Form 433 a Oic 2018

What is the Form 433 A Oic

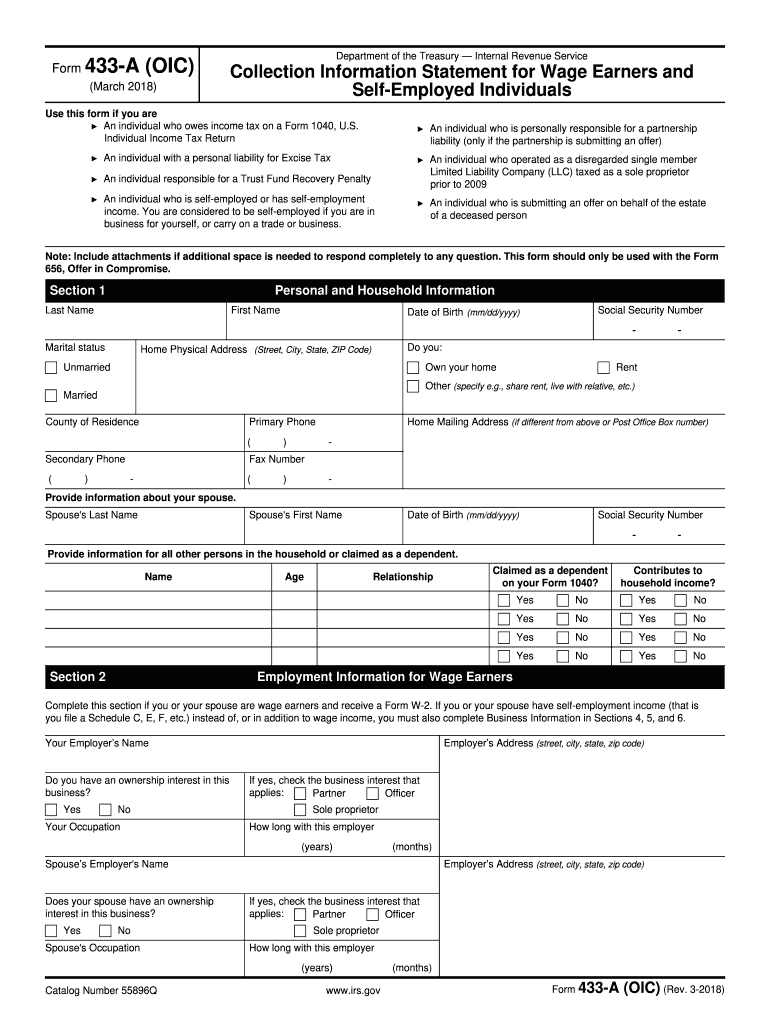

The Form 433 A OIC is a crucial document used by individuals seeking to settle their tax debts with the IRS through an Offer in Compromise (OIC). This form provides the IRS with a comprehensive overview of an individual's financial situation, including income, expenses, assets, and liabilities. By submitting this form, taxpayers can propose a reduced amount to settle their tax obligations, making it an essential tool for those facing financial difficulties.

How to use the Form 433 A Oic

Using the Form 433 A OIC involves several steps. First, gather all necessary financial information, including pay stubs, bank statements, and monthly expenses. Next, accurately fill out the form, ensuring that all sections are completed and that the information reflects your current financial status. After completing the form, submit it to the IRS along with your Offer in Compromise application. It is important to review the form carefully before submission to avoid delays or rejections.

Steps to complete the Form 433 A Oic

Completing the Form 433 A OIC requires attention to detail. Follow these steps:

- Collect financial documents, such as income statements and expense records.

- Fill out personal information, including your name, address, and Social Security number.

- Detail your income sources, listing all forms of income and their amounts.

- Outline monthly expenses, categorizing them into necessary living costs and discretionary spending.

- Provide information on assets, including real estate, vehicles, and bank accounts.

- Review the completed form for accuracy before submitting it to the IRS.

Required Documents

When submitting the Form 433 A OIC, several supporting documents are required to validate your financial information. These documents typically include:

- Recent pay stubs or proof of income.

- Bank statements for all accounts.

- Documentation of monthly expenses, such as utility bills and rent statements.

- Proof of assets, including property deeds or vehicle titles.

Providing thorough documentation helps the IRS assess your financial situation accurately and can increase the likelihood of your offer being accepted.

IRS Guidelines

The IRS has specific guidelines for submitting the Form 433 A OIC. It is essential to follow these guidelines to ensure compliance and avoid delays. Key points include:

- Ensure all information is current and accurate.

- Submit the form with the Offer in Compromise application.

- Be prepared to provide additional documentation if requested by the IRS.

- Understand that the IRS may take several months to review your offer.

Familiarizing yourself with these guidelines can streamline the process and improve your chances of a successful outcome.

Eligibility Criteria

To qualify for submitting the Form 433 A OIC, taxpayers must meet specific eligibility criteria set by the IRS. These criteria include:

- Being unable to pay the full tax liability due to financial hardship.

- Having filed all required tax returns.

- Not being in an open bankruptcy proceeding.

Understanding these criteria is crucial for determining whether you can pursue an Offer in Compromise and utilize the Form 433 A OIC effectively.

Quick guide on how to complete 433 2018 2019 form

Uncover the simplest method to complete and endorse your Form 433 A Oic

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow provides a superior approach to finalize and sign your Form 433 A Oic and associated forms for public services. Our efficient electronic signature platform equips you with all you require to manage documents swiftly and in compliance with official standards - powerful PDF editing, organizing, securing, signing, and sharing features are all available within a user-friendly interface.

Only a few steps are needed to finalize and endorse your Form 433 A Oic:

- Insert the editable template into the editor using the Get Form button.

- Verify what information you need to supply in your Form 433 A Oic.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Update the content with Text boxes or Images from the upper toolbar.

- Emphasize what is signNow or Obscure sections that are no longer relevant.

- Select Sign to generate a legally valid electronic signature using any method you prefer.

- Insert the Date next to your signature and conclude your task with the Done button.

Store your completed Form 433 A Oic in the Documents folder within your account, download it, or transfer it to your preferred cloud storage. Our platform also provides versatile form sharing options. There's no need to print your forms when you need to submit them to the appropriate public office - simply use email, fax, or request a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct 433 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the 433 2018 2019 form

How to create an eSignature for your 433 2018 2019 Form in the online mode

How to create an electronic signature for the 433 2018 2019 Form in Google Chrome

How to create an eSignature for putting it on the 433 2018 2019 Form in Gmail

How to create an electronic signature for the 433 2018 2019 Form from your smart phone

How to create an eSignature for the 433 2018 2019 Form on iOS devices

How to create an eSignature for the 433 2018 2019 Form on Android

People also ask

-

What is Form 433 A Oic and how is it used?

Form 433 A Oic is a financial disclosure form used by taxpayers to provide the IRS with detailed information about their financial situation when applying for an Offer in Compromise. This form helps the IRS assess whether you qualify for a settlement of your tax debts based on your ability to pay.

-

How can airSlate SignNow assist with Form 433 A Oic submissions?

airSlate SignNow streamlines the process of signing and submitting Form 433 A Oic by allowing users to electronically sign documents and send them securely. Our platform ensures that you can complete your forms efficiently without the hassles of printing and mailing.

-

Is airSlate SignNow suitable for individuals filing Form 433 A Oic?

Yes, airSlate SignNow is an excellent choice for individuals filing Form 433 A Oic. Our user-friendly interface helps users easily complete their forms and ensures that they can sign and submit them without any complications.

-

What are the pricing options for using airSlate SignNow for Form 433 A Oic?

airSlate SignNow offers various pricing plans that cater to different needs, making it affordable for anyone needing to file Form 433 A Oic. You can choose a plan that fits your budget, whether you are a sole filer or a business requiring multiple signatures.

-

Does airSlate SignNow provide templates for Form 433 A Oic?

Yes, airSlate SignNow provides customizable templates for Form 433 A Oic, which can save you time and ensure accuracy. With our templates, you can quickly fill out your financial information and prepare your submission without starting from scratch.

-

What security measures does airSlate SignNow have for Form 433 A Oic documents?

airSlate SignNow prioritizes the security of your Form 433 A Oic documents with robust encryption and compliance with industry standards. Your sensitive financial information is protected, ensuring that only authorized individuals have access to your documents.

-

Can I integrate airSlate SignNow with other tools for managing Form 433 A Oic?

Absolutely! airSlate SignNow seamlessly integrates with various tools and applications, allowing you to manage your Form 433 A Oic alongside other business processes. This integration fosters a more efficient workflow for document management and submission.

Get more for Form 433 A Oic

- Annual guardian report oregon form

- Dichiarazione garanzia eo alloggio esempio form

- Form p60 download

- Mc 210 rv form

- Annual review of driving record certification of violations form

- Application packet fort campbell blanchfield army community campbell amedd army form

- Page 1 of 4 headaches residual functional capacity form

- Single tenant lease net 01 air commercial real estate form

Find out other Form 433 A Oic

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy