Instruction 8863 Form 2016

What is the Instruction 8863 Form

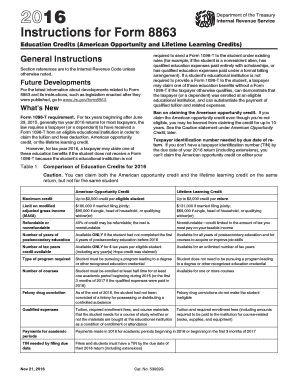

The Instruction 8863 Form is a crucial document used by taxpayers in the United States to claim education credits on their federal tax returns. Specifically, it is designed to help individuals apply for the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making higher education more affordable. Understanding the purpose and details of this form is essential for eligible taxpayers seeking to maximize their education-related tax benefits.

Steps to complete the Instruction 8863 Form

Completing the Instruction 8863 Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, the details of your educational institution, and the amount of qualified expenses incurred. Next, follow these steps:

- Fill out your personal information at the top of the form.

- Indicate the type of credit you are claiming—either the American Opportunity Credit or the Lifetime Learning Credit.

- Provide the details of your eligible educational expenses, including tuition and related fees.

- Calculate the credit amount based on the provided guidelines and complete the necessary calculations on the form.

- Review the form for accuracy before submitting it with your tax return.

How to obtain the Instruction 8863 Form

The Instruction 8863 Form can be easily obtained through the Internal Revenue Service (IRS) website. Taxpayers can download the form directly in PDF format, ensuring they have the most current version. Additionally, the form may be available at local libraries, post offices, or tax preparation offices. It is important to ensure that you are using the latest version of the form to comply with current tax regulations.

Legal use of the Instruction 8863 Form

To ensure the legal use of the Instruction 8863 Form, it is essential to follow IRS guidelines and requirements. The form must be completed accurately and submitted with your federal tax return by the established deadlines. Taxpayers should retain copies of all supporting documents, such as receipts and enrollment statements, as these may be required for verification in the event of an audit. Using a reliable eSignature tool can also help ensure that the form is executed properly and securely.

Filing Deadlines / Important Dates

Filing deadlines for the Instruction 8863 Form align with the federal tax return deadlines. Typically, individual tax returns are due on April fifteenth of each year. However, if you require an extension, you may file for an extension, which generally allows you until October fifteenth to submit your return. It is crucial to be aware of these deadlines to avoid penalties and ensure that you receive your education credits in a timely manner.

Eligibility Criteria

Eligibility for the credits claimed on the Instruction 8863 Form is based on specific criteria established by the IRS. To qualify for the American Opportunity Credit, students must be enrolled at least half-time in a degree or certificate program and must not have completed four years of higher education. The Lifetime Learning Credit has broader eligibility, allowing taxpayers to claim it for any post-secondary education course, regardless of enrollment status. Income limits may also apply, affecting the amount of credit that can be claimed.

Quick guide on how to complete 2016 instruction 8863 form

Prepare Instruction 8863 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Instruction 8863 Form on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Instruction 8863 Form seamlessly

- Find Instruction 8863 Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or disorganized documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Instruction 8863 Form and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 instruction 8863 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 instruction 8863 form

How to generate an electronic signature for the 2016 Instruction 8863 Form online

How to generate an electronic signature for your 2016 Instruction 8863 Form in Chrome

How to create an electronic signature for putting it on the 2016 Instruction 8863 Form in Gmail

How to create an eSignature for the 2016 Instruction 8863 Form right from your smart phone

How to make an eSignature for the 2016 Instruction 8863 Form on iOS devices

How to make an eSignature for the 2016 Instruction 8863 Form on Android

People also ask

-

What is the Instruction 8863 Form and why is it important?

The Instruction 8863 Form is a vital document used by taxpayers to claim education credits on their tax returns. Understanding how to correctly fill out the Instruction 8863 Form can signNowly impact your tax benefits, making it essential for those eligible for education-related tax credits.

-

How can airSlate SignNow help with the Instruction 8863 Form?

With airSlate SignNow, you can easily create, send, and eSign the Instruction 8863 Form online. Our platform streamlines the process, ensuring you can complete your document quickly and securely, thus saving time and reducing the risk of errors.

-

What features does airSlate SignNow offer for completing the Instruction 8863 Form?

airSlate SignNow offers a variety of features for completing the Instruction 8863 Form, including customizable templates, electronic signatures, and secure document storage. These features facilitate a smooth workflow, allowing you to manage your documents efficiently.

-

Is airSlate SignNow a cost-effective solution for managing the Instruction 8863 Form?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing the Instruction 8863 Form and other documents. With flexible pricing plans, you can choose the option that best suits your needs without sacrificing quality or functionality.

-

Can I integrate airSlate SignNow with other applications for the Instruction 8863 Form?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to share and manage the Instruction 8863 Form alongside your other tools. This seamless integration enhances productivity by allowing you to work within your preferred software environment.

-

What are the benefits of using airSlate SignNow for the Instruction 8863 Form?

Using airSlate SignNow for the Instruction 8863 Form provides several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and that sensitive information remains protected.

-

Is it easy to eSign the Instruction 8863 Form with airSlate SignNow?

Yes, eSigning the Instruction 8863 Form with airSlate SignNow is incredibly easy. Our user-friendly interface allows you to sign documents electronically in just a few clicks, ensuring a hassle-free experience for both you and your recipients.

Get more for Instruction 8863 Form

- Fg 143 2007 form

- Mnscu073 form

- Hanes4education redemption form

- Tricare reserve select trs tricare retired reserve trr premium payment credit card eft authorization form sos

- Trs loans form

- Check reissue request form code bk6 trsnyc

- Trsnyc tier 4 policy 2011 form

- Form tc201 instructions for pdf download

Find out other Instruction 8863 Form

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast