1096 Form 2014

What is the 1096 Form

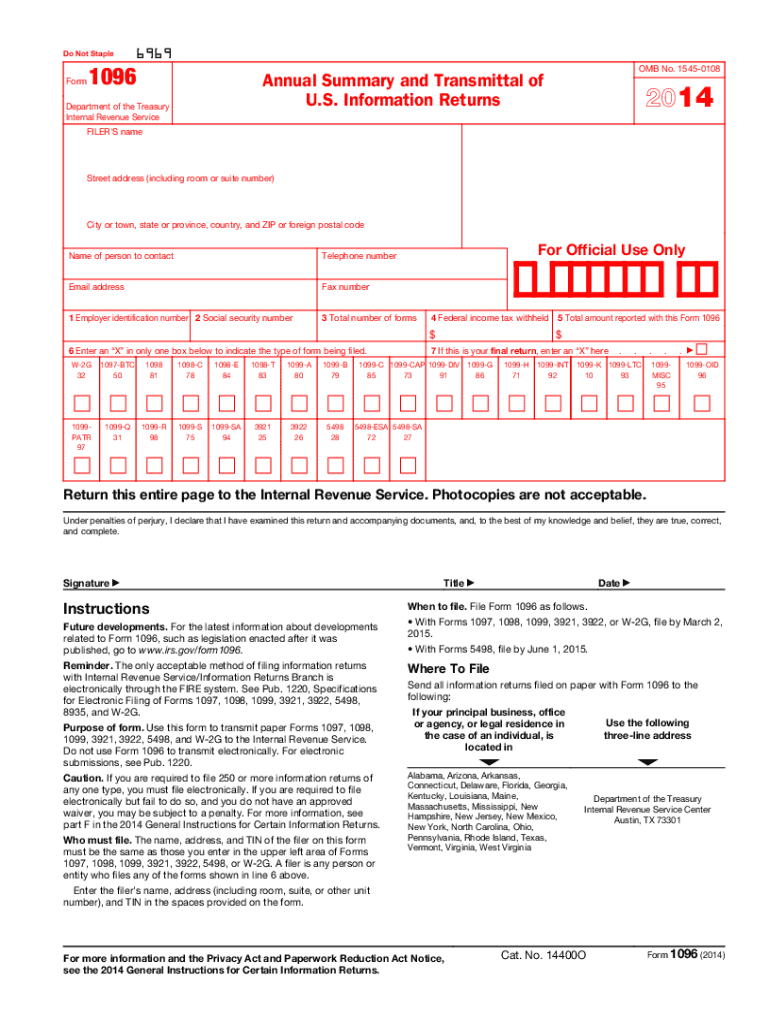

The 1096 Form is a summary form used by businesses to report certain types of payments made to non-employees, such as independent contractors, to the Internal Revenue Service (IRS). It serves as a cover sheet for accompanying forms, such as the 1099 series, which detail individual payments. This form is essential for tax compliance and ensures that the IRS receives accurate information regarding income paid to various entities.

How to use the 1096 Form

To use the 1096 Form, businesses must first gather all relevant 1099 forms they have issued for the tax year. The 1096 serves as a summary of these forms. Fill out the 1096 by providing your business information, including name, address, and Employer Identification Number (EIN). Additionally, indicate the total number of 1099 forms being submitted and the total amount reported. Once completed, the 1096 Form should be submitted along with the corresponding 1099 forms to the IRS.

Steps to complete the 1096 Form

Completing the 1096 Form involves several key steps:

- Gather all 1099 forms issued during the tax year.

- Fill in your business information, including name, address, and EIN.

- Indicate the total number of 1099 forms being submitted.

- Calculate and enter the total amount reported on the 1099 forms.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

The filing deadline for the 1096 Form typically aligns with the due date for the accompanying 1099 forms. Generally, businesses must submit the 1096 Form to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. It is crucial to adhere to these deadlines to avoid penalties and ensure compliance with IRS regulations.

Legal use of the 1096 Form

The 1096 Form is legally required for businesses that have made reportable payments to non-employees. It helps the IRS track income and ensures that all parties fulfill their tax obligations. Using the form correctly is essential for maintaining compliance with federal tax laws. Failure to file the 1096 Form or inaccuracies in reporting can lead to penalties and increased scrutiny from tax authorities.

Form Submission Methods (Online / Mail / In-Person)

The 1096 Form can be submitted to the IRS in several ways. Businesses can file it by mail, ensuring it is sent to the appropriate IRS address based on their location. For those opting for electronic filing, the IRS offers an e-filing option that allows for quicker processing. It is important to check the IRS guidelines for the correct submission method and ensure that all forms are submitted together to avoid delays.

Quick guide on how to complete 2014 1096 form

Complete 1096 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage 1096 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign 1096 Form with ease

- Find 1096 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and maintains the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries over lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Alter and eSign 1096 Form and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1096 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1096 form

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The way to make an eSignature for a PDF file on Android devices

People also ask

-

What is a 1096 Form and why is it important?

The 1096 Form acts as a summary of information returns, like 1099 forms, and is crucial for reporting payments to the IRS. It consolidates data on various income types and assists businesses in meeting tax obligations. Using airSlate SignNow to manage the 1096 Form simplifies the eSigning process and ensures accuracy.

-

How can airSlate SignNow help with the 1096 Form?

airSlate SignNow provides an efficient platform for creating, sending, and signing the 1096 Form electronically. The service streamlines the document handling process, minimizing errors and saving time. With its user-friendly interface, you can easily manage all aspects of your 1096 Form workflow.

-

Is there a cost associated with using airSlate SignNow for the 1096 Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose a plan that suits your needs, whether you need basic eSigning for the 1096 Form or extensive features for larger operations. The investment in airSlate SignNow provides signNow time and cost savings.

-

What features does airSlate SignNow include for handling the 1096 Form?

airSlate SignNow includes features like customizable templates for the 1096 Form, automated reminders for signatures, and secure storage options. These features enhance efficiency and help ensure compliance with tax regulations. The platform also allows for easy collaboration among team members.

-

Can I integrate airSlate SignNow with other tools for managing the 1096 Form?

Absolutely! airSlate SignNow offers integrations with popular tools such as Google Drive, Salesforce, and Dropbox. This allows you to streamline your process for the 1096 Form by seamlessly transferring data between platforms. Integrations enhance productivity and ensure your documents are easily accessible.

-

How does airSlate SignNow ensure the security of my 1096 Form data?

airSlate SignNow employs advanced security measures to protect your 1096 Form data. Features like encryption, secure access, and compliance with industry standards ensure that your documents are safe. You can trust that your sensitive information remains confidential while using our eSigning platform.

-

What benefits can businesses gain from using airSlate SignNow for the 1096 Form?

By using airSlate SignNow for the 1096 Form, businesses can expect improved efficiency, reduced paper usage, and faster turnaround times. The platform simplifies the signing process, enhancing productivity and ensuring compliance with tax filing deadlines. Ultimately, it supports a more organized and effective workflow.

Get more for 1096 Form

Find out other 1096 Form

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien