MICHIGAN Adjustments of Capital Gains and Losses MI 1040D MICHIGAN Adjustments of Capital Gains and Losses MI 1040D 2020

Understanding the Michigan Adjustments of Capital Gains and Losses MI 1040D

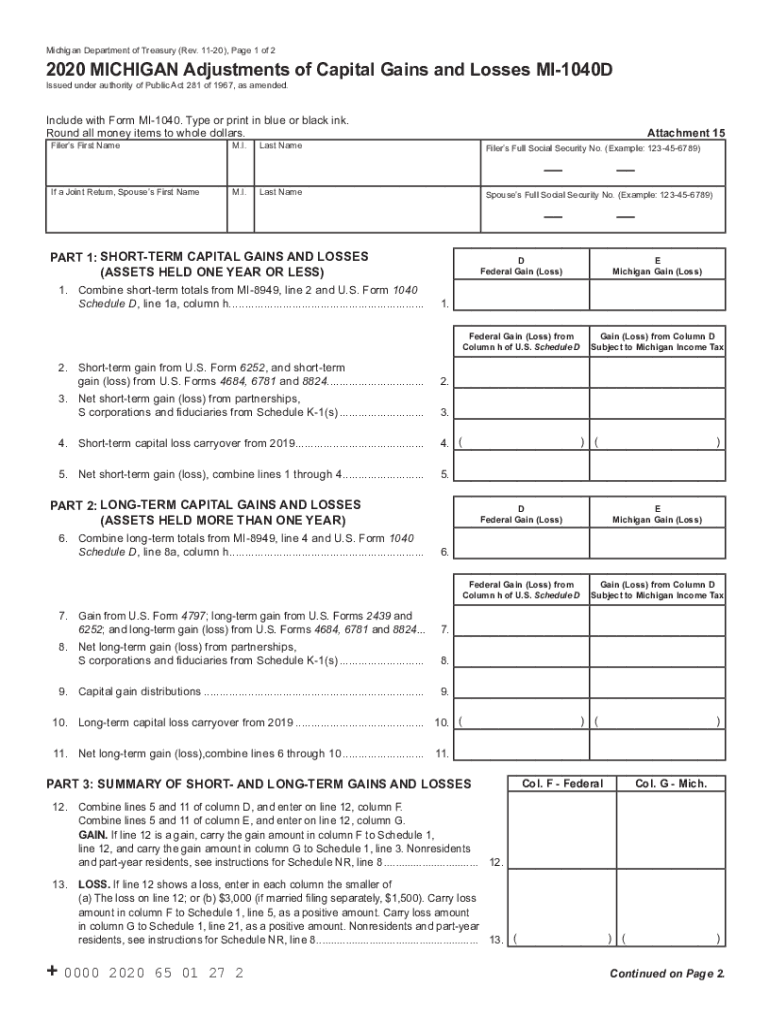

The Michigan Adjustments of Capital Gains and Losses MI 1040D is a form used by Michigan taxpayers to report adjustments related to capital gains and losses. This form is specifically designed to ensure that taxpayers accurately reflect their capital gains and losses on their Michigan state income tax returns. The adjustments made on this form can significantly impact the total tax liability, as Michigan has specific rules governing the taxation of capital gains. Understanding how to complete this form is essential for compliance with state tax regulations.

Steps to Complete the Michigan Adjustments of Capital Gains and Losses MI 1040D

Completing the MI 1040D involves several steps that ensure accurate reporting of capital gains and losses. Begin by gathering all necessary documentation, including records of transactions that resulted in capital gains or losses. Follow these steps to complete the form:

- Enter your name and Social Security number at the top of the form.

- Report total capital gains and losses from your federal tax return.

- Make necessary adjustments as per Michigan tax laws, which may include exemptions or deductions specific to the state.

- Calculate the adjusted capital gains or losses and ensure all figures are accurate.

- Sign and date the form before submission.

Legal Use of the Michigan Adjustments of Capital Gains and Losses MI 1040D

The MI 1040D is legally recognized for reporting capital gains and losses in Michigan. To ensure its legal validity, the form must be completed accurately and submitted in accordance with state tax laws. The Michigan Department of Treasury requires that taxpayers maintain supporting documentation for all reported figures. This includes transaction records and any relevant tax documents. Failure to comply with these legal requirements may result in penalties or audits.

State-Specific Rules for the Michigan Adjustments of Capital Gains and Losses MI 1040D

Michigan has unique rules regarding capital gains and losses that differ from federal regulations. Taxpayers must be aware of these state-specific rules when completing the MI 1040D. For example, certain capital gains may be exempt from taxation, while others may be subject to different rates. Additionally, Michigan allows for specific deductions that can reduce taxable income. Understanding these nuances is crucial for accurate tax reporting and compliance.

Examples of Using the Michigan Adjustments of Capital Gains and Losses MI 1040D

To illustrate the application of the MI 1040D, consider a scenario where a taxpayer sells stocks at a profit. The taxpayer would report the total capital gain from the sale on the MI 1040D. If the taxpayer also incurred losses from other investments, these can be offset against the gains. Another example includes real estate transactions, where the sale of a property may result in significant capital gains. Accurately reporting these figures on the MI 1040D is essential for determining the correct tax liability.

Filing Deadlines for the Michigan Adjustments of Capital Gains and Losses MI 1040D

Timely filing of the MI 1040D is critical to avoid penalties. The deadline for submitting this form typically aligns with the state income tax return deadline, which is usually April fifteenth. If taxpayers require additional time, they may file for an extension, but they must still pay any estimated taxes owed by the original deadline. Staying informed about these deadlines helps ensure compliance and prevents unnecessary fees.

Quick guide on how to complete 2020 michigan adjustments of capital gains and losses mi 1040d 2020 michigan adjustments of capital gains and losses mi 1040d

Prepare MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Manage MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D without hassle

- Locate MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D and click on Obtain Form to initiate.

- Employ the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for such tasks.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Complete button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form retrieval, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 michigan adjustments of capital gains and losses mi 1040d 2020 michigan adjustments of capital gains and losses mi 1040d

Create this form in 5 minutes!

How to create an eSignature for the 2020 michigan adjustments of capital gains and losses mi 1040d 2020 michigan adjustments of capital gains and losses mi 1040d

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the MI 1040D form and why is it important?

The MI 1040D form is used for filing Michigan individual income tax returns. It is important because it helps taxpayers report their income accurately and meet state tax obligations. Using the MI 1040D ensures you take advantage of any eligible deductions and credits.

-

How can airSlate SignNow help with completing the MI 1040D?

AirSlate SignNow streamlines the process of completing the MI 1040D by allowing you to fill out and eSign documents digitally. Its user-friendly interface makes it easy for users to navigate tax forms without any hassle. With airSlate SignNow, you can ensure your MI 1040D is completed accurately and securely.

-

Is there a cost associated with using airSlate SignNow for MI 1040D?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including features specifically for managing forms like the MI 1040D. While pricing varies based on selected features, the solution remains cost-effective compared to traditional methods. You can choose a plan that best fits your budget and requirements for hassle-free filing.

-

Can I integrate airSlate SignNow with other software for filing the MI 1040D?

Absolutely! AirSlate SignNow seamlessly integrates with many popular accounting and tax software solutions. This means you can easily sync your data, making it simpler to file your MI 1040D with accuracy and consistency across platforms.

-

What are the key features of airSlate SignNow for managing the MI 1040D?

AirSlate SignNow offers versatile features for managing the MI 1040D, including eSignature capabilities, templates, and document tracking. These tools allow you to create, send, and sign documents efficiently. Additionally, this enhances collaboration among tax preparers and clients for a smoother filing process.

-

How does using airSlate SignNow benefit my MI 1040D filing process?

Using airSlate SignNow simplifies the MI 1040D filing process by enabling quick digital entries and secure electronic signatures. This not only saves time but also minimizes errors often associated with manual paperwork. With airSlate SignNow, you can expedite your filing while ensuring compliance with state regulations.

-

Is airSlate SignNow secure for handling sensitive information like the MI 1040D?

Yes, airSlate SignNow prioritizes security with advanced encryption and strict data protection measures. Your MI 1040D and any sensitive information you share are safeguarded against unauthorized access. You can trust that your documents remain confidential throughout the entire signing process.

Get more for MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

Find out other MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D MICHIGAN Adjustments Of Capital Gains And Losses MI 1040D

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement

- Sign Vermont Rental house lease agreement Now

- How Can I Sign Colorado Rental lease agreement forms

- Can I Sign Connecticut Rental lease agreement forms

- Sign Florida Rental lease agreement template Free

- Help Me With Sign Idaho Rental lease agreement template

- Sign Indiana Rental lease agreement forms Fast

- Help Me With Sign Kansas Rental lease agreement forms

- Can I Sign Oregon Rental lease agreement template

- Can I Sign Michigan Rental lease agreement forms

- Sign Alaska Rental property lease agreement Simple

- Help Me With Sign North Carolina Rental lease agreement forms

- Sign Missouri Rental property lease agreement Mobile

- Sign Missouri Rental property lease agreement Safe

- Sign West Virginia Rental lease agreement forms Safe

- Sign Tennessee Rental property lease agreement Free

- Sign West Virginia Rental property lease agreement Computer

- How Can I Sign Montana Rental lease contract