Form 8288 B 2006

What is the Form 8288 B

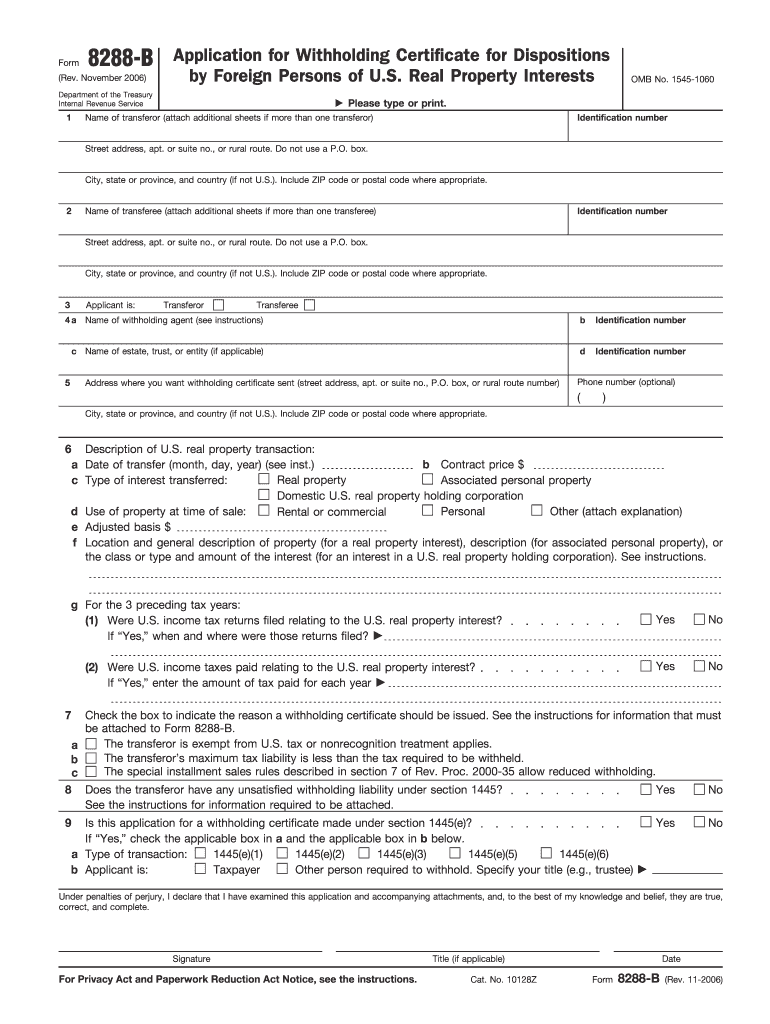

The Form 8288 B is a tax document used by foreign individuals and entities to apply for a withholding certificate. This form is particularly relevant in transactions involving the sale of U.S. real estate by foreign sellers. The purpose of the form is to request a reduction or exemption from the withholding tax that is typically required under the Foreign Investment in Real Property Tax Act (FIRPTA). By submitting Form 8288 B, the applicant provides the Internal Revenue Service (IRS) with the necessary information to determine if a reduced withholding rate is applicable based on the specifics of the transaction.

How to use the Form 8288 B

Using Form 8288 B involves several steps to ensure compliance with IRS regulations. First, the applicant must complete the form accurately, providing details about the seller, the property, and the transaction. This includes information such as the seller's name, address, and taxpayer identification number, as well as the property's location and sale price. After completing the form, it must be submitted to the IRS along with any required documentation that supports the request for a withholding certificate. This may include a copy of the purchase agreement and any other relevant financial documents. It is essential to ensure that all information is correct to avoid delays or rejections.

Steps to complete the Form 8288 B

Completing the Form 8288 B requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect details about the seller, the buyer, and the property involved in the transaction.

- Fill out the form: Provide accurate information in each section of the form, ensuring that all required fields are completed.

- Attach supporting documents: Include any documents that validate the request for a withholding certificate, such as the purchase agreement.

- Review the form: Double-check all entries for accuracy and completeness to prevent errors.

- Submit the form: Send the completed Form 8288 B and any attachments to the appropriate IRS address as specified in the form instructions.

Legal use of the Form 8288 B

The legal use of Form 8288 B is governed by U.S. tax laws, specifically those pertaining to foreign investments in real estate. To be considered valid, the form must be filled out correctly and submitted in accordance with IRS guidelines. The form serves as a formal request for a withholding certificate, which, if granted, allows the seller to reduce or eliminate the withholding tax on the sale of U.S. property. It is crucial for foreign sellers to understand their obligations under FIRPTA and to use this form properly to ensure compliance and avoid penalties.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting Form 8288 B. These guidelines outline the eligibility criteria for requesting a withholding certificate, the required documentation, and the timelines for submission. It is important for applicants to familiarize themselves with these guidelines to ensure that their requests are processed efficiently. The IRS also emphasizes the importance of accuracy in the information provided, as any discrepancies can lead to delays or denials of the withholding certificate.

Filing Deadlines / Important Dates

Filing deadlines for Form 8288 B are crucial for foreign sellers to adhere to in order to avoid penalties. Generally, the form must be submitted to the IRS at the time of the sale or within a specified period afterward, as indicated in the IRS instructions. It is important to be aware of these deadlines, as late submissions can result in automatic withholding of taxes at the full rate, which may not be recoverable. Keeping track of important dates related to the sale and the filing of Form 8288 B can help ensure compliance with U.S. tax laws.

Quick guide on how to complete form 8288 b 2006

Complete Form 8288 B effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly and efficiently. Handle Form 8288 B on any device with the airSlate SignNow applications for Android or iOS and enhance any document-focused operation today.

The easiest way to edit and electronically sign Form 8288 B with ease

- Find Form 8288 B and click Get Form to begin.

- Utilize the available tools to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with specialized tools provided by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal significance as a standard handwritten signature.

- Review the details and hit the Done button to save your changes.

- Choose your delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form 8288 B and ensure effective communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8288 b 2006

Create this form in 5 minutes!

How to create an eSignature for the form 8288 b 2006

The best way to generate an electronic signature for a PDF file online

The best way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 8288 B and why is it important?

Form 8288 B is a critical document used by foreign entities to claim a withholding certificate that can exempt them from U.S. tax withholding on certain income. Filing Form 8288 B is essential for ensuring compliance with IRS regulations, particularly for those involved in U.S. real estate transactions. By utilizing airSlate SignNow, you can efficiently eSign and send needed documents, including Form 8288 B.

-

How can airSlate SignNow assist in signing Form 8288 B?

airSlate SignNow provides a user-friendly platform that allows you to easily sign Form 8288 B electronically. With our eSigning features, you can quickly add signatures and required information, ensuring your document is ready for submission without delays. This streamlined process is both time-efficient and cost-effective.

-

Are there any costs associated with using airSlate SignNow for Form 8288 B?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs. Whether you are a small business or a large enterprise, you can choose a plan that allows you to flawlessly handle documents like Form 8288 B without breaking the bank. Pricing is transparent, ensuring you know what to expect as you eSign your documents.

-

What features does airSlate SignNow offer for managing Form 8288 B?

airSlate SignNow offers several features tailored for managing documents, including Form 8288 B, such as templates, cloud storage, and real-time tracking. These features streamline the process of preparing and signing your documents, ensuring that you can focus on other important tasks. Additionally, the platform's intuitive interface makes it easy for anyone to use.

-

Can I integrate airSlate SignNow with other software to handle Form 8288 B?

Certainly! airSlate SignNow integrates seamlessly with popular business applications which can help streamline your workflow when handling Form 8288 B. By connecting with CRM systems, document storage solutions, and other tools, you can simplify the entire process of managing your eSignatures and documentation. This integration saves time and reduces the chances of errors.

-

Is it secure to use airSlate SignNow for Form 8288 B?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Form 8288 B and other documents are safe. Our platform employs industry-standard encryption and security protocols to protect your sensitive information while you eSign and share documents. You can trust airSlate SignNow to keep your data secure throughout the process.

-

How does airSlate SignNow enhance the eSigning experience for Form 8288 B?

airSlate SignNow enhances the eSigning experience for documents like Form 8288 B by offering a straightforward and fast signing process. Our platform allows multiple signers to collaborate on the same document, ensuring all necessary parties can provide their signatures easily. This efficiency not only speeds up the completion of Form 8288 B but also minimizes potential roadblocks.

Get more for Form 8288 B

- Living trust for individual who is single divorced or widow or widower with no children illinois form

- Living trust for individual who is single divorced or widow or widower with children illinois form

- Living trust for husband and wife with one child illinois form

- Living trust for husband and wife with minor and or adult children illinois form

- Amendment to living trust illinois form

- Living trust property record illinois form

- Financial account transfer to living trust illinois form

- Assignment to living trust illinois form

Find out other Form 8288 B

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy