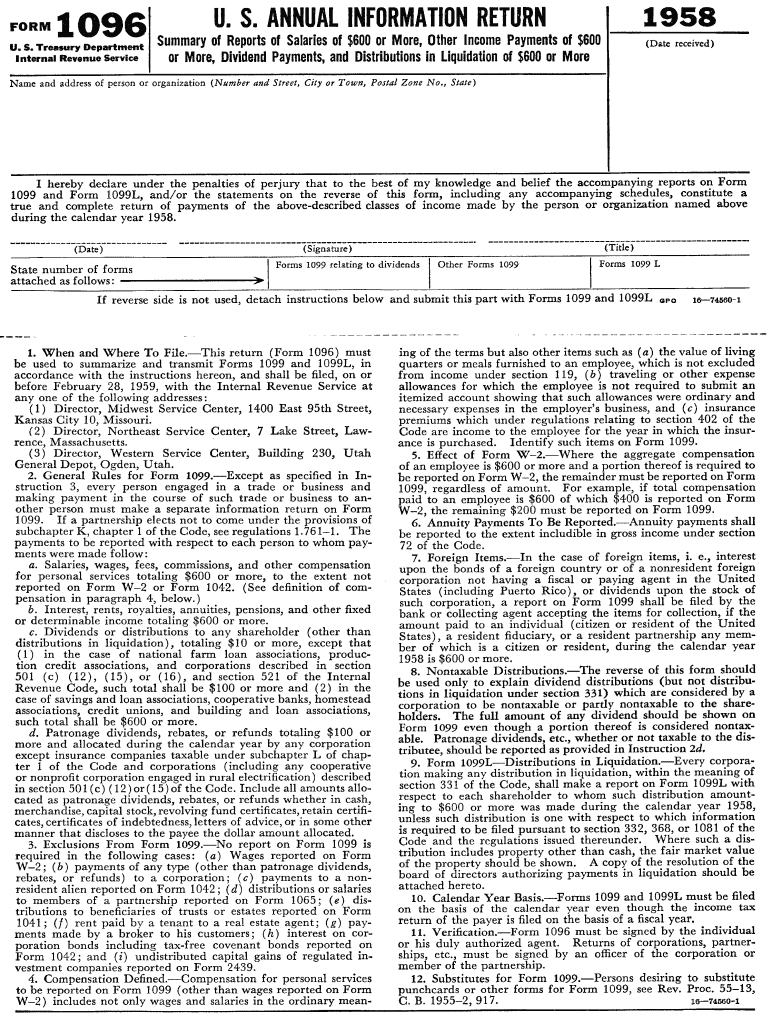

FORM 1096 1958 Irs 1958

What is the FORM IRS

The FORM IRS is an essential document used for reporting various types of information returns to the Internal Revenue Service (IRS). This form serves as a summary of all information returns, including forms such as 1099 and W-2, that a business or individual has filed for the tax year. It is crucial for ensuring that the IRS has a complete record of income and other financial information reported by taxpayers.

How to use the FORM IRS

To use the FORM IRS, taxpayers must first gather all relevant information returns they have issued throughout the year. This includes collecting copies of forms like 1099-MISC, 1099-INT, and W-2. Once you have compiled these forms, you will fill out the 1096 form with details such as the total number of forms submitted, the total amount reported, and your business's identifying information. After completing the form, it must be submitted to the IRS along with the corresponding information returns.

Steps to complete the FORM IRS

Completing the FORM IRS involves several key steps:

- Gather all relevant information returns for the tax year.

- Fill in your business name, address, and Employer Identification Number (EIN).

- Indicate the type of information return you are submitting.

- Count the total number of forms you are submitting and enter this number.

- Calculate the total amount reported on these forms and enter it on the 1096.

- Sign and date the form before submission.

Legal use of the FORM IRS

The FORM IRS is legally binding when filled out correctly and submitted on time. It is essential for compliance with IRS regulations. Failure to file this form can result in penalties. The form must be submitted along with the corresponding information returns to ensure that the IRS can accurately track income and tax obligations. Adhering to the filing guidelines and deadlines is crucial for maintaining compliance.

Filing Deadlines / Important Dates

Filing deadlines for the FORM IRS typically align with the deadlines for the information returns it summarizes. Generally, these forms must be submitted to the IRS by the end of February if filed on paper or by the end of March if filed electronically. It is important to check the IRS website or consult a tax professional for specific dates each tax year, as they may vary.

Form Submission Methods (Online / Mail / In-Person)

The FORM IRS can be submitted in several ways. Taxpayers can file the form electronically through the IRS e-file system if they are also e-filing their information returns. Alternatively, the form can be printed and mailed to the appropriate IRS address, which varies depending on the taxpayer's location and whether they are enclosing payment. In-person submission is generally not an option for this form.

Quick guide on how to complete form 1096 1958 irs

Complete FORM 1096 1958 Irs effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage FORM 1096 1958 Irs on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-based process today.

How to modify and eSign FORM 1096 1958 Irs with ease

- Locate FORM 1096 1958 Irs and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tiresome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign FORM 1096 1958 Irs to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1096 1958 irs

Create this form in 5 minutes!

How to create an eSignature for the form 1096 1958 irs

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is FORM 1096 1958 Irs and why is it important?

FORM 1096 1958 Irs is an essential tax form used to summarize annual information returns, including forms related to nonemployee compensation and other income. Businesses need to file this form to inform the IRS about forms submitted, thereby ensuring compliance and avoiding potential penalties.

-

How can airSlate SignNow help with FORM 1096 1958 Irs?

airSlate SignNow streamlines the eSigning and submission process for FORM 1096 1958 Irs, allowing businesses to digitally sign and send this important tax form in a few clicks. Our platform ensures that all details are secured and compliant with IRS regulations.

-

Is there a cost associated with using airSlate SignNow for FORM 1096 1958 Irs?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business needs, allowing you to choose the best option for handling FORM 1096 1958 Irs. We provide a cost-effective solution that supports seamless eSignature capabilities for all your document needs.

-

What features does airSlate SignNow offer for managing FORM 1096 1958 Irs?

Our platform provides features like document templates, secure cloud storage, and audit trails specifically for managing FORM 1096 1958 Irs. Users can easily customize documents, track changes, and maintain compliance with IRS standards.

-

Can I integrate airSlate SignNow with other tools for FORM 1096 1958 Irs?

Yes, airSlate SignNow integrates seamlessly with various business applications, enhancing your workflow for FORM 1096 1958 Irs. This integration allows for easy data transfer and ensures that all your forms are handled efficiently.

-

What benefits does airSlate SignNow provide for businesses filing FORM 1096 1958 Irs?

airSlate SignNow enhances business efficiency by reducing the time and paper needed to manage FORM 1096 1958 Irs. Our solution not only speeds up the filing process but also ensures accuracy and secure transmission of your important documents.

-

Is airSlate SignNow user-friendly for filing FORM 1096 1958 Irs?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and file FORM 1096 1958 Irs without prior experience in eSigning. Our intuitive interface simplifies the eSigning process, allowing users to focus on their core business tasks.

Get more for FORM 1096 1958 Irs

- Warrant deed from four individuals to two trusts hawaii form

- Hawaii quitclaim deed form

- Quitclaim deed trust form

- Hawaii husband wife form

- Heirship affidavit descent hawaii form

- Quitclaim deed time share husband and wife to an individual hawaii form

- Hawaii grant deed form

- Hawaii quitclaim deed 497304329 form

Find out other FORM 1096 1958 Irs

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple