Irs Form 8863 Instructions 2012

What is the IRS Form 8863 Instructions

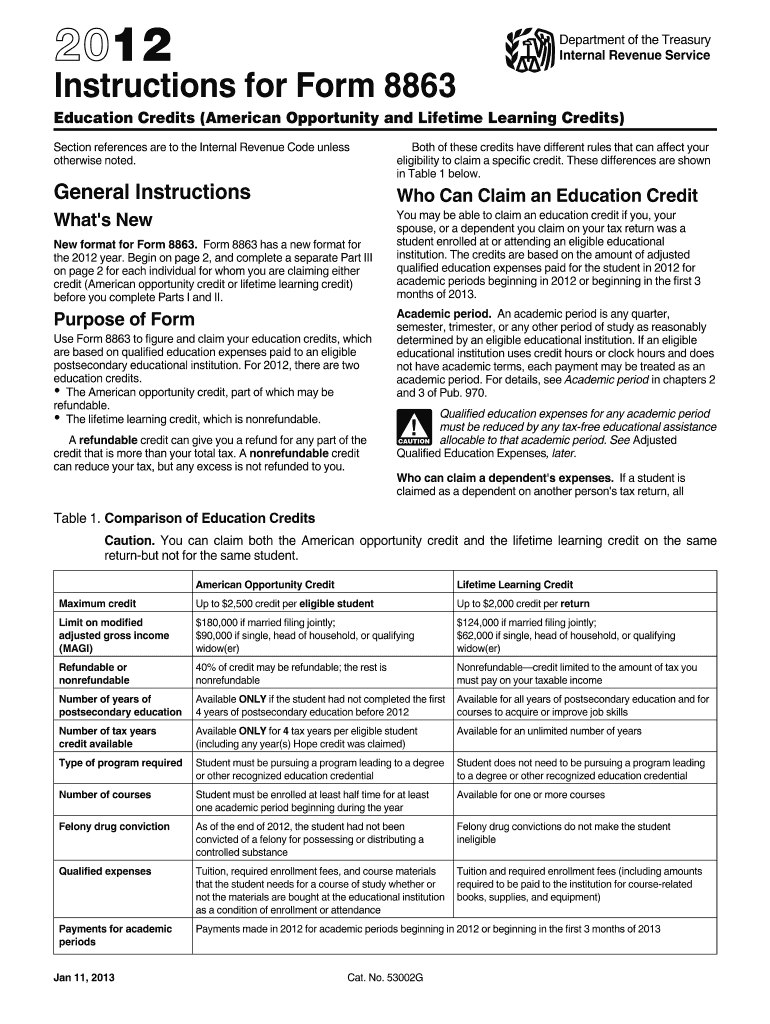

The IRS Form 8863 Instructions provide guidance for taxpayers who are claiming education credits on their tax returns. This form is specifically used to claim the American Opportunity Credit and the Lifetime Learning Credit. Both credits can help offset the costs of higher education, making it essential for eligible students and their families to understand how to complete the form accurately. The instructions detail eligibility requirements, how to fill out the form, and the necessary documentation to support your claims.

Steps to Complete the IRS Form 8863 Instructions

Completing the IRS Form 8863 requires careful attention to detail. Here are the general steps to follow:

- Gather necessary documents, including Form 1098-T from educational institutions, which reports qualified tuition and related expenses.

- Review the eligibility criteria for both the American Opportunity Credit and the Lifetime Learning Credit to determine which applies to your situation.

- Fill out Part I of the form to claim the American Opportunity Credit, if applicable, by providing information about the student and the qualified expenses.

- Complete Part II for the Lifetime Learning Credit, ensuring that you accurately report the expenses and the number of students eligible.

- Double-check all entries for accuracy, ensuring that the amounts reported match your documentation.

- Attach the completed Form 8863 to your tax return before submission.

How to Obtain the IRS Form 8863 Instructions

Taxpayers can obtain the IRS Form 8863 Instructions through several methods. The most straightforward way is to visit the official IRS website, where the form and its instructions are available for download in PDF format. Additionally, taxpayers may request a paper copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs also include the form and instructions, providing an integrated approach to filing taxes.

Legal Use of the IRS Form 8863 Instructions

The IRS Form 8863 Instructions are legally binding when completed and submitted in accordance with IRS regulations. Taxpayers must ensure that the information provided is accurate and truthful to avoid penalties. Misrepresentation or failure to comply with the instructions can lead to audits or disallowance of credits claimed. Understanding the legal implications of the form helps taxpayers navigate the complexities of tax law effectively.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 8863 coincide with the general tax filing deadlines. Typically, the deadline for submitting your tax return, including Form 8863, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to ensure timely submission and avoid penalties for late filing.

Eligibility Criteria

To claim education credits using the IRS Form 8863, taxpayers must meet specific eligibility criteria. For the American Opportunity Credit, the student must be enrolled at least half-time in a degree or certificate program and must not have completed four years of higher education. The Lifetime Learning Credit is available for students enrolled in eligible educational institutions, regardless of the number of years completed. Income limits also apply, affecting the amount of credit that can be claimed.

Required Documents

When completing the IRS Form 8863, taxpayers must provide several key documents to substantiate their claims. The primary document is Form 1098-T, which educational institutions issue to report tuition payments. Additionally, receipts for qualified expenses, such as books and supplies, may be required. Keeping thorough records of all educational expenses is essential for supporting claims and ensuring compliance with IRS regulations.

Quick guide on how to complete irs form 8863 instructions 2012

Complete Irs Form 8863 Instructions effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely maintain it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Irs Form 8863 Instructions on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and electronically sign Irs Form 8863 Instructions with ease

- Find Irs Form 8863 Instructions and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere moments and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irs Form 8863 Instructions and guarantee outstanding communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 8863 instructions 2012

Create this form in 5 minutes!

How to create an eSignature for the irs form 8863 instructions 2012

The best way to generate an eSignature for your PDF online

The best way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What are the Irs Form 8863 Instructions?

The Irs Form 8863 Instructions provide detailed guidance on how to claim education credits for eligible students. Understanding these instructions is crucial for accurately filing your taxes and maximizing potential benefits. airSlate SignNow can help streamline the process by allowing you to electronically sign and send necessary documents.

-

How can I access the Irs Form 8863 Instructions?

You can access the Irs Form 8863 Instructions through the official IRS website or through various tax preparation software platforms. Many of these platforms also provide assistance in completing the form correctly. With airSlate SignNow, you can easily manage and sign your documents related to these instructions.

-

What features does airSlate SignNow offer for managing Irs Form 8863?

airSlate SignNow offers features such as document preparation, electronic signatures, and customizable templates that simplify handling Irs Form 8863. These tools ensure compliance with IRS regulations and help users submit their forms efficiently. Additionally, you can track document status and make revisions easily.

-

Is airSlate SignNow cost-effective for businesses needing Irs Form 8863 Instructions?

Yes, airSlate SignNow is a cost-effective solution for businesses, providing scalable pricing plans that fit various budgets. With its ability to manage signing and documentation needs related to the Irs Form 8863 Instructions, companies can save both time and money. This efficiency is especially beneficial during tax season.

-

Can airSlate SignNow integrate with tax software for Irs Form 8863 Instructions?

Absolutely! airSlate SignNow integrates seamlessly with popular tax software to enhance your experience with Irs Form 8863 Instructions. This integration allows users to import and export documents, ensuring that all necessary forms are easily accessible and properly signed, thus streamlining the tax filing process.

-

How does airSlate SignNow enhance compliance with Irs Form 8863 Instructions?

With airSlate SignNow, you can ensure compliance with Irs Form 8863 Instructions through secure electronic signatures and document tracking. The platform provides an audit trail that confirms who signed what and when, minimizing errors and enhancing accountability. This is crucial for satisfying IRS requirements.

-

What are the benefits of using airSlate SignNow for Irs Form 8863 Instructions?

Using airSlate SignNow for Irs Form 8863 Instructions offers benefits such as increased efficiency, reduced paper clutter, and secure electronic storage. This digital approach not only simplifies the process but also enhances collaboration and minimizes delays, ensuring that you can meet tax deadlines effectively.

Get more for Irs Form 8863 Instructions

Find out other Irs Form 8863 Instructions

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy