Form 433 a OIC Rev 4 Collection Information Statement for Wage Earners and 2020

What is the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

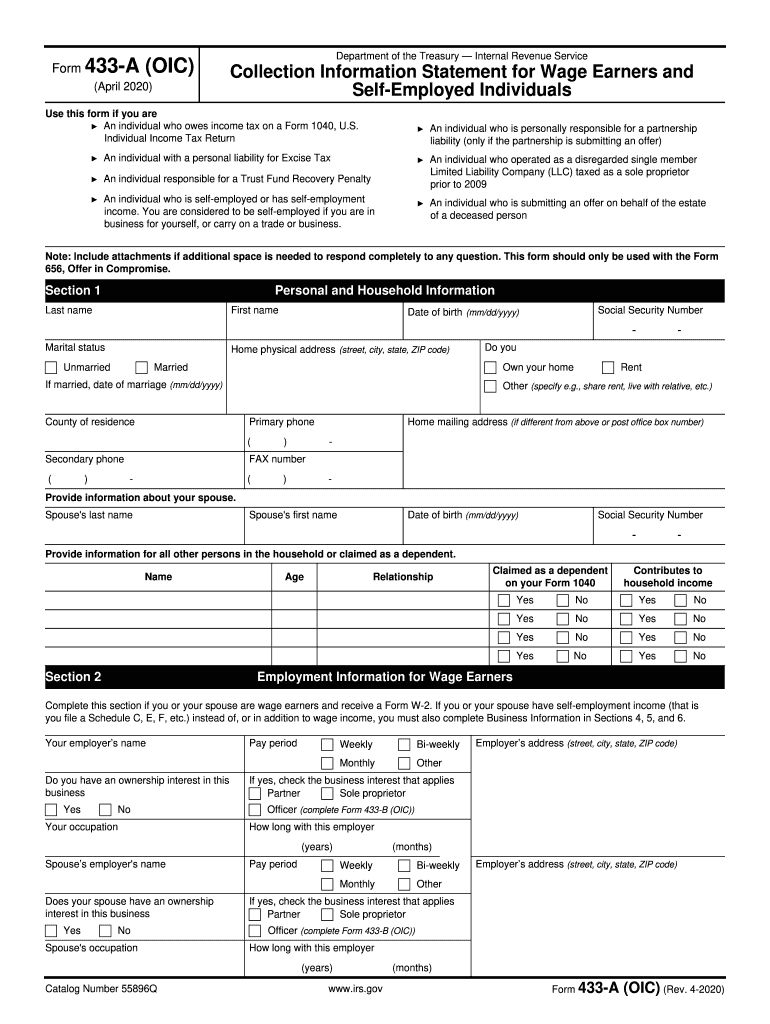

The Form 433 A OIC Rev 4 is a critical document used by individuals seeking to settle their tax debts with the IRS through an Offer in Compromise (OIC). This form collects detailed financial information about the taxpayer’s income, expenses, assets, and liabilities. The IRS uses this information to determine the taxpayer's ability to pay and whether they qualify for an OIC. This form is specifically designed for wage earners, making it essential for those who receive a paycheck and wish to negotiate their tax liabilities.

Steps to Complete the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

Completing the Form 433 A OIC Rev 4 involves several key steps to ensure accuracy and compliance with IRS requirements. Begin by gathering all necessary financial documents, including pay stubs, bank statements, and records of monthly expenses. Next, fill out the personal information section, including your name, Social Security number, and address. Then, provide details about your income, including wages, bonuses, and any other sources of income. Following this, list your monthly expenses, such as housing, utilities, and transportation costs. Finally, disclose any assets you own, such as real estate, vehicles, and savings accounts. Review the completed form for accuracy before submission.

Eligibility Criteria for the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

To be eligible for submitting the Form 433 A OIC Rev 4, taxpayers must meet specific criteria set by the IRS. Firstly, individuals must have filed all required tax returns for the past five years. Additionally, they should not be in an open bankruptcy proceeding. The IRS also requires that taxpayers demonstrate an inability to pay their tax liabilities in full. This is typically shown through the financial information provided on the form. Understanding these eligibility requirements is crucial for individuals considering an Offer in Compromise.

IRS Guidelines for the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

The IRS has established guidelines for completing and submitting the Form 433 A OIC Rev 4. These guidelines emphasize the importance of providing accurate and complete information. Taxpayers must ensure that all financial details are current and reflect their situation accurately. The IRS may request additional documentation to support the information provided on the form. It is essential to follow these guidelines closely to avoid delays in processing the Offer in Compromise.

Required Documents for the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

When submitting the Form 433 A OIC Rev 4, taxpayers must include several supporting documents to substantiate the information provided. Required documents typically include copies of recent pay stubs, bank statements, and proof of monthly expenses. Additionally, any documentation related to assets, such as property deeds or vehicle titles, should be included. Having these documents ready can facilitate a smoother review process by the IRS.

Form Submission Methods for the Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners

The Form 433 A OIC Rev 4 can be submitted to the IRS through various methods. Taxpayers have the option to file the form electronically or submit it via mail. If filing by mail, it is advisable to send the form using a trackable delivery method to ensure it reaches the IRS. Electronic submission may be available through authorized e-filing services, which can expedite the processing time. Understanding the submission methods is important for ensuring timely and accurate filing.

Quick guide on how to complete form 433 a oic rev 4 2020 collection information statement for wage earners and

Complete Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without holdups. Manage Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And seamlessly

- Locate Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And and click Get Form to begin.

- Use the provided tools to complete your document.

- Emphasize important parts of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal value as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, endless form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And and guarantee smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic rev 4 2020 collection information statement for wage earners and

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic rev 4 2020 collection information statement for wage earners and

How to make an electronic signature for a PDF file in the online mode

How to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is form 433 2020?

Form 433 2020 is a financial statement used by the IRS to collect detailed information about a taxpayer's financial situation. It provides the IRS with insight into your income, expenses, and assets, making it crucial in negotiations for tax relief. By understanding your financial position, you can better navigate tax liabilities.

-

How can airSlate SignNow help me with form 433 2020?

airSlate SignNow simplifies the process of preparing and signing form 433 2020. With this platform, users can create and fill out the form quickly, ensuring all necessary financial details are accurately captured. The eSignature feature allows for secure submission without the hassle of printing and mailing physical documents.

-

Is there a cost associated with using airSlate SignNow for form 433 2020?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Most plans are designed to be cost-effective, allowing you to manage form 433 2020 along with other documents without breaking the bank. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow provide for completing form 433 2020?

airSlate SignNow provides features like customizable templates, document sharing, and real-time collaboration that make completing form 433 2020 easier. Additionally, users can track the status of their documents and receive notifications upon completion. This streamlines the process and ensures timely submissions.

-

Can I integrate airSlate SignNow with other applications for form 433 2020?

Absolutely! airSlate SignNow boasts integration capabilities with various platforms like Google Drive, Dropbox, and CRM software, allowing you to streamline the process of handling form 433 2020. Integrating these tools enhances efficiency and saves time during your document management tasks.

-

How secure is airSlate SignNow when handling form 433 2020?

Security is a top priority for airSlate SignNow. When dealing with sensitive information like that found in form 433 2020, the platform uses advanced encryption methods to protect your data. Users can feel assured that their information remains confidential and secure throughout the signing process.

-

How does airSlate SignNow improve the submission process for form 433 2020?

airSlate SignNow improves the submission process for form 433 2020 by eliminating the need for paperwork and streamlining electronic submissions. With its eSignature feature, users can easily sign and send the form directly from their devices. This not only saves time but also reduces the risk of lost documents.

Get more for Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And

Find out other Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament