MI 1040D, Adjustments of Capital Gains and Losses 2007

What is the MI 1040D, Adjustments Of Capital Gains And Losses

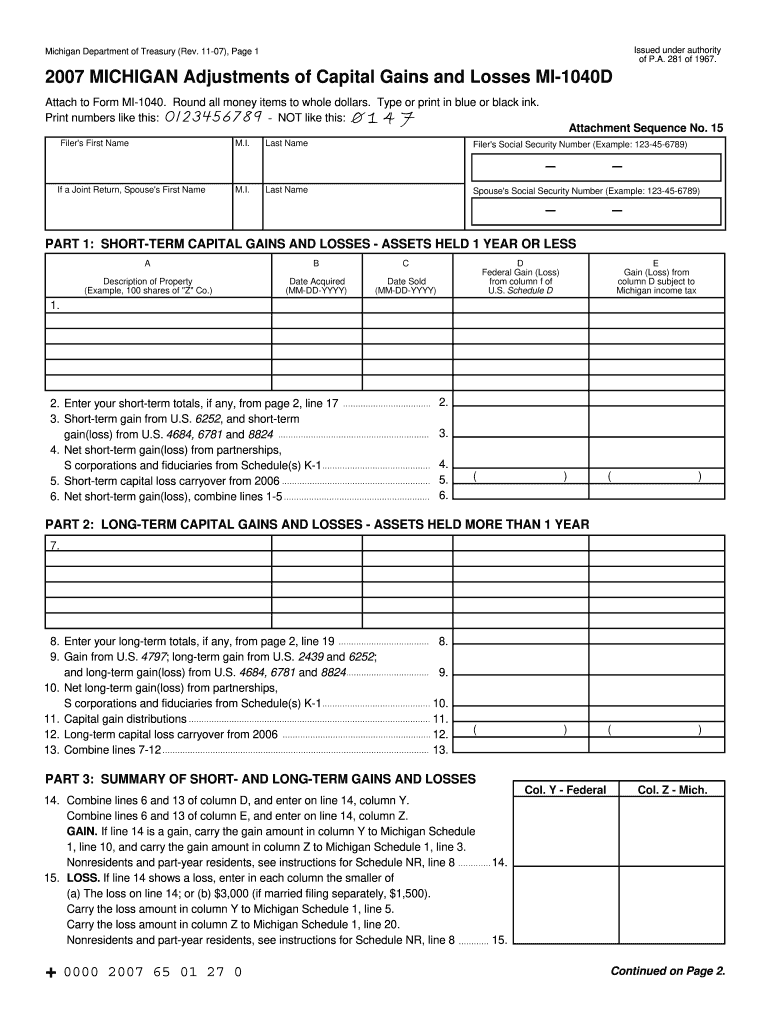

The MI 1040D, Adjustments Of Capital Gains And Losses, is a tax form used by residents of Michigan to report adjustments related to capital gains and losses. This form is essential for taxpayers who need to reconcile their capital gains and losses with the state tax authority. It allows individuals to accurately reflect their financial situation and ensure compliance with state tax laws. By detailing the adjustments, taxpayers can determine their taxable income and potential tax liabilities, which is crucial for accurate tax reporting.

Steps to complete the MI 1040D, Adjustments Of Capital Gains And Losses

Completing the MI 1040D involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including records of capital gains and losses. Next, fill out the form by providing detailed information about each transaction, including dates, amounts, and descriptions. It is important to calculate the net capital gain or loss accurately, as this will affect your overall tax liability. After completing the form, review it thoroughly for any errors or omissions before signing and submitting it to the appropriate tax authority.

Legal use of the MI 1040D, Adjustments Of Capital Gains And Losses

The MI 1040D is legally recognized by the Michigan Department of Treasury. It must be used in accordance with state tax laws to report capital gains and losses accurately. Taxpayers are required to file this form if they have capital transactions that affect their taxable income. Using the MI 1040D correctly ensures that taxpayers comply with legal obligations and avoid potential penalties associated with incorrect reporting.

Filing Deadlines / Important Dates

Filing deadlines for the MI 1040D align with the general tax filing deadlines in Michigan. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, it is essential to check for any changes or extensions that may apply. Taxpayers should also be aware of any specific deadlines related to their individual circumstances, such as extensions granted for filing federal tax returns.

Form Submission Methods (Online / Mail / In-Person)

The MI 1040D can be submitted through various methods to accommodate taxpayer preferences. Individuals have the option to file online through the Michigan Department of Treasury's e-filing system, which provides a secure and efficient way to submit forms. Alternatively, taxpayers can mail the completed form to the designated address provided in the instructions. In-person submissions may also be possible at local tax offices, although it is advisable to check availability and any required appointments.

Examples of using the MI 1040D, Adjustments Of Capital Gains And Losses

Examples of using the MI 1040D include scenarios where taxpayers have sold stocks, real estate, or other investments resulting in capital gains or losses. For instance, if an individual sold shares of stock at a profit, they would report the gain on the MI 1040D. Conversely, if they sold a property at a loss, that loss would also be documented on the form. These examples illustrate the importance of accurately reporting all capital transactions to ensure correct tax calculations.

Quick guide on how to complete mi 1040d adjustments of capital gains and losses

Your assistance manual on how to prepare your MI 1040D, Adjustments Of Capital Gains And Losses

If you’re wondering how to complete and submit your MI 1040D, Adjustments Of Capital Gains And Losses, here are a few brief guidelines on how to simplify tax processing.

To begin, you simply need to create your airSlate SignNow account to transform your document management online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to edit, generate, and finalize your income tax forms effortlessly. Using its editor, you can toggle between text, check boxes, and eSignatures, and return to modify details as necessary. Optimize your tax management with sophisticated PDF editing, eSigning, and easy sharing.

Follow these steps to complete your MI 1040D, Adjustments Of Capital Gains And Losses in just a few minutes:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; explore various versions and schedules.

- Press Get form to open your MI 1040D, Adjustments Of Capital Gains And Losses in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can lead to increased filing errors and delay refunds. Naturally, before electronically filing your taxes, consult the IRS website for submission guidelines in your jurisdiction.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040d adjustments of capital gains and losses

FAQs

-

ITR 2 How to fill short term losses and gain of equity shares of previous years?

ITR2A is a much simpler subset of ITR2 and is not covered separately. Individuals or HUFs with no income from business/profession, no captial gains and no income from foreign assets can use ITR2A.Individuals or HUF’S with no income from business/profession, but with capital gains and income from foreign assets should use ITR2.Guide to efile Income Tax Return: ITR2, ITR2A and ITR4For expert advise visit Financial Hospital

-

How do I declare a short term capital gain tax in the ITR in India? I want to know about the ITR form number and where and what to fill in the details. This is my first time to pay a short term capital gain tax on an equity sale.

The selection of ITR form will depend upon the type of one's income.For Income from salary, house property, capital gains for ITR2 is suggestedHowever for income from above heads and business/profession ITR4 is suggestedIn both the forms under head CG, revenue from sale of equity shares are required to be mentioned along with purchase amount and expenses incurred on sale are also required to be mentioned.For short term and long term separate rows are there.Just fill up and it will take the net capital gain to respective cell in computation if income.

-

How to fill chest gap? I started working out 3 months ago and I have a bit of chest gain as a whole but in the middle, there’s a gap of about 2 fingers. I only do flat and incline BB and DB press. Will it fill up with crossover or remain that way?

Bench press is all you need.After a while you hit plateaus which regresses your progress in the gym. Start implementing few variations in your chest workout and reduce your frequency of hitting chest.Here's an effective technique to improve your overall workouts and over come this particular problem of yours.REVERSE PYRAMID PROGRESSION :Start your exercise with a medium weight just to warm up the muscle and joints.then instead of climbing your way to weight like the traditional way of sets go, start with your heaviest set.Eg.If you bench 80 kgs Max for 10 reps then start with 80 kgs and rep it for 5–6 reps.then your second set should be 10% decreased weight of the original set.which means that your second set should 72kgs for 6–8 reps.And similarly the third and last set should be 10% decreased weight of the second set for 8–10 reps.This technique helps you to train at your full potential because your muscles are fresh and not fatigued which in return promotes better growth.In short lift heavy,and heavy and heavy with time and you should be good to go.

-

I have gained exemption in accounts in group 1 and when I recently filled my exam form, I forgot to fill the detail of the exemption. So, how can I correct the same?

Talk to ICAI examination deptt imediately. May be this would not be a problem at all. But dont take risk. And contact them, if possible personally face to face and not by phone.

-

How can I avoid paying capital gains tax on the sale of my nightly vacation rental? I did not realize how much I was going to have to pay and now am stuck in a contract to sell?

If you’re looking for tax-avoidance strategies, you should consult a tax advisor.It is possible that such a qualified tax professional would recommend you do a like-kind exchange, where you purchase another property with the proceeds of the sale.The basis in the original property would be rolled into the new property, so you’re not “getting out” of paying taxes, just deferring them.In any case, it would be irresponsible to attempt such a transaction without any further research than an anonymous answer from the internet.

Create this form in 5 minutes!

How to create an eSignature for the mi 1040d adjustments of capital gains and losses

How to create an electronic signature for the Mi 1040d Adjustments Of Capital Gains And Losses in the online mode

How to generate an eSignature for the Mi 1040d Adjustments Of Capital Gains And Losses in Chrome

How to make an electronic signature for signing the Mi 1040d Adjustments Of Capital Gains And Losses in Gmail

How to create an electronic signature for the Mi 1040d Adjustments Of Capital Gains And Losses straight from your mobile device

How to create an electronic signature for the Mi 1040d Adjustments Of Capital Gains And Losses on iOS devices

How to generate an electronic signature for the Mi 1040d Adjustments Of Capital Gains And Losses on Android

People also ask

-

What is the MI 1040D, Adjustments Of Capital Gains And Losses form?

The MI 1040D, Adjustments Of Capital Gains And Losses form is used by Michigan residents to report adjustments regarding capital gains and losses on their state tax return. This form allows taxpayers to properly calculate their gains or losses, ensuring they account for any state-specific modifications. It's crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow help with the MI 1040D, Adjustments Of Capital Gains And Losses?

airSlate SignNow provides an efficient way to sign and send your MI 1040D, Adjustments Of Capital Gains And Losses form electronically. With its user-friendly interface, you can easily manage your documents, ensuring timely submission to tax authorities. Utilizing airSlate SignNow simplifies the process, helping you stay organized and compliant.

-

What features does airSlate SignNow offer for handling tax documents like the MI 1040D?

airSlate SignNow offers features such as document templates, automated workflows, and electronic signatures, all essential for managing tax documents like the MI 1040D, Adjustments Of Capital Gains And Losses. These tools streamline the document preparation process, allowing you to focus more on your financial planning. Additionally, the platform ensures secure storage and easy retrieval of your important tax documents.

-

Is airSlate SignNow cost-effective for filing forms like the MI 1040D?

Yes, airSlate SignNow is a cost-effective solution for managing tax forms, including the MI 1040D, Adjustments Of Capital Gains And Losses. With transparent pricing plans, businesses and individuals can find a package that fits their budget without sacrificing quality. This affordability makes airSlate SignNow an ideal choice for those seeking to manage their tax paperwork efficiently.

-

Can I integrate airSlate SignNow with accounting software for MI 1040D submissions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software solutions, making it easy to manage your MI 1040D, Adjustments Of Capital Gains And Losses submissions. By integrating your tools, you can streamline your workflow and reduce errors during the filing process. This integration ensures a smooth experience from document preparation to submission.

-

What are the benefits of using airSlate SignNow for my MI 1040D forms?

Using airSlate SignNow for your MI 1040D, Adjustments Of Capital Gains And Losses offers numerous benefits, including time savings, enhanced accuracy, and improved compliance. The platform allows for quick electronic signatures, reducing the turnaround time for document processing. Furthermore, with automated reminders, you can stay on top of important deadlines and submissions.

-

How secure is my data when using airSlate SignNow for tax documents?

Security is a top priority at airSlate SignNow. When managing your MI 1040D, Adjustments Of Capital Gains And Losses and other tax documents, you can be assured that all data is encrypted and stored securely. The platform adheres to industry standards for data protection, allowing you to manage tax-related documents with confidence.

Get more for MI 1040D, Adjustments Of Capital Gains And Losses

- District grand lodge of east africa nairobi form

- Waxing consent form bodybyshaecom

- Employee information sheet human resources form

- Daily sign insign out record dssr form

- Dmv approved translators las vegas form

- Complete the text with the correct form of the verbs in brackets

- Reiki session intake form confidential information

- Dhs 4959 eng form

Find out other MI 1040D, Adjustments Of Capital Gains And Losses

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation