Michigan MI 1040 Individual Income Tax State of Michigan 2017

What is the Michigan MI 1040 Individual Income Tax State Of Michigan

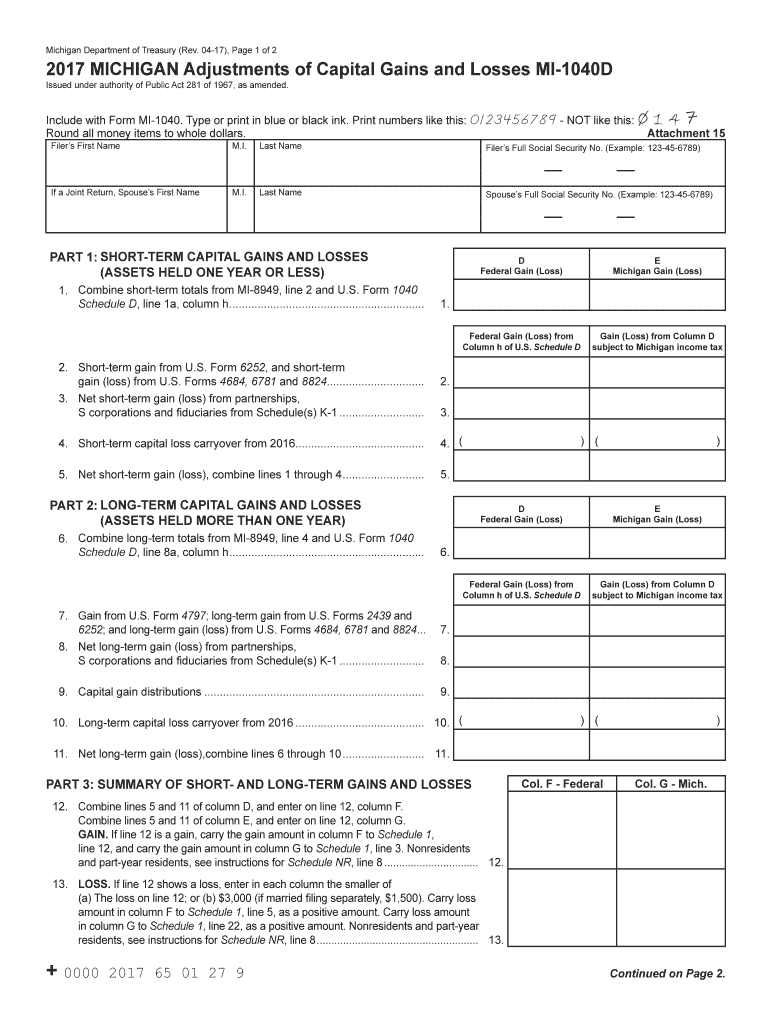

The Michigan MI 1040 Individual Income Tax form is a crucial document for residents of Michigan who need to report their personal income to the state. This form is used to calculate the amount of state income tax owed based on various factors, including income level, deductions, and credits. It is essential for ensuring compliance with state tax laws and for contributing to the funding of public services within Michigan.

Steps to complete the Michigan MI 1040 Individual Income Tax State Of Michigan

Completing the Michigan MI 1040 form involves several key steps:

- Gather your financial documents, including W-2s, 1099s, and any other relevant income statements.

- Determine your filing status, which could be single, married filing jointly, married filing separately, or head of household.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources of income.

- Calculate your deductions and credits to determine your taxable income.

- Compute the tax owed based on the applicable tax rates.

- Sign and date the form before submitting it to the state.

How to obtain the Michigan MI 1040 Individual Income Tax State Of Michigan

The Michigan MI 1040 form can be obtained through various means:

- Visit the Michigan Department of Treasury website, where you can download the form in PDF format.

- Request a physical copy by contacting the Michigan Department of Treasury directly.

- Access the form through tax preparation software that supports Michigan state tax filings.

Required Documents

To accurately complete the Michigan MI 1040 form, you will need several documents:

- W-2 forms from employers to report wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, such as mortgage interest statements or proof of charitable contributions.

Filing Deadlines / Important Dates

It is important to be aware of key deadlines when filing the Michigan MI 1040 form:

- The standard filing deadline for individual income tax returns is April 15 of each year.

- If the deadline falls on a weekend or holiday, it may be extended to the next business day.

- Extensions may be available, but any taxes owed must still be paid by the original deadline to avoid penalties.

Penalties for Non-Compliance

Failure to file the Michigan MI 1040 form on time or to pay the taxes owed can result in penalties:

- A late filing penalty may be assessed if the return is submitted after the deadline without an approved extension.

- Interest will accrue on any unpaid taxes from the due date until the tax is paid in full.

- Additional penalties may apply for underreporting income or for fraudulent claims.

Quick guide on how to complete 2014 michigan mi 1040 individual income tax state of michigan

Your assistance manual on how to prepare your Michigan MI 1040 Individual Income Tax State Of Michigan

If you’re wondering how to generate and submit your Michigan MI 1040 Individual Income Tax State Of Michigan, here are some brief guidelines on how to simplify tax processing.

To begin, you simply need to sign up for your airSlate SignNow account to modify how you handle documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to edit, draft, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and eSignatures and return to modify information as necessary. Enhance your tax management with advanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your Michigan MI 1040 Individual Income Tax State Of Michigan in no time:

- Create your account and begin working on PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Michigan MI 1040 Individual Income Tax State Of Michigan in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Use the Signature Tool to insert your legally-binding eSignature (if applicable).

- Review your document and correct any inaccuracies.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Keep in mind that filing on paper can increase the likelihood of return errors and slow down refunds. It is advisable to check the IRS website for filing rules specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct 2014 michigan mi 1040 individual income tax state of michigan

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the 2014 michigan mi 1040 individual income tax state of michigan

How to make an eSignature for the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan online

How to create an electronic signature for the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan in Chrome

How to create an electronic signature for putting it on the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan in Gmail

How to make an eSignature for the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan right from your smart phone

How to make an eSignature for the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan on iOS devices

How to generate an eSignature for the 2014 Michigan Mi 1040 Individual Income Tax State Of Michigan on Android devices

People also ask

-

What is the Michigan MI 1040 Individual Income Tax State Of Michigan?

The Michigan MI 1040 Individual Income Tax State Of Michigan is the tax form used by residents of Michigan to report their income and calculate their state tax obligations. It is essential for individuals to accurately fill out this form to comply with state tax laws and avoid penalties.

-

How can airSlate SignNow help with Michigan MI 1040 Individual Income Tax State Of Michigan forms?

airSlate SignNow simplifies the process of filling out and signing Michigan MI 1040 Individual Income Tax State Of Michigan forms. Our platform enables users to create, send, and eSign documents quickly, ensuring a smooth tax filing experience and compliance with all state regulations.

-

What are the pricing options for using airSlate SignNow for Michigan MI 1040 Individual Income Tax State Of Michigan?

airSlate SignNow offers flexible pricing plans that cater to various needs and budgets. Pricing starts at a competitive rate, making it accessible for individuals and businesses alike who need to manage Michigan MI 1040 Individual Income Tax State Of Michigan forms efficiently.

-

Is airSlate SignNow secure for handling Michigan MI 1040 Individual Income Tax State Of Michigan documents?

Yes, airSlate SignNow prioritizes security and compliance, utilizing advanced encryption and authentication methods. This ensures that all documents, including Michigan MI 1040 Individual Income Tax State Of Michigan forms, are secure and protected throughout the signing process.

-

What features does airSlate SignNow offer for Michigan MI 1040 Individual Income Tax State Of Michigan management?

airSlate SignNow provides features such as customizable templates, real-time tracking, and automatic reminders to streamline the management of Michigan MI 1040 Individual Income Tax State Of Michigan forms. These tools enhance efficiency and help ensure timely submissions.

-

Can airSlate SignNow integrate with other software for Michigan MI 1040 Individual Income Tax State Of Michigan preparation?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax preparation software, allowing for an optimized workflow when handling Michigan MI 1040 Individual Income Tax State Of Michigan documents. This integration helps users maintain organized records and simplifies document sharing.

-

What are the benefits of using airSlate SignNow for my Michigan MI 1040 Individual Income Tax State Of Michigan filings?

Using airSlate SignNow for your Michigan MI 1040 Individual Income Tax State Of Michigan filings provides convenience, efficiency, and peace of mind. With features like eSigning and document management, users can complete their tax forms quickly and securely while reducing the risk of errors.

Get more for Michigan MI 1040 Individual Income Tax State Of Michigan

- Navy counseling chit fillable pdf form

- Alabama dept of revenue form nr af2

- Campsite reservation form saskatchewan regional parks

- Icici cheque book request form

- Bollettino postale pdf form

- For office use only xviii airborne corps and fort bragg bragg army form

- Iaaicom form

- 4951579222108137089634884284096201197879296n jpg form

Find out other Michigan MI 1040 Individual Income Tax State Of Michigan

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself