. It can connect seamlessly with tools like CRM systems, cloud storage solutions, and accounting software. This integration capability allows you to automate tasks and improve efficiency in managing your irs d documentation.

-

What are the benefits of using airSlate SignNow for irs d eSignatures?

Using airSlate SignNow for irs d eSignatures streamlines the signing process, making it fast and efficient. The platform enhances security and reduces the chances of errors compared to traditional methods. Its user-friendly interface also ensures that both senders and signers can navigate the process easily, saving time and resources.

-

Is airSlate SignNow suitable for small businesses dealing with irs d?

Absolutely! airSlate SignNow is particularly well-suited for small businesses managing irs d documents. The cost-effective pricing and straightforward functionalities make it accessible for smaller operations, while delivering the capabilities they need to maintain compliance and efficiency.

-

How does customer support work for airSlate SignNow users with irs d queries?

airSlate SignNow offers comprehensive customer support for users encountering issues related to irs d. The dedicated support team is available through multiple channels, including email, chat, and phone. This ensures that you receive prompt assistance, helping you resolve your queries effectively.

Get more for SCHEDULE D Form 1065 Capital Gains And Course Hero

Find out other SCHEDULE D Form 1065 Capital Gains And Course Hero

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation