Form 433 a OIC Rev 4 Collection Information Statement for Wage Earners and Self Employed Individuals 2024

What is the Form 433 A OIC Rev 4 Collection Information Statement for Wage Earners and Self Employed Individuals

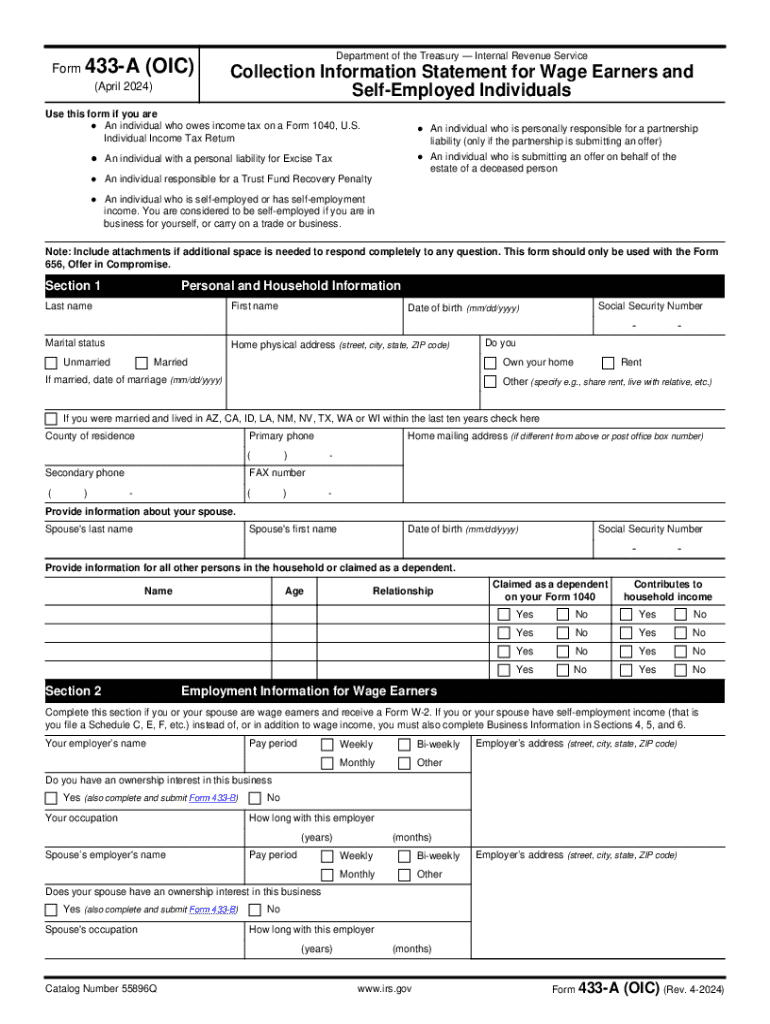

The Form 433 A OIC Rev 4 is a crucial document used by individuals seeking to settle their IRS debts through an Offer in Compromise (OIC). This form provides the IRS with a comprehensive overview of a taxpayer's financial situation, including income, expenses, assets, and liabilities. By accurately completing this form, taxpayers can demonstrate their inability to pay the full amount owed, which is essential for qualifying for an OIC. The form is specifically designed for wage earners and self-employed individuals, ensuring that it captures the unique financial circumstances of these groups.

Steps to Complete the Form 433 A OIC Rev 4 Collection Information Statement

Completing the Form 433 A OIC Rev 4 requires careful attention to detail. Here are the key steps:

- Gather financial documents, including pay stubs, bank statements, and tax returns.

- Provide personal information, such as your name, address, and Social Security number.

- Detail your income sources, including wages, self-employment earnings, and any other income.

- List your monthly expenses, ensuring to include necessary living expenses like housing, utilities, and food.

- Disclose your assets, including cash, real estate, and vehicles, along with their estimated values.

- Review the completed form for accuracy and completeness before submission.

Eligibility Criteria for the Form 433 A OIC Rev 4

To qualify for submitting the Form 433 A OIC Rev 4, taxpayers must meet specific eligibility criteria. These criteria include:

- Being in compliance with all filing requirements, meaning all required tax returns must be filed.

- Having a valid Offer in Compromise application, which demonstrates the taxpayer's financial hardship.

- Meeting the IRS's definition of "doubt as to collectibility," indicating that the taxpayer cannot pay the full tax liability.

How to Obtain the Form 433 A OIC Rev 4 Collection Information Statement

The Form 433 A OIC Rev 4 can be obtained directly from the IRS website. It is available as a fillable PDF, allowing taxpayers to complete the form electronically. Additionally, taxpayers may request a paper copy by contacting the IRS directly or visiting a local IRS office. It is essential to ensure that the most current version of the form is used to avoid any issues during the submission process.

Form Submission Methods for the Form 433 A OIC Rev 4

Submitting the Form 433 A OIC Rev 4 can be done through various methods, depending on the taxpayer's preference. The primary submission methods include:

- Mailing the completed form to the appropriate IRS address, which can be found on the form instructions.

- Submitting the form in person at a local IRS office, which may provide immediate assistance.

- Using electronic submission methods if available, which can expedite the processing time.

Key Elements of the Form 433 A OIC Rev 4 Collection Information Statement

The Form 433 A OIC Rev 4 includes several key elements that taxpayers must complete. These elements are designed to provide a clear financial picture to the IRS:

- Personal Information: Basic identification details, including name and contact information.

- Income Section: A detailed account of all sources of income, including wages and self-employment earnings.

- Monthly Expenses: A breakdown of necessary living expenses, such as housing, food, and transportation costs.

- Asset Disclosure: Information on all assets owned, including cash, real estate, and vehicles.

- Liabilities: Any outstanding debts or obligations that may impact financial stability.

Handy tips for filling out Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And Self Employed Individuals online

Quick steps to complete and e-sign Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And Self Employed Individuals online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a HIPAA and GDPR compliant platform for optimum simpleness. Use signNow to electronically sign and send out Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And Self Employed Individuals for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 433 a oic rev 4 collection information statement for wage earners and self employed individuals

Create this form in 5 minutes!

How to create an eSignature for the form 433 a oic rev 4 collection information statement for wage earners and self employed individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS debt settlement and how can it help me?

IRS debt settlement is a negotiation process that allows taxpayers to settle their tax debts for less than the full amount owed. By utilizing airSlate SignNow, you can streamline the documentation process required for IRS debt settlement, making it easier to manage your tax obligations efficiently.

-

How does airSlate SignNow facilitate IRS debt settlement?

airSlate SignNow provides an easy-to-use platform for sending and eSigning necessary documents related to IRS debt settlement. This ensures that all paperwork is completed accurately and submitted on time, which is crucial for a successful settlement process.

-

What are the costs associated with using airSlate SignNow for IRS debt settlement?

airSlate SignNow offers a cost-effective solution for managing IRS debt settlement documents. Pricing plans are designed to fit various business needs, ensuring that you can access essential features without breaking the bank.

-

Can I integrate airSlate SignNow with other tools for IRS debt settlement?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your IRS debt settlement process. This allows you to connect with accounting software and other tools, ensuring a smooth workflow and better management of your tax documents.

-

What features does airSlate SignNow offer for IRS debt settlement?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for IRS debt settlement. These tools help you prepare and manage your tax documents efficiently, reducing the stress associated with the settlement process.

-

Is airSlate SignNow secure for handling IRS debt settlement documents?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents related to IRS debt settlement are encrypted and stored securely. This gives you peace of mind knowing that your sensitive information is protected throughout the settlement process.

-

How can airSlate SignNow improve my chances of a successful IRS debt settlement?

By using airSlate SignNow, you can ensure that all necessary documents for IRS debt settlement are completed accurately and submitted promptly. This increases your chances of a successful settlement, as timely and correct documentation is critical in negotiations with the IRS.

Get more for Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And Self Employed Individuals

- Gravity pitch gizmo answer key form

- Inventory pdf form

- Ap school study certificate pdf form

- Kenya scouts association registration form

- Formato de solicitud de beca

- Nys department of labor license and certification unit phone number form

- Mock recall template form

- Water assistance program notice of withdrawal form

Find out other Form 433 A OIC Rev 4 Collection Information Statement For Wage Earners And Self Employed Individuals

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online