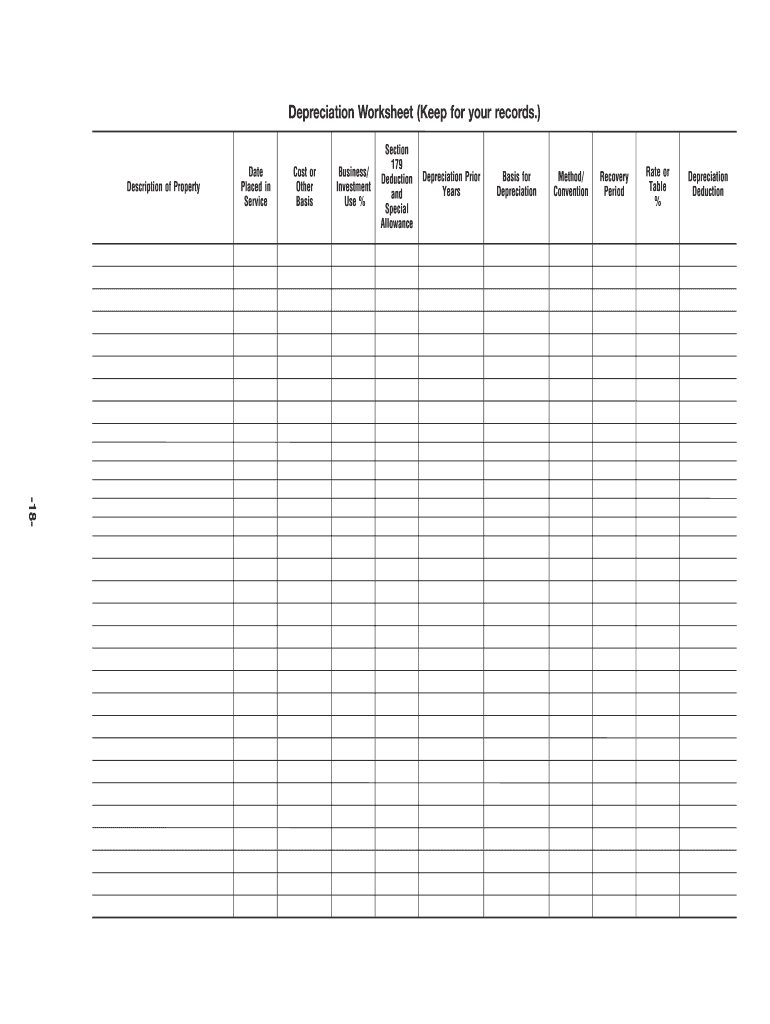

Depreciation Worksheet Form

What is the depreciation worksheet?

The depreciation worksheet is a crucial financial document used to calculate the depreciation of assets over time. It helps businesses and individuals track the value of their assets, ensuring accurate reporting for tax purposes. This worksheet typically includes sections for asset details, acquisition costs, useful life, and the method of depreciation chosen, such as straight-line or declining balance. Understanding how to properly fill out this form is essential for compliance with IRS regulations.

How to use the depreciation worksheet

Using the depreciation worksheet involves several straightforward steps. First, gather all relevant information about the asset, including its purchase price, date of acquisition, and estimated useful life. Then, select the appropriate depreciation method based on your financial strategy. Next, input the data into the worksheet, ensuring accuracy in calculations. Finally, review the completed worksheet to confirm that all entries are correct before filing with your tax return.

Steps to complete the depreciation worksheet

Completing the depreciation worksheet requires a systematic approach. Begin by identifying the asset and its purchase details. Follow these steps:

- Enter the asset's name and description.

- Record the acquisition date and cost.

- Determine the useful life of the asset.

- Select the depreciation method (e.g., straight-line or declining balance).

- Calculate annual depreciation expense based on the chosen method.

- Summarize the total depreciation to date for reporting purposes.

Ensure to double-check all calculations for accuracy before submission.

Legal use of the depreciation worksheet

The legal use of the depreciation worksheet is governed by IRS guidelines, which outline how depreciation should be reported for tax purposes. It is essential to adhere to these regulations to avoid penalties. The completed worksheet serves as documentation for asset depreciation claims on tax returns, making it a vital part of financial record-keeping. Properly executed, it can withstand scrutiny during audits and support the legitimacy of reported figures.

IRS guidelines

The IRS provides specific guidelines for completing the depreciation worksheet to ensure compliance with tax laws. These guidelines include instructions on selecting the appropriate depreciation method, determining useful life, and reporting depreciation on tax returns. It is important to stay updated on any changes to these regulations, as they can affect how assets are depreciated and reported. Familiarizing oneself with IRS requirements can help in accurately filling out the worksheet and avoiding potential issues.

Required documents

To complete the depreciation worksheet accurately, several documents are typically required. These include:

- Purchase invoices or receipts for the asset.

- Documentation of the asset's useful life as per IRS guidelines.

- Any previous depreciation schedules if applicable.

- Records of any improvements or modifications made to the asset.

Having these documents on hand will facilitate a smoother completion process and ensure that all information is accurate.

Quick guide on how to complete depreciation worksheet

Effortlessly Prepare Depreciation Worksheet on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without any delays. Manage Depreciation Worksheet on any device using airSlate SignNow’s Android or iOS applications and enhance any document-based workflow today.

How to Edit and eSign Depreciation Worksheet with Ease

- Locate Depreciation Worksheet and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Update and eSign Depreciation Worksheet and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the depreciation worksheet

The best way to generate an electronic signature for a PDF in the online mode

The best way to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is a depreciation worksheet?

A depreciation worksheet is a tool used to calculate and track the depreciation of assets over time. It helps businesses manage their financial records effectively by providing clear insights into asset values. With airSlate SignNow, you can easily create and manage your depreciation worksheet alongside other important documents.

-

How can airSlate SignNow help with my depreciation worksheet?

airSlate SignNow simplifies the process of creating and sharing a depreciation worksheet. You can easily eSign and send documents, ensuring that all stakeholders can access the information quickly. This efficiency helps maintain accurate records and accelerates your financial processes.

-

Is airSlate SignNow cost-effective for creating a depreciation worksheet?

Yes, airSlate SignNow offers a cost-effective solution for creating a depreciation worksheet and other documents. Our pricing plans are designed to fit various business needs, ensuring you receive great value without compromising on features. You can access powerful tools to streamline your documentation process.

-

What features does airSlate SignNow provide for managing a depreciation worksheet?

airSlate SignNow provides essential features for managing your depreciation worksheet, including customizable templates, electronic signatures, and secure sharing options. You can collaborate in real-time, making updates and changes more efficient. These features enhance overall productivity and accuracy in financial reporting.

-

Can I integrate other accounting software with airSlate SignNow for my depreciation worksheet?

Yes, airSlate SignNow allows for seamless integration with various accounting software to enhance the functionality of your depreciation worksheet. These integrations streamline your financial processes by allowing you to share data between applications effortlessly. This ensures your asset management is both efficient and comprehensive.

-

What benefits does using airSlate SignNow’s depreciation worksheet offer my business?

Using airSlate SignNow for your depreciation worksheet offers numerous benefits, including improved accuracy in financial tracking, enhanced collaboration among team members, and faster turnaround times for document approvals. This ultimately leads to more informed decision-making and better asset management. Our solution empowers your business to stay organized and compliant.

-

How secure is my data when using airSlate SignNow for my depreciation worksheet?

Your data's security is a top priority at airSlate SignNow. We implement advanced encryption methods and secure cloud storage to protect your depreciation worksheet and other sensitive documents. You can have peace of mind knowing that your financial data is safe while utilizing our services.

Get more for Depreciation Worksheet

- Behavior or the behavior of persons on your leased premises form

- With release of lien as to leasehold estate form

- New tenant welcome card form fill out and sign printable

- By the stated deadline landlord may take further action against you including form

- Termination of the lease evicting you from the leased premises and filing suit against form

- How do i report a change of name or address to medicare form

- Minimum clerk age jurisdictions california department of form

- Cv 11c statement of consent to proceed before a united form

Find out other Depreciation Worksheet

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer