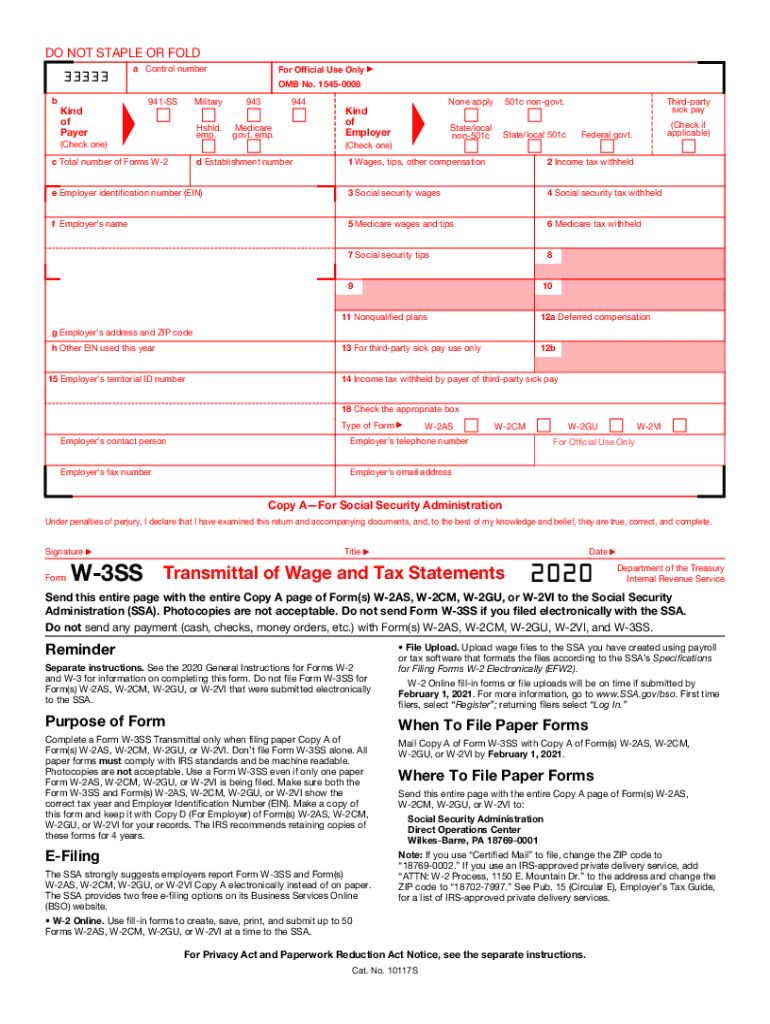

Form W 3SS Transmittal of Wage and Tax Statements 2020

What is the Form W-3 Transmittal of Wage and Tax Statements

The Form W-3 is a crucial document used by employers in the United States to transmit wage and tax statements to the Internal Revenue Service (IRS). Specifically, it accompanies Forms W-2, which report the annual wages and tax withholding for employees. The W-3 serves as a summary of the W-2 forms, providing the IRS with a consolidated view of the total wages paid and taxes withheld for all employees during the tax year. This form is essential for ensuring accurate reporting and compliance with federal tax regulations.

Steps to Complete the Form W-3

Completing the Form W-3 involves several key steps to ensure accuracy and compliance. First, gather all necessary information from the W-2 forms you are submitting. This includes total wages, Social Security wages, Medicare wages, and the total amount of federal income tax withheld. Next, enter this information into the appropriate fields on the W-3 form. Be sure to check that the employer's information, including name, address, and Employer Identification Number (EIN), is correct. Once completed, review the form for any errors before submitting it to the IRS along with the W-2 forms.

Legal Use of the Form W-3

The Form W-3 is legally required for employers who issue W-2 forms to their employees. It ensures compliance with IRS regulations regarding wage reporting. The information provided on the W-3 must match the data on the W-2 forms to avoid discrepancies that could lead to penalties. Employers should maintain records of submitted W-3 forms and W-2s for at least four years, as the IRS may request these documents for verification purposes.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines when filing the Form W-3. Generally, the W-3 must be submitted to the IRS by the end of January following the tax year for which the forms are being filed. For example, if you are submitting forms for the 2023 tax year, the W-3 must be filed by January 31, 2024. Additionally, copies of the W-2 forms must be provided to employees by the same deadline. Timely filing is crucial to avoid penalties and ensure compliance with tax laws.

Form Submission Methods

The Form W-3 can be submitted to the IRS in several ways. Employers have the option to file electronically using the IRS e-file system, which is recommended for those submitting a large number of W-2 forms. Alternatively, employers can mail paper copies of the W-3 and accompanying W-2 forms to the appropriate IRS address. It is important to ensure that the forms are sent to the correct location based on the employer's state of residence to avoid delays in processing.

Penalties for Non-Compliance

Failure to file the Form W-3 or inaccuracies in the information provided can result in penalties from the IRS. Employers may face fines for late submissions, which can accumulate based on how late the forms are filed. Additionally, if the information on the W-3 does not match the W-2 forms or the IRS records, this can lead to further scrutiny and potential penalties. Maintaining accurate records and filing on time is essential for avoiding these issues.

Quick guide on how to complete 2020 form w 3ss transmittal of wage and tax statements

Effortlessly Prepare Form W 3SS Transmittal Of Wage And Tax Statements on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form W 3SS Transmittal Of Wage And Tax Statements on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Easily Edit and Electronically Sign Form W 3SS Transmittal Of Wage And Tax Statements

- Obtain Form W 3SS Transmittal Of Wage And Tax Statements and select Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and hit the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require reprinting. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form W 3SS Transmittal Of Wage And Tax Statements and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form w 3ss transmittal of wage and tax statements

Create this form in 5 minutes!

How to create an eSignature for the 2020 form w 3ss transmittal of wage and tax statements

How to create an eSignature for a PDF online

How to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to create an electronic signature from your smartphone

How to generate an eSignature for a PDF on iOS

How to create an electronic signature for a PDF file on Android

People also ask

-

What is the IRS Form W3 and why is it important?

The IRS Form W3 is a summary transmittal form that aggregates all W2 forms filed by an employer during the tax year. It is crucial because it ensures that the IRS has the correct information regarding wages and tax withholdings for employees. Properly filling out and submitting the IRS Form W3 can help avoid penalties and ensure compliance with federal tax regulations.

-

How can airSlate SignNow help me with my IRS Form W3?

With airSlate SignNow, you can easily create, sign, and send your IRS Form W3 electronically. The platform streamlines the entire process by allowing you to manage your documents securely and efficiently. This not only saves time but also ensures that your submissions are accurate and compliant.

-

What features does airSlate SignNow offer for handling IRS Form W3?

airSlate SignNow provides features like customizable templates, document sharing, and eSigning capabilities specifically for IRS Form W3. Additionally, it offers advanced security measures to protect sensitive information. These features enhance the process of managing your tax documents effectively.

-

Is there a cost associated with using airSlate SignNow for IRS Form W3?

Yes, airSlate SignNow offers various pricing plans based on your needs, including features for managing IRS Form W3. The available plans make it accessible for businesses of all sizes, providing excellent value for seamless document management. You can choose a plan that fits your requirements and budget.

-

Can I integrate airSlate SignNow with other applications for IRS Form W3 processing?

Absolutely! airSlate SignNow offers various integrations with popular applications such as Google Workspace, Salesforce, and more. This allows you to streamline your workflow while managing IRS Form W3 alongside other critical business applications, enhancing overall efficiency.

-

How secure is airSlate SignNow when submitting IRS Form W3?

airSlate SignNow prioritizes security, employing encryption and compliance measures to safeguard your documents, including IRS Form W3. The platform is designed to protect your sensitive information from unauthorized access, making it a safe choice for electronic document management.

-

Can I track the status of my submitted IRS Form W3 using airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your submitted IRS Form W3 in real-time. You can receive notifications when your documents are viewed or signed, providing you with peace of mind and transparency throughout the process. This feature helps you stay organized and informed.

Get more for Form W 3SS Transmittal Of Wage And Tax Statements

- Employee handbook 42215 nakoma resort clio california form

- Fmcsa pre trip inspection checklist pdf form

- Osjl_rts_request_form v1 6pdf

- Hsbc forms download

- Royal navy application form pdf

- Srg2150 form

- Mobile disco booking form wedding entertainment in gretna green gretna weddings

- Tv licence cancellation form pdf download

Find out other Form W 3SS Transmittal Of Wage And Tax Statements

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT