78 10 870 Httpbville Lib Ny Usomekafilesoriginal Form

Understanding the motor etax dor ga gov

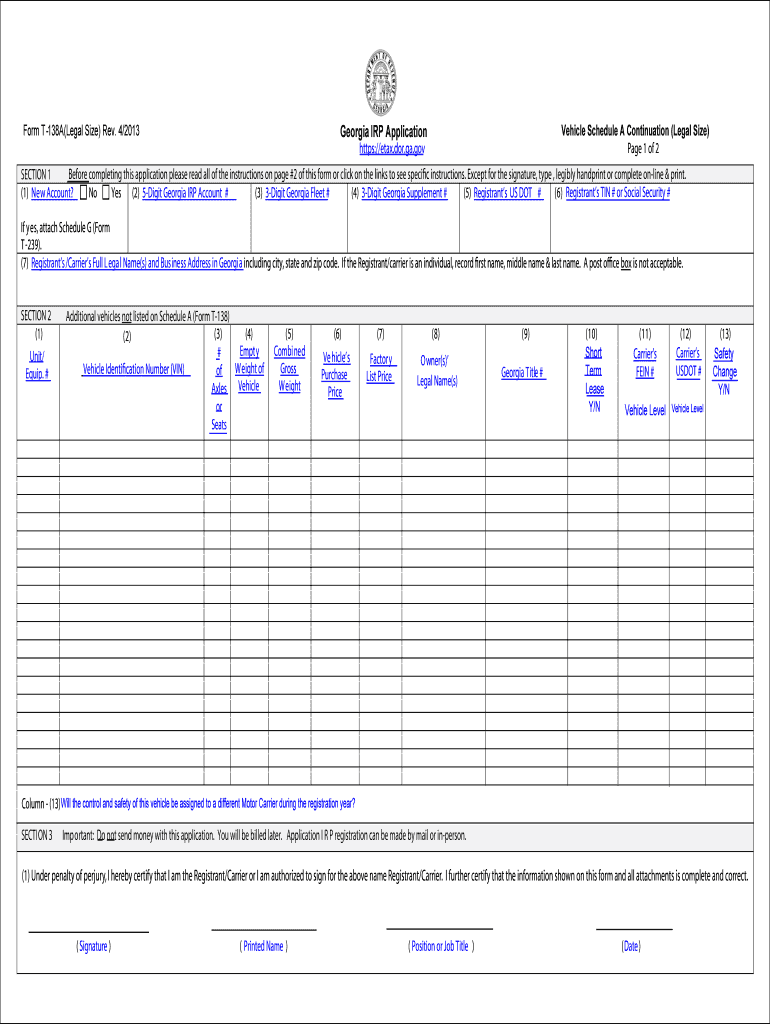

The motor etax dor ga gov is a crucial online service provided by the Georgia Department of Revenue. This platform enables users to manage their motor vehicle taxes efficiently. By utilizing this service, residents can file their taxes, check their status, and make payments online, streamlining the entire process. Understanding how this system works is essential for compliance and to avoid any potential penalties.

Steps to complete the motor etax dor ga gov online

Completing the motor etax dor ga gov online involves several straightforward steps:

- Visit the official Georgia Department of Revenue website.

- Navigate to the motor vehicle tax section.

- Provide necessary personal information, including your vehicle details.

- Review your information for accuracy.

- Submit your tax filing electronically.

- Receive confirmation of your submission.

Following these steps will ensure that your motor vehicle taxes are filed correctly and on time.

Required documents for the motor etax dor ga gov

When using the motor etax dor ga gov online services, certain documents are necessary to facilitate the process. These typically include:

- Your driver's license number or state ID.

- Vehicle identification number (VIN).

- Proof of residency.

- Any previous tax documents related to your vehicle.

Having these documents ready can expedite your filing process and help ensure accuracy.

Legal considerations for the motor etax dor ga gov

It is important to understand the legal implications of using the motor etax dor ga gov. Electronic submissions are legally binding, provided they comply with state and federal regulations. This includes adherence to the ESIGN Act, which ensures that electronic signatures have the same legal standing as traditional handwritten signatures. Ensuring compliance with these laws protects both the filer and the state.

Penalties for non-compliance with motor etax dor ga gov

Failing to comply with the motor etax dor ga gov requirements can lead to various penalties. These may include:

- Late fees for overdue payments.

- Increased tax liability due to penalties.

- Potential legal action for persistent non-compliance.

Being aware of these consequences emphasizes the importance of timely and accurate submissions.

Digital vs. paper version of the motor etax dor ga gov

Choosing between the digital and paper versions of the motor etax dor ga gov can significantly impact the filing experience. The digital version offers advantages such as faster processing times, immediate confirmation, and reduced risk of errors. In contrast, paper submissions can lead to delays and potential issues with lost documents. Opting for the online service is generally recommended for efficiency and convenience.

Quick guide on how to complete section 1 motor etax dor ga

Complete 78 10 870 Httpbville lib ny usomekafilesoriginal effortlessly on any device

Digital document management has gained traction among corporations and individuals alike. It offers an ideal environmentally friendly replacement for traditional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage 78 10 870 Httpbville lib ny usomekafilesoriginal on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

Ways to alter and eSign 78 10 870 Httpbville lib ny usomekafilesoriginal with ease

- Locate 78 10 870 Httpbville lib ny usomekafilesoriginal and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools offered by airSlate SignNow designed specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign 78 10 870 Httpbville lib ny usomekafilesoriginal and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What will be the appropriate section to choose while filling out the ITR 1 form online?

Please find details of return filed under sectionSection 139(1) – Original return filed before the last due date for filing returnOriginal returnfiling for the first time in an assessment yearSection 139(4) – Belated returnOriginal returnFiling for the first time after the due date of filing the return for the assessment yearSection 139(5) – Revised returnRevised return filed subsequent to original returnThis will be revised returnVoluntarily filing the revised returnInfo needed is:Acknowledgement numberdate of filing originalSection 139(9) – Defective returnWhen due to an error, the return is considered as defective (as if no return has been filed)The department may issue notice to correct the errors and file the returnSo the return filed subsequent to the intimation u/s 139(9) will be original returnYou have to provide following info while filing the return in response to noticeReceipt No: i.e Acknowledgement number of Original (Defective in this case) returnDate of filing the original (Defective in this case) returnNotice no. (Eg. CPC/1415/G5/1421417689)Date of NoticeSection 142(1) – Notice to assessee for filing the returnWhen a person has not filed the return, he may receive notice u/s 142(1) asking him to file the returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 142(1)Section 148 – Issue of notice for reassessment (Income escaping assessment)Department can issue a notice to a person for filing the income tax return u/s 148This will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 148Section 153A – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153A to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153ASection 153C – Fresh assessment pursuance of an orderDepartment can issue a notice u/s 153C to a person for filing the income tax returnThis will be the original returnYou need to mention the notice date only while filing the return subsequent to the notice u/s 153CBe Peaceful !!!

Create this form in 5 minutes!

How to create an eSignature for the section 1 motor etax dor ga

How to generate an eSignature for the Section 1 Motor Etax Dor Ga in the online mode

How to make an electronic signature for the Section 1 Motor Etax Dor Ga in Chrome

How to create an electronic signature for putting it on the Section 1 Motor Etax Dor Ga in Gmail

How to generate an eSignature for the Section 1 Motor Etax Dor Ga from your smart phone

How to generate an eSignature for the Section 1 Motor Etax Dor Ga on iOS

How to make an electronic signature for the Section 1 Motor Etax Dor Ga on Android

People also ask

-

What are motor etax dor ga gov online services?

Motor etax dor ga gov online services are digital tools provided by the Georgia Department of Revenue for managing motor vehicle taxes and related filings. These services streamline the process of paying taxes and accessing necessary documentation, making it easier for residents to handle their motor vehicle responsibilities.

-

How can airSlate SignNow enhance my experience with motor etax dor ga gov online services?

airSlate SignNow offers a user-friendly solution for sending and eSigning documents associated with motor etax dor ga gov online services. You can efficiently manage your paperwork, ensuring timely submissions without the hassles of traditional methods, all while maintaining compliance with state requirements.

-

What are the costs associated with using motor etax dor ga gov online services?

While the Georgia Department of Revenue's motor etax dor ga gov online services may have no direct costs, users should consider associated fees for specific transactions. airSlate SignNow provides a cost-effective eSignature solution, enabling users to reduce overhead and streamline their document management process.

-

Are there any benefits to using motor etax dor ga gov online services?

Yes, using motor etax dor ga gov online services offers several benefits, including convenience, time savings, and reduced paperwork. These online services enable users to easily track their payments and submissions, minimizing errors and enhancing efficiency.

-

Can I integrate airSlate SignNow with motor etax dor ga gov online services?

Absolutely! airSlate SignNow can be seamlessly integrated with motor etax dor ga gov online services, enhancing your document workflow. This integration allows for the easy handling of signatures on essential government documents, leading to a more streamlined process.

-

What features does airSlate SignNow offer that are beneficial for motor etax dor ga gov online services?

airSlate SignNow provides features such as real-time tracking, secure storage, and customizable templates, making it ideal for users dealing with motor etax dor ga gov online services. These features ensure that your documents are organized and accessible when you need them the most.

-

Is airSlate SignNow compliant with Georgia state laws for motor etax filings?

Yes, airSlate SignNow is designed to comply with Georgia state laws regarding electronic signatures and documentation for motor etax filings. This compliance ensures that your transactions and eSigned documents are legally recognized and secure.

Get more for 78 10 870 Httpbville lib ny usomekafilesoriginal

Find out other 78 10 870 Httpbville lib ny usomekafilesoriginal

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now