Form 8863 2017

Understanding Form 8863

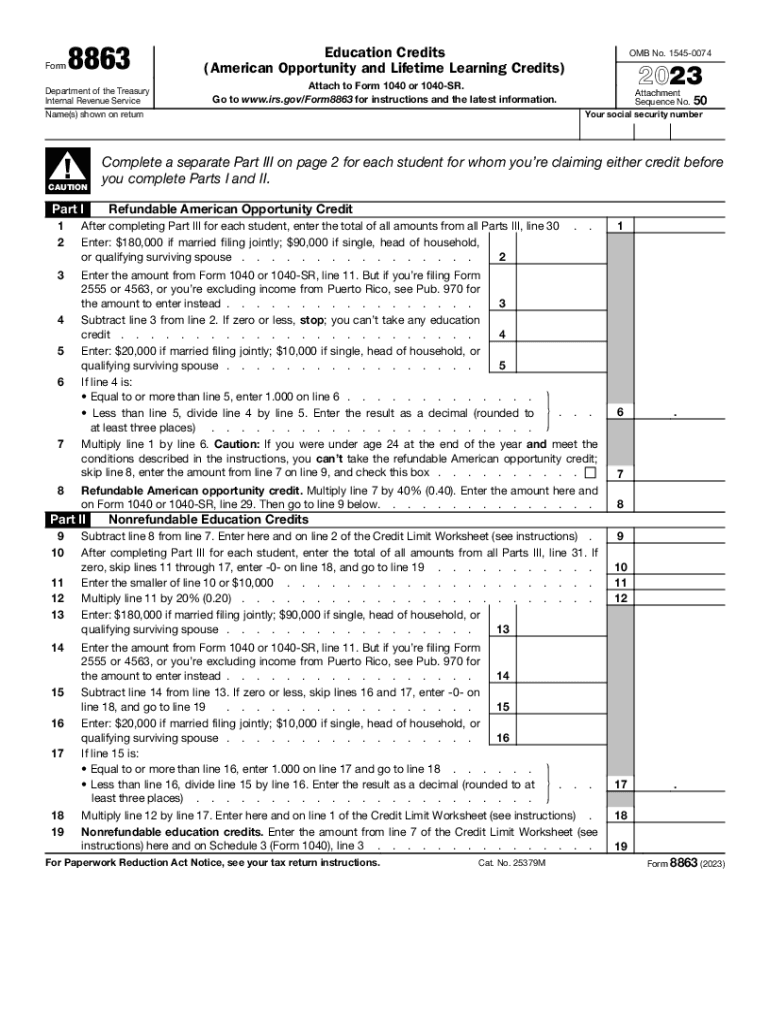

Form 8863, also known as the Education Credits (American Opportunity and Lifetime Learning Credits) form, is used by taxpayers to claim education credits for qualified tuition and related expenses. These credits can significantly reduce the amount of tax owed, making higher education more affordable. The form is specifically designed for students or their parents who are eligible for the American Opportunity Credit or the Lifetime Learning Credit, both of which provide financial relief for educational costs.

How to Complete Form 8863

Completing Form 8863 involves several steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary documentation, including Form 1098-T, which reports tuition payments made to educational institutions. Next, determine eligibility for the credits by reviewing the criteria outlined by the IRS. Fill out the form by providing personal information, details about the educational institution, and the amount of qualified expenses. It is essential to calculate the credits accurately to maximize potential tax benefits.

Essential Elements of Form 8863

Key elements of Form 8863 include personal identification information, educational institution details, and a breakdown of qualified expenses. The form consists of two parts: Part I is for the American Opportunity Credit, while Part II is for the Lifetime Learning Credit. Each part requires specific information regarding the student, including enrollment status and the number of years the credit has been claimed. Understanding these elements is crucial for correctly completing the form and ensuring eligibility for the credits.

Obtaining Form 8863

Form 8863 can be obtained directly from the IRS website or through tax preparation software that includes the form as part of its offerings. It is available in a fillable PDF format, allowing taxpayers to complete it digitally. Additionally, physical copies can be requested from the IRS or found at local libraries and post offices. Ensuring you have the most current version of the form is important, as tax regulations may change from year to year.

Filing Deadlines for Form 8863

Filing deadlines for Form 8863 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15. If taxpayers require additional time, they can file for an extension, but it is essential to submit Form 8863 by the extended deadline to claim any eligible credits. Keeping track of these deadlines helps avoid penalties and ensures that taxpayers can take full advantage of available education credits.

Eligibility Criteria for Education Credits

To qualify for the education credits claimed on Form 8863, taxpayers must meet specific eligibility criteria. The student must be enrolled at least half-time in a degree or certificate program at an eligible institution. Additionally, the taxpayer's modified adjusted gross income must fall below certain thresholds, which can vary based on the credit being claimed. It is important to review these criteria carefully to determine eligibility before completing the form.

Quick guide on how to complete form 8863 705497781

Prepare Form 8863 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage Form 8863 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 8863 without any hassle

- Find Form 8863 and click on Get Form to begin.

- Take advantage of the tools we offer to complete your form.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and then click the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 8863 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8863 705497781

Create this form in 5 minutes!

How to create an eSignature for the form 8863 705497781

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the basic form 8863 instructions for filing taxes?

The form 8863 instructions provide guidance on how to claim education credits for eligible students. This document outlines essential eligibility requirements, such as enrolled status, qualified expenses, and income limitations. Ensuring you follow the form 8863 instructions helps maximize your tax benefits associated with education.

-

How can airSlate SignNow assist with completing form 8863?

airSlate SignNow simplifies the process of filling out form 8863 by allowing users to create and manage electronic documents seamlessly. The platform offers templates and pre-filled fields that can signNowly reduce errors and enhance efficiency. Using airSlate SignNow can help ensure your form 8863 is completed correctly and submitted on time.

-

Is there a cost associated with using airSlate SignNow for form 8863 instructions?

airSlate SignNow offers various pricing plans that cater to different user needs, including those who require assistance with form 8863 instructions. While there may be associated costs, the platform provides a cost-effective solution to help users manage their documents and signatures efficiently. Review the subscription options to choose a plan that fits your budget.

-

What features of airSlate SignNow enhance the form 8863 instruction process?

AirSlate SignNow includes features like electronic signatures, document templates, and cloud storage that streamline the form 8863 instruction process. These tools ensure that users can fill out and send their documents quickly and securely. This efficiency can be particularly beneficial during tax season when timely submissions are crucial.

-

Can I integrate airSlate SignNow with other tax software for form 8863?

Yes, airSlate SignNow easily integrates with various tax preparation software, enhancing the completion of form 8863 instructions. These integrations allow users to import data directly from their accounting software, minimizing data entry errors. Leveraging these integrations ensures a smoother workflow when preparing for tax submissions.

-

Are there any specific benefits of using airSlate SignNow when dealing with form 8863?

Using airSlate SignNow for your form 8863 needs offers several benefits, including quicker turnaround times and reduced paperwork. The ability to eSign documents securely means you can manage your tax submissions from anywhere. Furthermore, the user-friendly interface can simplify the process for individuals unfamiliar with tax forms.

-

Where can I find detailed tutorials for form 8863 instructions on airSlate SignNow?

You can find a variety of helpful tutorials and resources for form 8863 instructions on the airSlate SignNow website. These resources often include step-by-step guides, video demonstrations, and FAQs that address common concerns. By utilizing these materials, you can enhance your understanding of the form and the associated processes.

Get more for Form 8863

- Laws of the state form

- Petition for final distribution superior court form

- I read in the instructions of tax form 1041 estate income

- Schedule h 490243722 form

- How to submit a trusts final income tax returns dummies form

- Probate court form no 56a summary of account of executor

- Summary of account of form

- In re estate of moody 49 a2d 562 115 vt 1 form

Find out other Form 8863

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed