Blank W 2 Forms for Employees to Fill Out 2012

What is the Blank W-2 Form?

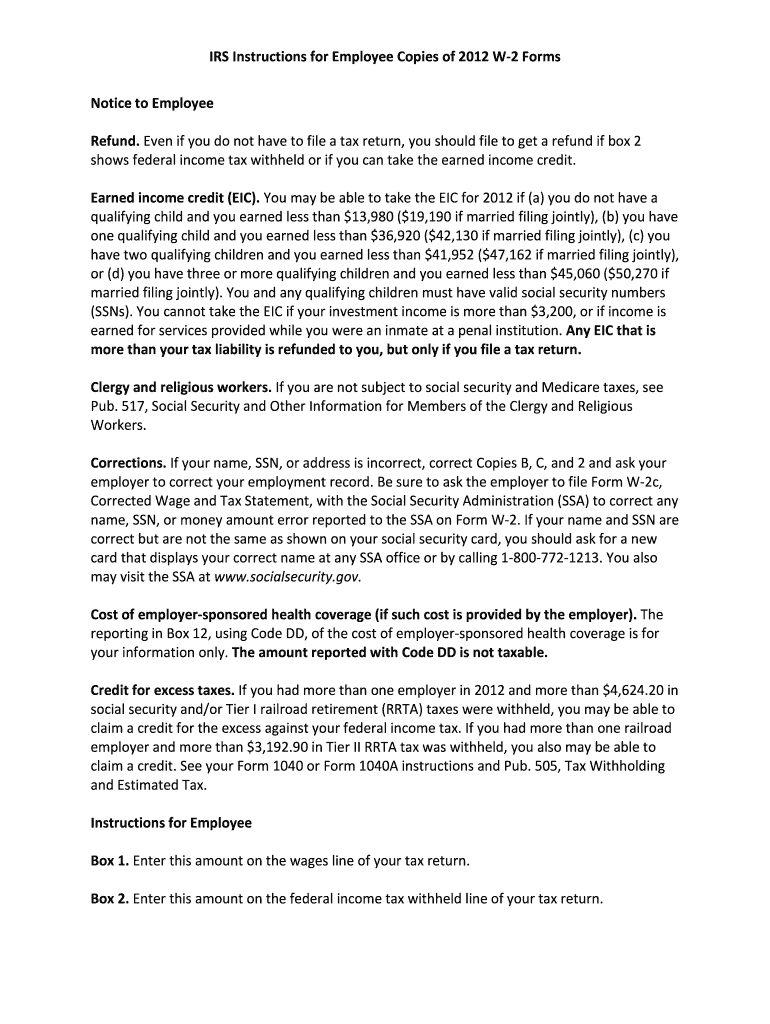

The Blank W-2 form is a crucial document used by employers to report wages paid to employees and the taxes withheld from those wages. Each year, employers must provide a W-2 form to their employees by January thirty-first, detailing their earnings and tax withholdings for the previous calendar year. This form is essential for employees when filing their federal and state tax returns, as it provides the necessary information to accurately report income and claim any applicable tax credits or deductions.

How to Obtain the Blank W-2 Form

Employers can obtain the Blank W-2 form from the Internal Revenue Service (IRS) website or through various accounting software platforms. The IRS provides the form in a printable format, ensuring that it meets all legal requirements for reporting income. Additionally, many payroll service providers offer the W-2 form as part of their services, simplifying the process for employers. It is important to ensure that the correct version of the form is used, as there may be updates or changes in tax laws that affect its format and requirements.

Steps to Complete the Blank W-2 Form

Completing the Blank W-2 form involves several key steps:

- Enter the employer's information, including name, address, and Employer Identification Number (EIN).

- Fill in the employee's details, such as name, address, and Social Security Number (SSN).

- Report the total wages paid to the employee in Box 1, along with any federal income tax withheld in Box 2.

- Include other relevant information, such as Social Security wages and Medicare wages in Boxes 3 and 5, respectively.

- Complete any additional boxes that apply, such as state tax information if applicable.

Legal Use of the Blank W-2 Form

The Blank W-2 form must be used in compliance with IRS regulations. Employers are legally required to provide this form to their employees by the designated deadline. Failure to do so can result in penalties for the employer. Additionally, employees must ensure that the information reported on the W-2 is accurate, as discrepancies can lead to issues with tax filings and potential audits. It is essential to keep copies of the W-2 form for record-keeping purposes.

IRS Guidelines for the Blank W-2 Form

The IRS has specific guidelines regarding the completion and distribution of the W-2 form. Employers must ensure that the form is filled out accurately and submitted to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. The IRS also provides detailed instructions on how to complete each section of the form, including what to include in each box. Adhering to these guidelines is crucial for compliance and to avoid penalties.

Form Submission Methods

The Blank W-2 form can be submitted to the IRS through various methods. Employers can file the form electronically using the IRS e-file system, which is often more efficient and reduces the likelihood of errors. Alternatively, the form can be mailed directly to the IRS. If submitting by mail, it is advisable to use certified mail to ensure that the form is received by the IRS by the deadline. Additionally, copies of the W-2 must be provided to employees by the deadline, either in paper form or electronically, with the employee's consent.

Quick guide on how to complete blank w 2 forms for employees to fill out

Effortlessly Complete Blank W 2 Forms For Employees To Fill Out on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly without any holdups. Handle Blank W 2 Forms For Employees To Fill Out on any device using airSlate SignNow's Android or iOS applications, and streamline any document-related task today.

How to Modify and Electronically Sign Blank W 2 Forms For Employees To Fill Out with Ease

- Obtain Blank W 2 Forms For Employees To Fill Out and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, the frustration of searching for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Blank W 2 Forms For Employees To Fill Out to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct blank w 2 forms for employees to fill out

Create this form in 5 minutes!

How to create an eSignature for the blank w 2 forms for employees to fill out

The way to create an eSignature for a PDF document online

The way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is a W2 reissue request form?

A W2 reissue request form is a document that employees use to request a duplicate copy of their W2 form for tax purposes. airSlate SignNow streamlines this process, allowing users to easily create, send, and eSign their requests. By utilizing our solution, businesses can ensure that employees receive their needed documents timely and efficiently.

-

How can I create a W2 reissue request form using airSlate SignNow?

Creating a W2 reissue request form with airSlate SignNow is simple and intuitive. You can start by selecting a customizable template or creating one from scratch. Our platform allows you to add required fields, signatures, and secure sharing options, making the document ready for eSigning in just a few clicks.

-

Is there a fee for using the W2 reissue request form feature?

airSlate SignNow offers competitive pricing plans that include access to the W2 reissue request form feature. Depending on your subscription, you may enjoy additional functionalities that enhance your document management capabilities. We offer a cost-effective solution tailored to meet the needs of businesses of all sizes.

-

What are the benefits of using airSlate SignNow for W2 reissue requests?

Using airSlate SignNow for W2 reissue requests brings numerous benefits, including increased efficiency and reduced processing time. Our platform allows for secure eSigning and cloud storage, which means you can track requests and access documents anytime. This streamlined process ultimately helps improve employee satisfaction and compliance with tax regulations.

-

Can airSlate SignNow integrate with other HR software for W2 reissue requests?

Yes, airSlate SignNow can seamlessly integrate with various HR software systems, enhancing the W2 reissue request process. By connecting with your existing tools, you can automate workflows and manage employee requests more efficiently. This integration capability ensures that your document handling is smooth and standardized across platforms.

-

How secure is the W2 reissue request form process with airSlate SignNow?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the W2 reissue request form. Our platform employs industry-standard encryption to protect your data throughout the signing process. Additionally, we comply with relevant regulations to ensure that employee information remains confidential and secure.

-

Can I track the status of my W2 reissue request form?

Absolutely! airSlate SignNow allows you to track the status of your W2 reissue request form in real time. You will receive notifications when the document is viewed or signed, keeping you informed every step of the way, which helps maintain accountability and ensures timely follow-ups.

Get more for Blank W 2 Forms For Employees To Fill Out

- Fortis bc pre authorized payment form

- Grading certificate form

- Chattel mortgage form

- Sponsorship application form muskowekwan muskowekwan

- Cea blood test form ontario fullexamscom

- Submit to the office of the dean of the student s home faculty form

- Tphc new pt intake form 140224doc tphc

- Icbc collector form

Find out other Blank W 2 Forms For Employees To Fill Out

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement