Form W 3ss 2014

What is the Form W-3SS

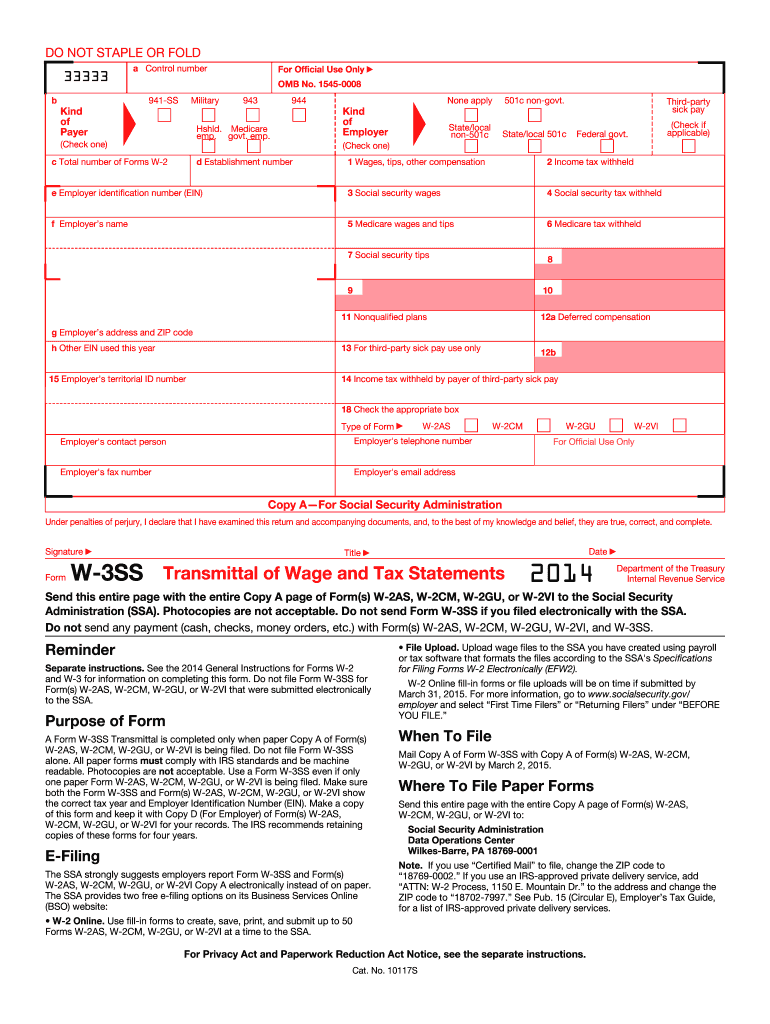

The Form W-3SS is a transmittal form used by employers to report annual wage and tax information for employees who are residents of the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands. It serves as a summary of the Forms W-2 submitted by employers for these territories. This form helps the IRS ensure accurate tax reporting and compliance for employees working in U.S. territories.

How to use the Form W-3SS

To use the Form W-3SS effectively, employers must first complete the individual Forms W-2 for each employee. After compiling the necessary wage and tax information, the employer fills out the W-3SS, summarizing the totals from the W-2 forms. It is essential to ensure that all information is accurate and matches the corresponding W-2 forms before submission. This form should be submitted to the IRS along with the W-2 forms for proper processing.

Steps to complete the Form W-3SS

Completing the Form W-3SS involves several key steps:

- Gather all Forms W-2 for employees in the applicable territories.

- Verify that the information on each W-2 is accurate, including names, Social Security numbers, and wage amounts.

- Fill out the W-3SS form, entering total wages, tips, and other compensation, along with the total federal income tax withheld.

- Review the completed form for accuracy and ensure all required fields are filled out.

- Submit the W-3SS along with the W-2 forms to the IRS by the designated deadline.

Legal use of the Form W-3SS

The Form W-3SS is legally required for employers reporting wages for employees in U.S. territories. Failure to file this form accurately and on time can lead to penalties. It is crucial for employers to understand the legal implications of submitting this form, as it ensures compliance with IRS regulations and helps maintain accurate tax records for employees.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form W-3SS. Generally, the form is due by January thirty-first of the year following the tax year being reported. It is important to check for any updates or changes to deadlines, as these can vary based on IRS regulations. Timely submission helps avoid penalties and ensures compliance with tax reporting requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form W-3SS can be submitted through various methods. Employers have the option to file the form electronically using the IRS e-file system, which is often the quickest and most efficient method. Alternatively, the form can be mailed to the IRS, ensuring that it is sent to the correct address for processing. In-person submission is generally not available for this form, making electronic filing or mailing the preferred options.

Quick guide on how to complete form w 3ss 2014

Complete Form W 3ss effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It presents a perfect eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any delays. Manage Form W 3ss on any device using airSlate SignNow's apps for Android or iOS and streamline any document-related operation today.

The easiest way to modify and eSign Form W 3ss without hassle

- Obtain Form W 3ss and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with features that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, tiresome form hunting, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 3ss and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 3ss 2014

Create this form in 5 minutes!

How to create an eSignature for the form w 3ss 2014

The way to make an eSignature for a PDF online

The way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

The best way to make an eSignature for a PDF document on Android

People also ask

-

What is Form W 3ss and how is it used in airSlate SignNow?

Form W 3ss is a tax form used for summarizing and transmitting multiple Forms 1099 to the IRS. In airSlate SignNow, you can easily create, send, and eSign Form W 3ss electronically, streamlining your filing process and ensuring compliance with tax regulations.

-

How does airSlate SignNow ensure the security of Form W 3ss?

airSlate SignNow employs advanced security measures, including end-to-end encryption and secure cloud storage, to protect your Form W 3ss and other sensitive documents. This ensures that your information is safe during transmission and storage.

-

What are the pricing options for using airSlate SignNow for Form W 3ss?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs, including options for individual users and teams. You can access all the necessary features to handle Form W 3ss efficiently at a competitive rate.

-

Can I integrate airSlate SignNow with my existing accounting software for Form W 3ss?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage Form W 3ss directly from your existing tools. This integration simplifies your workflow and ensures that all your documents are interconnected.

-

What features does airSlate SignNow offer for managing Form W 3ss?

airSlate SignNow provides a range of features for managing Form W 3ss, including customizable templates, bulk sending options, and real-time tracking of document status. These features enhance efficiency and ensure that your tax documents are handled with ease.

-

How does eSigning of Form W 3ss work in airSlate SignNow?

eSigning Form W 3ss in airSlate SignNow is straightforward. Users can send the form for electronic signatures, and recipients can sign it digitally from any device, making the process quick and legally binding without the need for paper.

-

Is there a mobile app for airSlate SignNow to manage Form W 3ss on the go?

Yes, airSlate SignNow offers a mobile app that allows you to manage and eSign Form W 3ss from anywhere. The app ensures that you can access your documents and sign them on the go, increasing flexibility and productivity.

Get more for Form W 3ss

- Legal last will and testament form for divorced person not remarried with adult children indiana

- Indiana last will testament template form

- Legal last will and testament form for divorced person not remarried with minor children indiana

- Legal last will and testament form for divorced person not remarried with adult and minor children indiana

- In will testament form

- Legal last will and testament form for a married person with no children indiana

- Legal last will and testament form for married person with minor children indiana

- Indiana will 497307256 form

Find out other Form W 3ss

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF