MICHIGAN Adjustments of Capital Gains and Losses MI 1040D MICHIGAN Adjustments of Capital Gains and Losses MI 1040D 2019

Understanding the Michigan Adjustments of Capital Gains and Losses MI 1040D

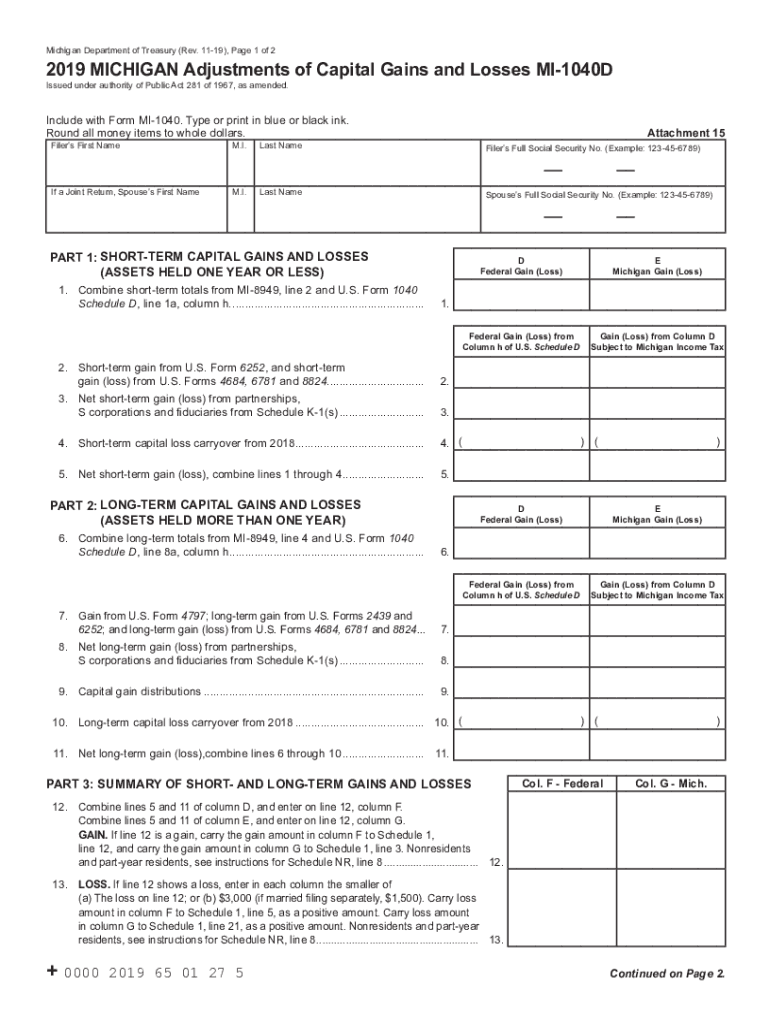

The Michigan Adjustments of Capital Gains and Losses MI 1040D is a crucial form for taxpayers who need to report their capital gains and losses for state tax purposes. This form allows individuals to adjust their federal capital gains and losses to align with Michigan tax laws. It's essential to understand how these adjustments can impact your overall tax liability in Michigan, especially since state regulations can differ significantly from federal guidelines.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1040D

Completing the MI 1040D involves several key steps to ensure accuracy and compliance with state tax laws. Begin by gathering all relevant financial documents, including records of your capital gains and losses. Next, follow these steps:

- Fill out your federal tax return first, as the MI 1040D requires information from it.

- Identify your total capital gains and losses as reported on your federal return.

- Use the MI 1040D form to adjust these figures according to Michigan’s specific rules.

- Double-check your calculations to ensure they align with Michigan’s tax regulations.

- Submit the completed form along with your Michigan tax return.

Key Elements of the Michigan Adjustments of Capital Gains and Losses MI 1040D

Understanding the key elements of the MI 1040D is vital for accurate completion. The form includes sections that require you to:

- Report your total capital gains and losses.

- Adjust these figures based on Michigan-specific rules, such as exemptions or deductions.

- Provide any additional information that may affect your state tax calculations.

Each of these elements plays a significant role in determining your final tax obligation in Michigan.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1040D

The legal use of the MI 1040D is governed by Michigan tax laws, which require accurate reporting of capital gains and losses. This form must be completed and submitted to ensure compliance with state tax regulations. Failure to accurately report these figures can result in penalties or audits, making it essential to understand the legal implications of the adjustments made on this form.

Filing Deadlines and Important Dates for the MI 1040D

Filing deadlines for the MI 1040D typically align with the federal tax deadlines. For most taxpayers, this means the form must be submitted by April fifteenth of the following tax year. However, if you are unable to meet this deadline, Michigan allows for extensions, but it is crucial to file for an extension before the original due date to avoid penalties.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1040D

Examples of scenarios where the MI 1040D is applicable include:

- A taxpayer who sold a property and realized a capital gain must report this on the MI 1040D.

- Individuals who have incurred capital losses from stock investments can use the form to adjust their taxable income accordingly.

These examples illustrate how the MI 1040D can be utilized to accurately reflect a taxpayer's financial situation in compliance with Michigan tax laws.

Quick guide on how to complete 2019 michigan adjustments of capital gains and losses mi 1040d 2019 michigan adjustments of capital gains and losses mi 1040d

Complete MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D effortlessly on any gadget

Online document management has gained immense traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the essentials needed to create, modify, and electronically sign your documents quickly and without hindrance. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The most effective method to modify and electronically sign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D with ease

- Locate MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D and click on Get Form to initiate.

- Utilize the tools we offer to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 michigan adjustments of capital gains and losses mi 1040d 2019 michigan adjustments of capital gains and losses mi 1040d

Create this form in 5 minutes!

How to create an eSignature for the 2019 michigan adjustments of capital gains and losses mi 1040d 2019 michigan adjustments of capital gains and losses mi 1040d

How to make an eSignature for a PDF file in the online mode

How to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

The best way to make an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the MI 1040 form 2018 and why is it important?

The MI 1040 form 2018 is the state income tax return form used by Michigan residents to report their income and calculate their tax liability for the year 2018. Completing this form accurately is crucial to ensure compliance with state tax laws and to avoid potential penalties.

-

How can airSlate SignNow help with completing the MI 1040 form 2018?

airSlate SignNow streamlines document preparation, allowing users to fill out and eSign their MI 1040 form 2018 effortlessly. With our user-friendly interface, you can easily upload, edit, and securely share your completed form.

-

Is there a cost associated with using airSlate SignNow for the MI 1040 form 2018?

Yes, airSlate SignNow offers a variety of pricing plans that cater to different needs. Our services are cost-effective, enabling you to manage the eSigning and sharing of the MI 1040 form 2018 without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for processing the MI 1040 form 2018?

Absolutely! airSlate SignNow provides seamless integration with various platforms, enhancing your workflow when handling the MI 1040 form 2018. Connect with popular applications like Google Drive or Dropbox to streamline your document management process.

-

What are the key features of airSlate SignNow that assist with the MI 1040 form 2018?

Key features of airSlate SignNow include customizable templates, real-time tracking of document status, and multiple signing options, all designed to simplify the process of managing the MI 1040 form 2018. These features help save time and increase productivity.

-

What benefits can I expect when using airSlate SignNow for my MI 1040 form 2018?

Using airSlate SignNow for your MI 1040 form 2018 grants you the benefit of security, efficiency, and convenience. You can electronically sign and send your documents securely, reducing the time spent on paperwork and enhancing your peace of mind.

-

How does eSigning the MI 1040 form 2018 with airSlate SignNow protect my information?

airSlate SignNow employs advanced encryption protocols to protect your data when eSigning the MI 1040 form 2018. Our platform ensures that your personal information remains confidential and secure during the document signing process.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

- Legal last will and testament form for domestic partner with adult and minor children washington

- Mutual wills package with last wills and testaments for married couple with adult and minor children washington form

- Washington widow 497430385 form

- Legal last will and testament form for widow or widower with minor children washington

- Legal last will form for a widow or widower with no children washington

- Legal last will and testament form for a widow or widower with adult and minor children washington

- Legal last will and testament form for divorced and remarried person with mine yours and ours children washington

- Legal last will and testament form with all property to trust called a pour over will washington

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

- eSign Wisconsin Cohabitation Agreement Free

- How To eSign Colorado Living Will

- eSign Maine Living Will Now

- eSign Utah Living Will Now

- eSign Iowa Affidavit of Domicile Now

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer