8863 Instructions Form 2015

What is the 8863 Instructions Form

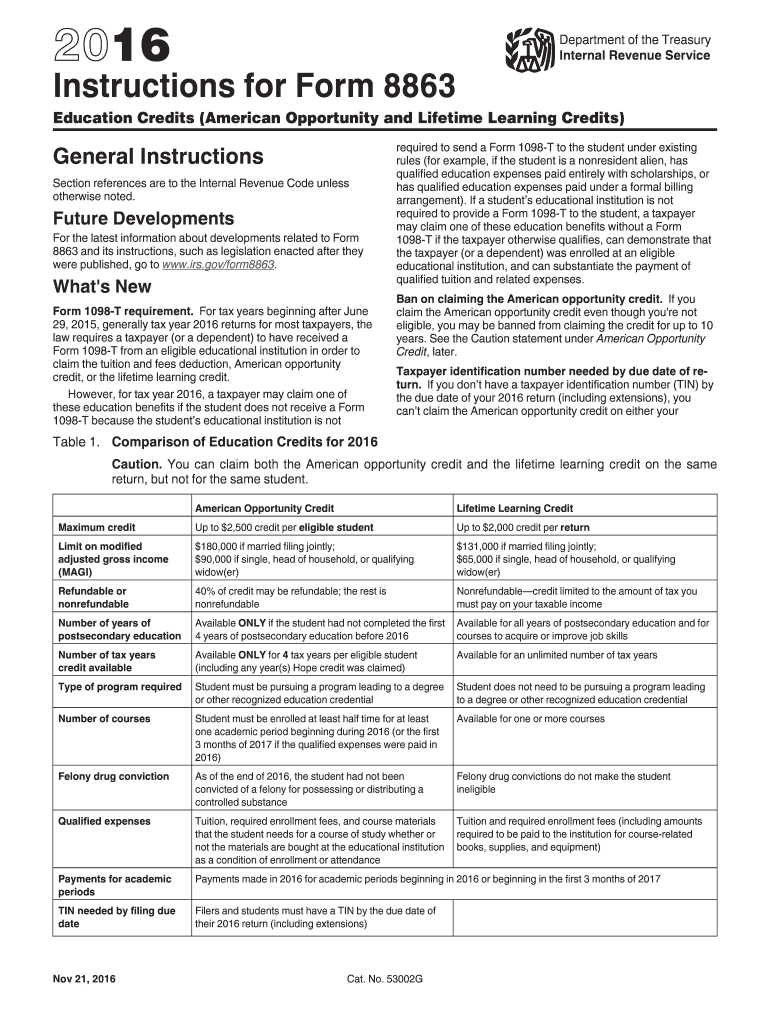

The 8863 Instructions Form is a crucial document used by taxpayers in the United States to claim education credits. Specifically, it is associated with the American Opportunity Credit and the Lifetime Learning Credit, which help offset the costs of higher education. Understanding this form is essential for eligible individuals seeking to maximize their tax benefits related to educational expenses.

Steps to complete the 8863 Instructions Form

Completing the 8863 Instructions Form involves several key steps:

- Gather necessary documentation, including Form 1098-T, which reports tuition payments.

- Determine eligibility for the American Opportunity Credit or the Lifetime Learning Credit based on your education expenses and enrollment status.

- Fill out the required sections of the form, ensuring all information is accurate and complete.

- Calculate the amount of credit you are eligible for and enter it on the form.

- Review the completed form for any errors before submission.

How to obtain the 8863 Instructions Form

The 8863 Instructions Form can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF file, which allows for easy access and printing. Additionally, tax preparation software often includes this form, streamlining the process for users who prefer digital filing.

Key elements of the 8863 Instructions Form

Several key elements must be understood when working with the 8863 Instructions Form:

- Eligible Expenses: Tuition and related fees qualify, but not room and board.

- Credit Limits: The American Opportunity Credit offers up to $2,500 per eligible student, while the Lifetime Learning Credit provides up to $2,000 per tax return.

- Filing Status: Your filing status may affect eligibility and the amount of credit you can claim.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8863 Instructions Form. These guidelines outline eligibility criteria, required documentation, and instructions for calculating credits. It is important to review these guidelines thoroughly to ensure compliance and maximize potential benefits.

Filing Deadlines / Important Dates

Filing deadlines for the 8863 Instructions Form align with the general tax filing deadlines in the United States. Typically, individual tax returns are due on April fifteenth of each year. However, if you require an extension, be aware of the extended deadlines and ensure that the form is submitted in a timely manner to avoid penalties.

Quick guide on how to complete 8863 instructions 2015 form

Complete 8863 Instructions Form effortlessly on any device

Online document administration has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage 8863 Instructions Form on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign 8863 Instructions Form without stress

- Obtain 8863 Instructions Form and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and electronically sign 8863 Instructions Form and ensure excellent communication at any stage of the form development process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8863 instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the 8863 instructions 2015 form

How to create an eSignature for the 8863 Instructions 2015 Form online

How to create an eSignature for the 8863 Instructions 2015 Form in Google Chrome

How to generate an eSignature for putting it on the 8863 Instructions 2015 Form in Gmail

How to generate an electronic signature for the 8863 Instructions 2015 Form from your smartphone

How to make an eSignature for the 8863 Instructions 2015 Form on iOS devices

How to generate an eSignature for the 8863 Instructions 2015 Form on Android devices

People also ask

-

What is the 8863 Instructions Form and who needs it?

The 8863 Instructions Form is essential for taxpayers claiming education credits on their federal tax returns. It helps individuals understand how to properly fill out the form to receive credits for qualified education expenses.

-

How can airSlate SignNow assist with the 8863 Instructions Form?

airSlate SignNow provides a streamlined solution for signing and sending the 8863 Instructions Form. With our user-friendly platform, you can easily manage your education credit claims without the hassle of printing and mailing documents.

-

Are there any costs associated with using airSlate SignNow for the 8863 Instructions Form?

airSlate SignNow offers competitive pricing plans for businesses looking to eSign documents like the 8863 Instructions Form. Our cost-effective solutions ensure that you get the most value while efficiently managing your documentation needs.

-

Can I integrate airSlate SignNow with other software for handling the 8863 Instructions Form?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage the 8863 Instructions Form alongside your existing software tools. This integration enhances your workflow by allowing you to access and sign documents within the platforms you already use.

-

What features does airSlate SignNow offer for managing the 8863 Instructions Form?

airSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage, all designed to simplify the process of handling the 8863 Instructions Form. These features ensure that you can efficiently prepare and sign your documents with ease.

-

Is airSlate SignNow secure for submitting the 8863 Instructions Form?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance protocols to protect your information when submitting the 8863 Instructions Form. You can trust that your sensitive data is safe with us.

-

How do I get started with airSlate SignNow for the 8863 Instructions Form?

Getting started with airSlate SignNow is simple. Sign up for an account, and you can begin using our platform to create, send, and eSign your 8863 Instructions Form in no time, all while enjoying our user-friendly interface.

Get more for 8863 Instructions Form

- To change the coverage that is listed on your declarations page you may use this form to do so

- Cna form statement

- Acic bail bond forms

- Risceo form

- Pearlinsurancecomrenew form

- Cna application g 142826 a form

- Addendum to eras application texas tech university ttuhsc form

- Massdot amending a title or adding a lien form

Find out other 8863 Instructions Form

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word