Irs Form Schedule D 2013

What is the IRS Form Schedule D

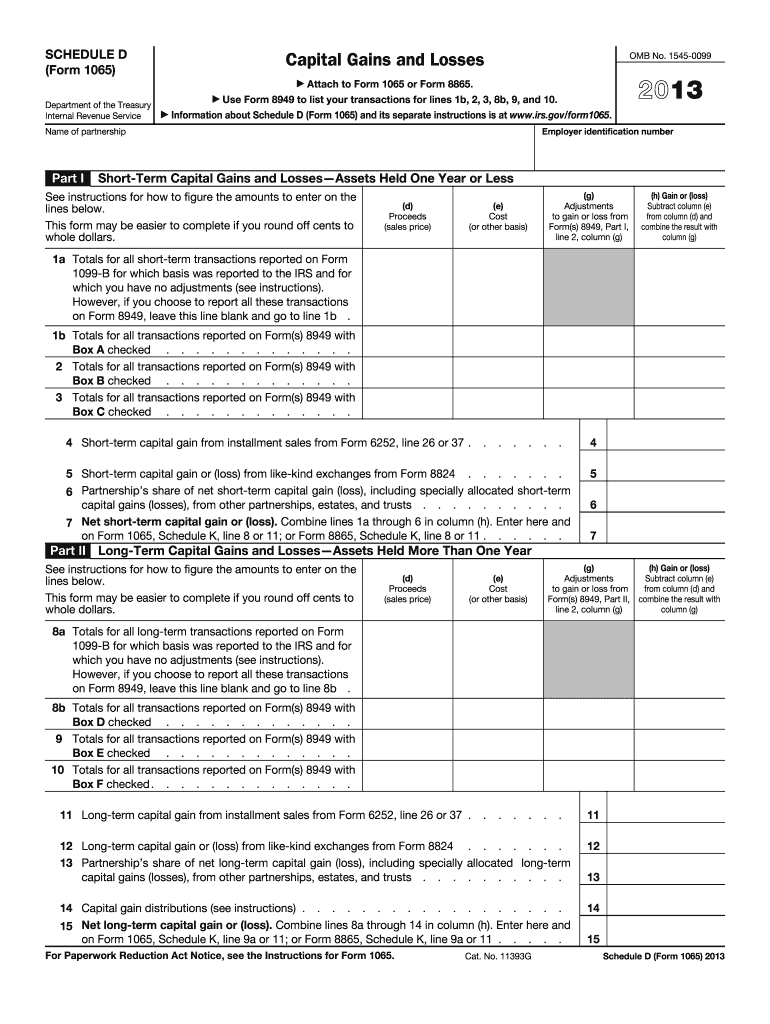

The IRS Form Schedule D is a tax form used by U.S. taxpayers to report capital gains and losses from the sale of securities or assets. This form is essential for individuals who have sold stocks, bonds, or other investments during the tax year. By detailing these transactions, taxpayers can determine their overall tax liability related to capital gains. Understanding the purpose of Schedule D is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the IRS Form Schedule D

To use the IRS Form Schedule D effectively, taxpayers must first gather all necessary information regarding their capital transactions. This includes details such as the date of purchase, date of sale, sale price, and cost basis of the assets sold. Once this information is compiled, taxpayers can fill out the form by categorizing their gains and losses into short-term and long-term sections. It is important to follow the instructions provided by the IRS to ensure accurate reporting and avoid potential penalties.

Steps to complete the IRS Form Schedule D

Completing the IRS Form Schedule D involves several key steps:

- Gather all relevant documentation, including transaction records and brokerage statements.

- Determine whether each transaction results in a capital gain or loss.

- Classify gains and losses into short-term (assets held for one year or less) and long-term (assets held for more than one year).

- Fill out the form, entering totals for each category in the appropriate sections.

- Transfer the net gain or loss to your main tax return form (e.g., Form 1040).

Legal use of the IRS Form Schedule D

The legal use of the IRS Form Schedule D is governed by IRS regulations, which require accurate reporting of capital gains and losses. Taxpayers must ensure that all information is truthful and complete to avoid issues with the IRS. E-signing the form through a compliant platform can enhance the legal validity of the submission, as electronic signatures are recognized under federal law, provided they meet specific criteria. Utilizing a secure platform can help maintain compliance with eSignature regulations.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form Schedule D typically align with the annual tax return deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following year. If additional time is needed, taxpayers can file for an extension, which usually grants an extra six months. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

The IRS Form Schedule D can be submitted through various methods, including online filing, mailing a paper form, or in-person submission at designated IRS offices. Online filing is often the most efficient method, as it allows for quicker processing and confirmation of receipt. When filing by mail, taxpayers should ensure that the form is sent to the correct IRS address and consider using a trackable mailing option for added security.

Quick guide on how to complete 2013 irs form schedule d

Complete Irs Form Schedule D effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the needed form and securely save it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without hurdles. Handle Irs Form Schedule D on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Irs Form Schedule D with ease

- Find Irs Form Schedule D and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from the device of your choice. Edit and eSign Irs Form Schedule D and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 irs form schedule d

Create this form in 5 minutes!

How to create an eSignature for the 2013 irs form schedule d

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is the purpose of IRS Form Schedule D?

IRS Form Schedule D is used to report capital gains and losses from the sale of securities. This form helps taxpayers calculate their overall capital gain or loss, which is essential for accurate tax filing. Understanding Schedule D is crucial for anyone involved in investments.

-

How can airSlate SignNow help with IRS Form Schedule D?

airSlate SignNow simplifies the process of preparing and submitting IRS Form Schedule D by allowing users to easily sign and manage documents online. Our eSigning solution ensures that you can securely send your Schedule D and other tax documents without hassle. With SignNow, you can focus on your investments while we handle the paperwork.

-

What features does airSlate SignNow offer for IRS Form Schedule D?

airSlate SignNow includes features like document templates, secure eSigning, and integration with various applications to streamline the preparation of IRS Form Schedule D. Users can easily access their documents anytime, making it convenient to update their tax information. Our platform effectively enhances the overall efficiency of managing tax-related documents.

-

Is airSlate SignNow affordable for small businesses handling IRS Form Schedule D?

Yes, airSlate SignNow offers competitive pricing plans that are cost-effective for small businesses managing IRS Form Schedule D. By eliminating the need for printing and mailing, our solution helps save on both time and costs. The investment in SignNow can lead to signNow savings, especially during tax season.

-

What integrations does airSlate SignNow have that support IRS Form Schedule D?

airSlate SignNow integrates seamlessly with popular business applications, enabling users to manage IRS Form Schedule D alongside other essential documents. Integrations with cloud storage services allow for easy access to your tax files whenever needed. This connectivity ensures a smooth workflow for handling all your tax-related matters.

-

Can I securely store my IRS Form Schedule D in airSlate SignNow?

Absolutely! airSlate SignNow provides a secure storage solution for all your documents, including IRS Form Schedule D. Our platform employs advanced encryption and security measures to protect your sensitive tax information, ensuring that your documents are safe and accessible whenever you need them.

-

How do I get started with airSlate SignNow for IRS Form Schedule D?

Getting started with airSlate SignNow is easy. Simply visit our website, sign up for an account, and start uploading your IRS Form Schedule D and other documents. Our user-friendly interface guides you through the process of eSigning and managing your forms efficiently.

Get more for Irs Form Schedule D

- Special or limited power of attorney for real estate sales transaction by seller delaware form

- Special or limited power of attorney for real estate purchase transaction by purchaser delaware form

- Limited power of attorney where you specify powers with sample powers included delaware form

- Limited power of attorney for stock transactions and corporate powers delaware form

- Special durable power of attorney for bank account matters delaware form

- Delaware statutory personal durable power of attorney delaware form

- Delaware small business startup package delaware form

- Delaware property management package delaware form

Find out other Irs Form Schedule D

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast