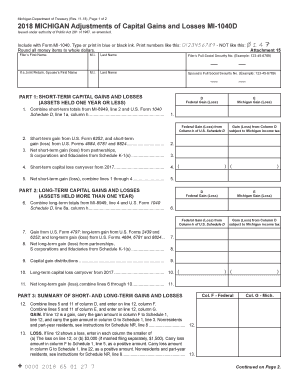

Michigan 1040d 2018

What is the Michigan 1040D?

The Michigan 1040D form is a state tax document used by residents of Michigan to report their income and calculate their tax liability. This form is specifically designed for individuals who need to report additional income or adjustments that are not covered in the standard Michigan 1040 form. It allows taxpayers to detail specific deductions, credits, and other financial information relevant to their state tax obligations.

How to use the Michigan 1040D

Using the Michigan 1040D involves several steps to ensure accurate reporting of your income and deductions. First, gather all necessary financial documents, including W-2s, 1099s, and any records of deductions or credits you plan to claim. Next, fill out the form by entering your personal information, income details, and any applicable adjustments. Be sure to follow the instructions carefully to avoid errors. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to complete the Michigan 1040D

Completing the Michigan 1040D requires careful attention to detail. Follow these steps:

- Gather all relevant tax documents, including income statements and deduction records.

- Download the Michigan 1040D form from the Michigan Department of Treasury website or access it through an authorized tax software.

- Fill out your personal information, including your name, address, and Social Security number.

- Report your total income and any adjustments you are claiming.

- Double-check your entries for accuracy and completeness.

- Submit the form electronically or print it out and mail it to the appropriate address.

Legal use of the Michigan 1040D

The Michigan 1040D form is legally recognized by the state of Michigan as an official document for tax reporting. It must be filled out accurately to comply with state tax laws. Misreporting or failing to file this form can result in penalties, including fines or interest on unpaid taxes. Therefore, it is essential to ensure that all information provided is truthful and complete, as per the guidelines set by the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan 1040D align with federal tax deadlines. Typically, individual taxpayers must submit their forms by April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to be aware of any changes in deadlines or extensions offered by the state, especially during tax season.

Required Documents

When filling out the Michigan 1040D, several documents are necessary to ensure accurate reporting. These include:

- W-2 forms from employers showing wages earned.

- 1099 forms for any additional income, such as freelance work or interest earned.

- Documentation for any deductions or credits you plan to claim, such as receipts for medical expenses or educational costs.

- Previous year’s tax return for reference, if applicable.

Quick guide on how to complete 2018 michigan adjustments of capital gains and losses mi 1040d

Your assistance manual on how to prepare your Michigan 1040d

If you’re looking to understand how to complete and submit your Michigan 1040d, here are some brief guidelines to simplify your tax procedures.

To begin, all you need to do is set up your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a remarkably user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. With its editing features, you can toggle between text, check boxes, and eSignatures, and return to amend responses when necessary. Streamline your tax processing with advanced PDF editing, eSigning, and easy sharing options.

Follow these steps to complete your Michigan 1040d swiftly:

- Create your account and start editing PDFs in no time.

- Utilize our directory to access any IRS tax form; explore various versions and schedules.

- Click Get form to open your Michigan 1040d in our editor.

- Populate the necessary fillable fields with your details (text, numbers, check marks).

- Use the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and fix any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper can lead to more errors and prolong refunds. Of course, before e-filing your taxes, consult the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2018 michigan adjustments of capital gains and losses mi 1040d

Create this form in 5 minutes!

How to create an eSignature for the 2018 michigan adjustments of capital gains and losses mi 1040d

How to make an eSignature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d online

How to generate an electronic signature for your 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d in Google Chrome

How to generate an eSignature for putting it on the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d in Gmail

How to make an eSignature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d from your mobile device

How to generate an eSignature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d on iOS devices

How to generate an electronic signature for the 2018 Michigan Adjustments Of Capital Gains And Losses Mi 1040d on Android devices

People also ask

-

What is the MI 1040 form 2018 and why is it important?

The MI 1040 form 2018 is the Michigan Individual Income Tax Return form used for filing state taxes. It's crucial for residents as it helps them report their income, calculate tax obligations, and claim any applicable credits or deductions. Using this form accurately ensures compliance with state tax laws.

-

How can airSlate SignNow help with the MI 1040 form 2018?

airSlate SignNow simplifies the process of completing and eSigning the MI 1040 form 2018. With its intuitive interface, users can easily fill out the form electronically, ensuring no mistakes occur during the filling process. Additionally, it allows for secure signing, so you can complete your tax filing with confidence.

-

Is there a cost associated with using airSlate SignNow for the MI 1040 form 2018?

airSlate SignNow offers flexible pricing plans suitable for various needs, from individuals to businesses. While there is a fee for access to premium features, the cost-effectiveness of the platform can save time and reduce errors when preparing the MI 1040 form 2018. It's a worthwhile investment for anyone needing to manage documents efficiently.

-

What features does airSlate SignNow provide for the MI 1040 form 2018?

AirSlate SignNow provides essential features like electronic signatures, template management, and document tracking for the MI 1040 form 2018. These features streamline the signing process, allow for real-time collaboration, and ensure that your documents are stored securely. This makes it easier to manage your state tax paperwork.

-

Can airSlate SignNow integrate with other applications for processing the MI 1040 form 2018?

Yes, airSlate SignNow integrates seamlessly with various applications like Google Drive, Dropbox, and major CRM systems, enhancing productivity in managing the MI 1040 form 2018. This integration capability allows you to pull in data easily and manage documents from a single interface, improving overall efficiency when filing your taxes.

-

What are the benefits of using airSlate SignNow for the MI 1040 form 2018 over traditional methods?

Using airSlate SignNow for the MI 1040 form 2018 offers signNow advantages over traditional paper-based methods. Digital signing reduces turnaround time and eliminates the need for physical storage, making it easier to manage your tax documents. Additionally, the security protocols ensure your information remains confidential and less prone to fraud.

-

How secure is the information provided on the MI 1040 form 2018 through airSlate SignNow?

AirSlate SignNow prioritizes security, implementing advanced encryption and compliance with industry standards to protect your information on the MI 1040 form 2018. Your data is kept confidential and securely stored, minimizing risks of unauthorized access. This ensures peace of mind when handling sensitive tax documents.

Get more for Michigan 1040d

Find out other Michigan 1040d

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed