433 Form 2014

What is the 433 Form

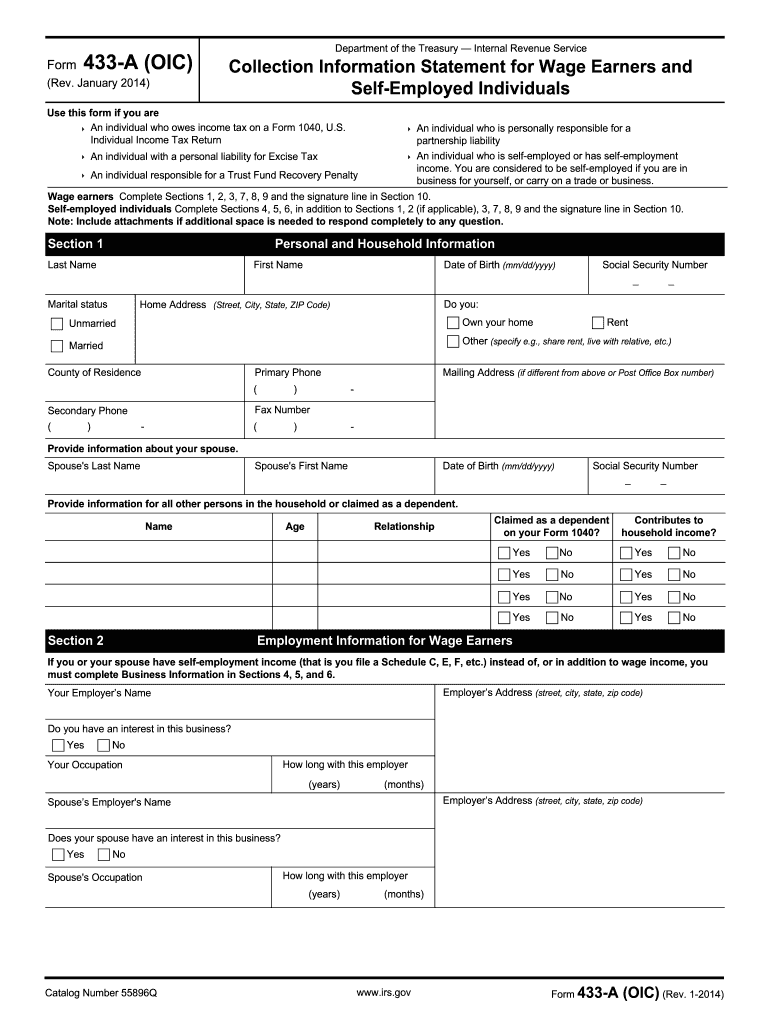

The 433 Form, often referred to as the Form 433-A or 433-B, is a financial statement used by the Internal Revenue Service (IRS) to assess an individual's or business's financial situation. This form is crucial for taxpayers who are seeking to establish an installment agreement or settle tax debts through an Offer in Compromise. It requires detailed information about income, expenses, assets, and liabilities, giving the IRS a clear picture of the taxpayer's financial health.

How to use the 433 Form

To effectively use the 433 Form, start by gathering all necessary financial documents, including pay stubs, bank statements, and information about assets. Complete the form by accurately reporting your income, expenses, and assets. Ensure that all information is current and truthful, as discrepancies can lead to delays or denials. Once completed, the form can be submitted to the IRS as part of your request for an installment agreement or Offer in Compromise.

Steps to complete the 433 Form

Completing the 433 Form involves several key steps:

- Collect financial documents, including income statements and expense records.

- Fill out the personal information section, ensuring accuracy.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- List all monthly expenses, categorizing them into necessary living costs.

- Provide information on assets, such as bank accounts, real estate, and vehicles.

- Review the form for accuracy and completeness before submission.

Legal use of the 433 Form

The legal use of the 433 Form is primarily within the context of negotiating tax liabilities with the IRS. It is essential for taxpayers to understand that the information provided must be truthful and complete, as it can be used to determine eligibility for various tax relief options. Misrepresentation can lead to legal consequences, including penalties or disqualification from relief programs.

Examples of using the 433 Form

There are several scenarios where the 433 Form is applicable:

- A self-employed individual seeking to set up a payment plan for outstanding tax debts.

- A business owner applying for an Offer in Compromise to settle tax liabilities for less than the full amount owed.

- A taxpayer facing financial hardship who needs to demonstrate their inability to pay taxes in full.

Required Documents

When completing the 433 Form, certain documents are required to substantiate the information provided. These documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for the last few months.

- Statements for any other income sources, such as rental income or dividends.

- Documentation of monthly expenses, including bills and loan statements.

- Proof of assets, such as property deeds or vehicle titles.

Quick guide on how to complete 433 2014 form

Complete 433 Form effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Manage 433 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign 433 Form with ease

- Find 433 Form and click Get Form to initiate.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors that need new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign 433 Form and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 433 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 433 2014 form

How to make an eSignature for your 433 2014 Form in the online mode

How to create an electronic signature for your 433 2014 Form in Chrome

How to create an eSignature for putting it on the 433 2014 Form in Gmail

How to generate an eSignature for the 433 2014 Form straight from your smart phone

How to generate an eSignature for the 433 2014 Form on iOS

How to generate an electronic signature for the 433 2014 Form on Android

People also ask

-

What is the 433 Form and how can airSlate SignNow help?

The 433 Form is a form used by the IRS for financial disclosures. With airSlate SignNow, you can easily fill out, sign, and send the 433 Form electronically, streamlining the entire process. Our platform ensures that your document is securely stored and easily accessible for all parties involved.

-

Is there a cost associated with using the 433 Form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that allow you to handle the 433 Form efficiently. You can choose from various subscription options based on your needs and the number of documents you plan to manage. Our cost-effective solution ensures that you can get the most value while managing your forms.

-

What features does airSlate SignNow offer for managing the 433 Form?

airSlate SignNow provides a range of features for the 433 Form, including customizable templates, electronic signatures, and document tracking. These features allow users to streamline their workflows, ensuring that the 433 Form is completed and returned quickly and securely. Additionally, our user-friendly interface makes it easy to navigate the signing process.

-

Can I integrate the 433 Form into my existing systems with airSlate SignNow?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms, allowing you to incorporate the 433 Form into your existing workflows. This capability ensures that you can manage your documents efficiently without disrupting your business operations. Explore our API and integration options to learn more.

-

How does airSlate SignNow ensure the security of the 433 Form?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to protect the 433 Form and all documents you handle on our platform. Additionally, we comply with industry standards to ensure that your data remains safe and confidential throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 433 Form?

Using airSlate SignNow for the 433 Form provides numerous benefits, including time savings, improved accuracy, and enhanced compliance. Our platform automates the signing process, reducing the chances of errors and ensuring that your forms are completed correctly. This efficiency helps you focus on your core business activities.

-

Can I track the status of my 433 Form using airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your 433 Form in real-time. You will receive notifications for each step of the signing process, ensuring you are always informed about where your document stands. This feature enhances accountability and keeps your workflow organized.

Get more for 433 Form

Find out other 433 Form

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast