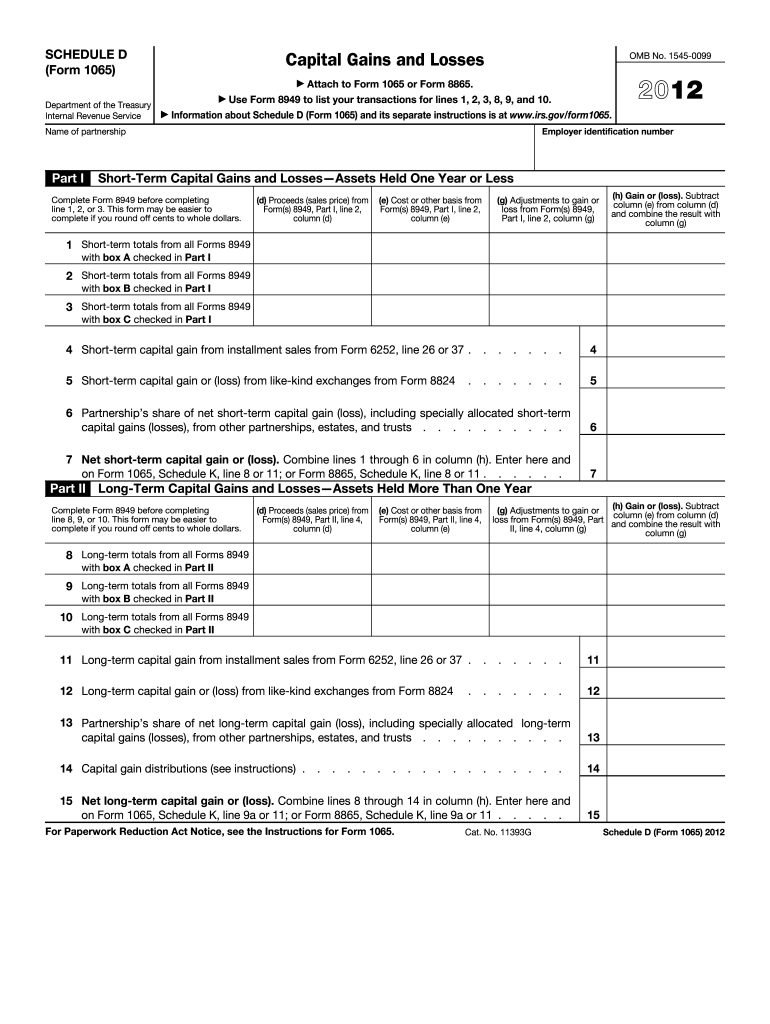

Irs D Form 2012

What is the IRS D Form

The IRS D Form is a specific document utilized for various tax-related purposes within the United States. This form is typically associated with the reporting of certain types of income, deductions, or other tax obligations. Understanding its purpose is crucial for individuals and businesses to ensure compliance with federal tax regulations. The form may vary in its application depending on the taxpayer's situation, such as whether they are self-employed, a corporation, or another entity type.

How to Use the IRS D Form

Using the IRS D Form involves several steps to ensure accurate completion and submission. First, identify the specific purpose of the form in relation to your tax situation. Next, gather all necessary documentation that supports the information you will enter on the form. This may include income statements, receipts for deductions, or other relevant financial documents. Once you have all required materials, fill out the form carefully, ensuring that all information is accurate and complete. Finally, submit the form according to the IRS guidelines, whether electronically or via mail.

Steps to Complete the IRS D Form

Completing the IRS D Form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Review the instructions provided with the form to understand the requirements.

- Gather all necessary documentation, including previous tax returns if applicable.

- Fill out the form section by section, ensuring accuracy in all entries.

- Double-check all calculations and information for errors or omissions.

- Sign and date the form as required before submission.

Legal Use of the IRS D Form

The legal use of the IRS D Form is governed by specific regulations set forth by the Internal Revenue Service. To be considered legally binding, the form must be completed accurately and submitted within the designated timeframes. Additionally, any signatures or electronic submissions must comply with federal eSignature laws, ensuring that the form holds legal weight in tax matters. Failure to adhere to these regulations may result in penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the IRS D Form can vary based on the type of tax situation and the specific year. Generally, individual taxpayers must submit their forms by April 15 of each year, while businesses may have different deadlines depending on their fiscal year. It is essential to keep track of these dates to avoid late fees or penalties. Mark your calendar and consider setting reminders to ensure timely submission.

Required Documents

When preparing to complete the IRS D Form, certain documents are typically required. These may include:

- Income statements such as W-2s or 1099s.

- Receipts for deductions or credits being claimed.

- Previous tax returns for reference.

- Any supporting documentation relevant to your specific tax situation.

Having these documents ready will streamline the process and help ensure accuracy.

Quick guide on how to complete 2012 irs d form

Complete Irs D Form smoothly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Irs D Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Irs D Form effortlessly

- Obtain Irs D Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Irs D Form and ensure excellent communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 irs d form

Create this form in 5 minutes!

How to create an eSignature for the 2012 irs d form

The best way to make an eSignature for a PDF file online

The best way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the IRS D Form and how can it be used with airSlate SignNow?

The IRS D Form is a document required for various tax-related purposes, including reporting certain transactions to the IRS. With airSlate SignNow, users can easily fill out, sign, and send IRS D Forms electronically, streamlining the entire process and ensuring compliance with tax regulations.

-

How much does it cost to use airSlate SignNow for managing IRS D Forms?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes, making it cost-effective for managing IRS D Forms. You can choose a subscription based on your needs, ensuring you only pay for the features you require to efficiently handle your document signing.

-

What features does airSlate SignNow offer for handling IRS D Forms?

airSlate SignNow provides a range of features for IRS D Forms, including customizable templates, secure eSignatures, and easy document sharing. These features enhance productivity and ensure that your IRS D Forms are completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for IRS D Form management?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easy to manage your IRS D Forms alongside other essential business tools. This integration helps streamline workflows and improves overall efficiency.

-

Is airSlate SignNow secure for sending IRS D Forms?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your IRS D Forms. This ensures that your sensitive information remains confidential and secure during the signing process.

-

How does airSlate SignNow improve the efficiency of processing IRS D Forms?

By using airSlate SignNow, businesses can automate the workflow for IRS D Forms, reducing the time spent on manual processes. The platform allows for quick e-signatures and real-time tracking, which signNowly speeds up document processing.

-

What benefits does airSlate SignNow provide for businesses dealing with IRS D Forms?

airSlate SignNow offers numerous benefits for businesses handling IRS D Forms, such as reduced paperwork, improved compliance, and enhanced collaboration. This not only saves time but also helps maintain accurate records for tax purposes.

Get more for Irs D Form

- Europcar car rental in 2012 etsi etsi form

- Contract of release and indemnification for form

- Certification of compliance with apa ethical principles form

- Fact sheet masters graduation masters degree in form

- Extraordinary value form

- How to file a travel insurance claim with europ assistance form

- Republic of lithuania power of attorney igaliojimas i form

- Maxx cold plus warranty the home depot form

Find out other Irs D Form

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template