Form 1096 Annual Summary and Transmittal of U S Information Returns 2024

What is the Form 1096 Annual Summary And Transmittal Of U S Information Returns

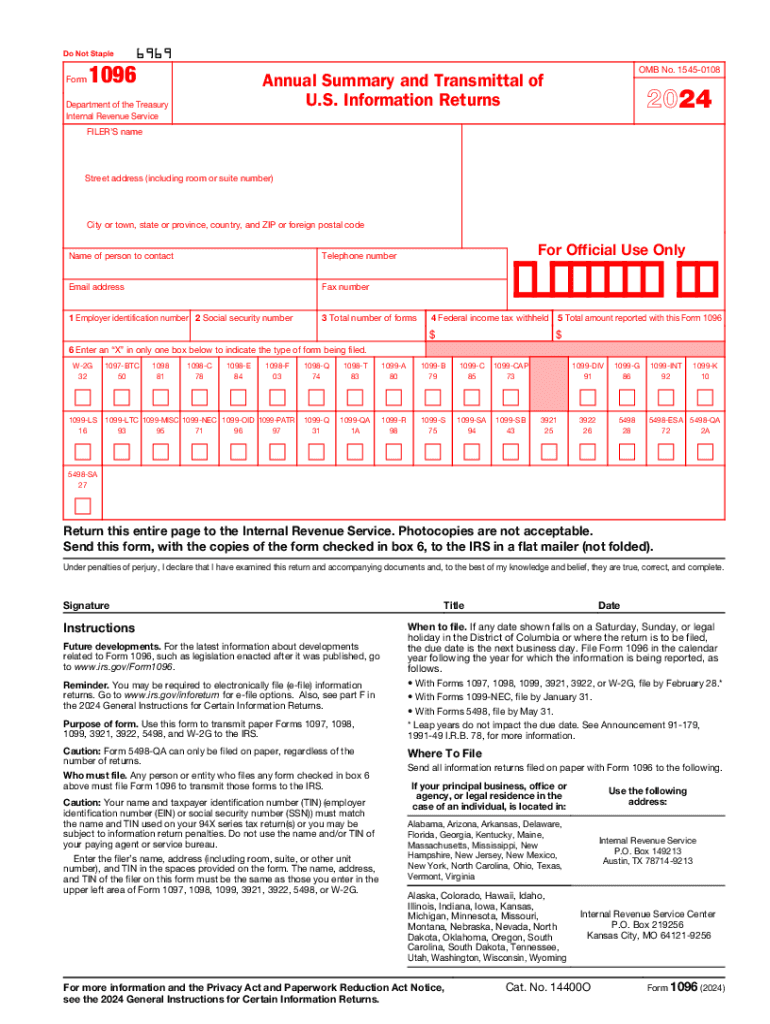

The Form 1096, also known as the Annual Summary and Transmittal of U.S. Information Returns, is a crucial document used by businesses and organizations to summarize and transmit various information returns to the Internal Revenue Service (IRS). This form acts as a cover sheet for several types of information returns, including Forms 1099, 1098, and W-2G. It is essential for reporting payments made to non-employees and other specific transactions that require IRS notification.

Steps to Complete the Form 1096 Annual Summary And Transmittal Of U S Information Returns

Completing the Form 1096 involves several key steps:

- Gather Information: Collect all relevant information returns that will be submitted alongside Form 1096.

- Fill Out the Form: Enter your business name, address, and taxpayer identification number (TIN) in the appropriate fields.

- Report the Total Number of Forms: Indicate the total number of information returns being submitted, which corresponds to the forms you are transmitting.

- Sign and Date: Ensure that an authorized individual signs and dates the form before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for Form 1096 to avoid penalties. Generally, the form must be filed by the last day of February if submitting by paper or by March 31 if filing electronically. For the tax year 2024, these dates will be particularly important to ensure compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 1096. These guidelines include instructions on which types of payments require the form, how to correct any errors, and the acceptable methods for filing. Adhering to these guidelines helps ensure that your submissions are processed smoothly and accurately.

Required Documents

To complete Form 1096, you will need to have the following documents ready:

- Completed information returns (such as Forms 1099, 1098, or W-2G).

- Your business's taxpayer identification number (TIN).

- Contact information for the individual responsible for the filing.

Penalties for Non-Compliance

Failure to file Form 1096 on time or submitting inaccurate information can result in penalties imposed by the IRS. These penalties vary based on how late the form is filed and the severity of the inaccuracies. It is important to understand these potential consequences to ensure timely and accurate submissions.

Quick guide on how to complete form 1096 annual summary and transmittal of u s information returns

Complete Form 1096 Annual Summary And Transmittal Of U S Information Returns effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage Form 1096 Annual Summary And Transmittal Of U S Information Returns on any device using airSlate SignNow applications for Android or iOS and simplify any document-related task today.

How to modify and eSign Form 1096 Annual Summary And Transmittal Of U S Information Returns with ease

- Find Form 1096 Annual Summary And Transmittal Of U S Information Returns and click Get Form to begin.

- Employ the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you want to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searching, or errors that necessitate printing out fresh copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1096 Annual Summary And Transmittal Of U S Information Returns and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1096 annual summary and transmittal of u s information returns

Create this form in 5 minutes!

How to create an eSignature for the form 1096 annual summary and transmittal of u s information returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 1096 and why is it important?

Form 1096 is a summary form used to report information returns to the IRS. It is essential for businesses that file forms like 1099, as it consolidates the information for the IRS. Understanding form 1096 is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with form 1096?

airSlate SignNow simplifies the process of preparing and submitting form 1096 by allowing users to eSign and send documents securely. Our platform ensures that your form 1096 is completed accurately and efficiently, reducing the risk of errors. This streamlines your tax reporting process.

-

Is there a cost associated with using airSlate SignNow for form 1096?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage form 1096 and other documents efficiently. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing form 1096?

airSlate SignNow provides features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing form 1096. These features enhance productivity and ensure that your documents are organized and easily accessible. Additionally, our platform allows for real-time collaboration.

-

Can I integrate airSlate SignNow with other software for form 1096?

Absolutely! airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage form 1096 alongside your other financial documents. This seamless integration helps streamline your workflow and ensures that all your data is synchronized.

-

What are the benefits of using airSlate SignNow for form 1096?

Using airSlate SignNow for form 1096 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit your form 1096 quickly, ensuring compliance with IRS regulations. Additionally, the eSignature feature saves time and resources.

-

Is airSlate SignNow user-friendly for filing form 1096?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to file form 1096. Our intuitive interface guides users through the process, ensuring that even those with minimal technical skills can navigate the platform effectively. This accessibility helps businesses of all sizes.

Get more for Form 1096 Annual Summary And Transmittal Of U S Information Returns

- Inventory and condition of leased premises for pre lease and post lease maine form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out maine form

- Property manager agreement maine form

- Agreement for delayed or partial rent payments maine form

- Tenants maintenance repair request form maine

- Guaranty attachment to lease for guarantor or cosigner maine form

- Amendment to lease or rental agreement maine form

- Warning notice due to complaint from neighbors maine form

Find out other Form 1096 Annual Summary And Transmittal Of U S Information Returns

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter