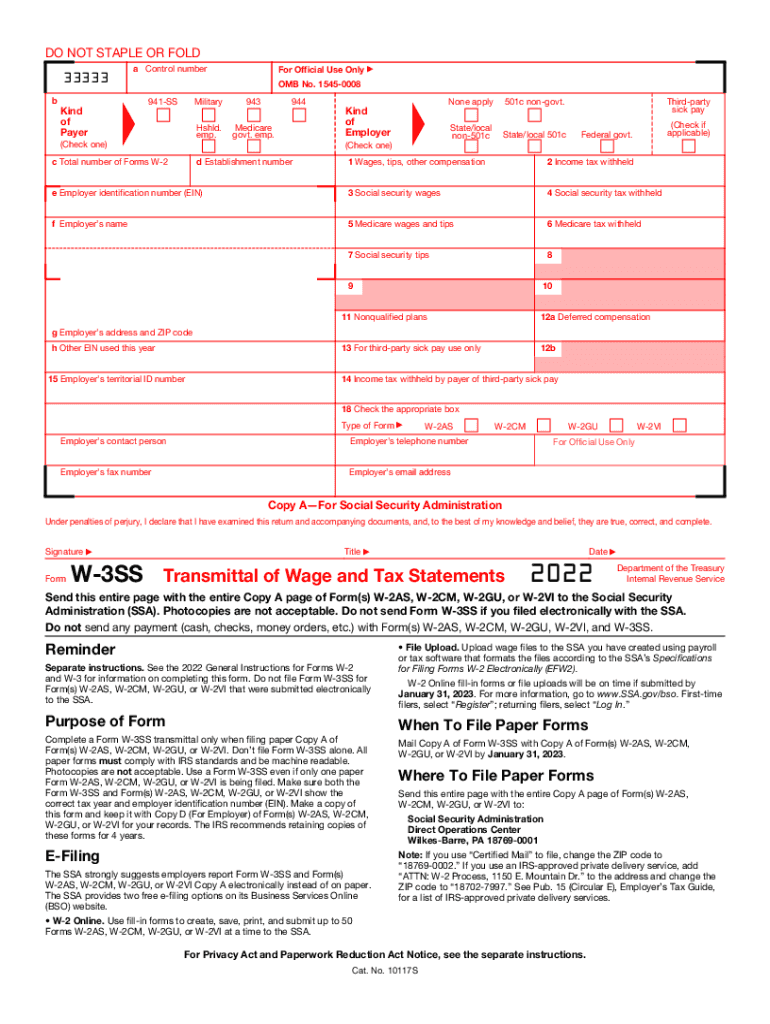

Form W 3SS 2022

What makes the 2022 form w 3ss legally valid?

As the world takes a step away from in-office work, the completion of paperwork more and more happens electronically. The 2022 form w 3ss isn’t an any different. Working with it using digital tools is different from doing this in the physical world.

An eDocument can be regarded as legally binding given that specific requirements are satisfied. They are especially crucial when it comes to stipulations and signatures related to them. Entering your initials or full name alone will not guarantee that the organization requesting the form or a court would consider it executed. You need a reliable tool, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - leading legal frameworks for eSignatures.

How to protect your 2022 form w 3ss when completing it online?

Compliance with eSignature regulations is only a portion of what airSlate SignNow can offer to make form execution legitimate and safe. Furthermore, it provides a lot of possibilities for smooth completion security smart. Let's rapidly run through them so that you can stay certain that your 2022 form w 3ss remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: key privacy regulations in the USA and Europe.

- Dual-factor authentication: adds an extra layer of protection and validates other parties' identities via additional means, such as a Text message or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information safely to the servers.

Submitting the 2022 form w 3ss with airSlate SignNow will give greater confidence that the output form will be legally binding and safeguarded.

Quick guide on how to complete 2022 form w 3ss

Manage Form W 3SS effortlessly on any device

Digital document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly substitution for conventional printed and signed documents, as you can acquire the correct format and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without interruptions. Handle Form W 3SS on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Form W 3SS without any hassle

- Locate Form W 3SS and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with specific tools that airSlate SignNow provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Finish button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form W 3SS and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form w 3ss

Create this form in 5 minutes!

People also ask

-

What is the wilenet login process for airSlate SignNow?

The wilenet login process for airSlate SignNow is simple and user-friendly. Users can access their account by visiting the official airSlate SignNow website and clicking on the 'Wilenet Login' section. Just enter your credentials, and you'll be ready to manage your document workflows efficiently.

-

Are there any fees associated with the wilenet login for airSlate SignNow?

No additional fees are required specifically for the wilenet login on airSlate SignNow. The cost is determined by your subscription plan, which offers various features to fit your business needs. Explore our pricing options to find the most cost-effective solution for you.

-

What features can I access after I log in using wilenet?

After logging in with wilenet, users can access various features such as document drafting, electronic signatures, and workflow automation. The platform offers customizable templates and integrations that streamline the signing process. These features help in enhancing overall productivity and user experience.

-

Can I use wilenet login on mobile devices?

Yes, the wilenet login for airSlate SignNow is compatible with mobile devices. Users can access their accounts from smartphones or tablets, allowing for on-the-go document management and signing. This flexibility ensures that you can manage your documents anytime, anywhere.

-

What benefits does airSlate SignNow provide for wilenet login users?

Wilenet login users benefit from a secure, easy-to-use platform that streamlines the document signing process. The service is designed to save time and reduce paperwork, making it an ideal choice for busy professionals. Additionally, airSlate SignNow enhances collaboration through real-time document tracking and notifications.

-

Is there a way to integrate wilenet login with other applications?

Yes, airSlate SignNow allows for seamless integrations with various applications, enhancing the wilenet login experience. Users can connect with tools like Google Drive, Salesforce, and more to streamline their workflows. These integrations ensure that all your documents and data are easily accessible.

-

What security measures are in place for wilenet login?

The security of your wilenet login is a top priority at airSlate SignNow. The platform employs advanced encryption protocols and multifactor authentication to protect your sensitive data. This ensures that your documents and login information remain secure from unauthorized access.

Get more for Form W 3SS

- Special durable power of attorney for bank account matters indiana form

- Indiana small business startup package indiana form

- Indiana property management package indiana form

- Sample annual minutes for an indiana professional corporation indiana form

- Indiana bylaws form

- In corporation form

- Sample organizational minutes for an indiana professional corporation indiana form

- Sample transmittal letter for articles of incorporation indiana form

Find out other Form W 3SS

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself