Idaho 41 Form 2019

What is the Idaho 41 Form

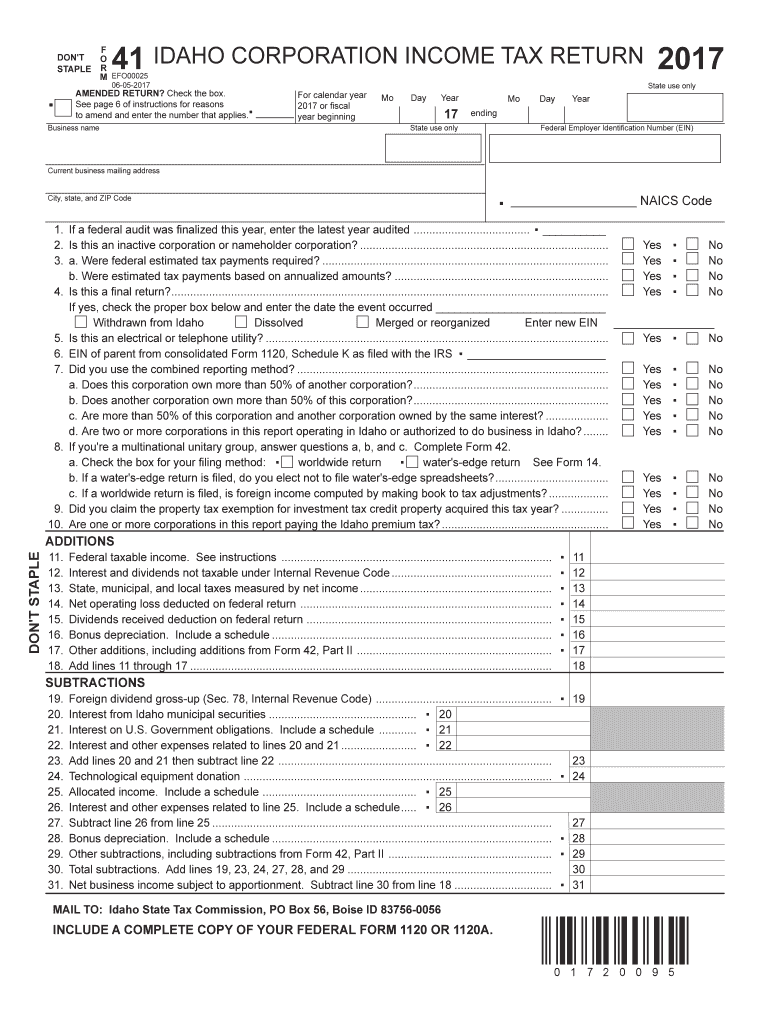

The Idaho 41 Form, officially known as the Idaho Corporation Income Tax Return, is a tax document that corporations operating in Idaho must complete and submit to report their income, deductions, and tax liability. This form is essential for ensuring compliance with state tax laws and is used to calculate the amount of tax owed by corporations based on their income earned within the state. It is important for businesses to accurately fill out this form to avoid penalties and ensure proper reporting of their financial activities.

How to use the Idaho 41 Form

Using the Idaho 41 Form involves several steps to ensure accurate completion and submission. Corporations need to gather all relevant financial information, including income statements, expense reports, and any applicable deductions. The form requires detailed entries regarding the corporation's income, including gross receipts and other sources of revenue. After filling out the form, corporations can submit it electronically or via mail, depending on their preference and the guidelines provided by the Idaho State Tax Commission.

Steps to complete the Idaho 41 Form

Completing the Idaho 41 Form involves a systematic approach:

- Gather Financial Documents: Collect all necessary financial records, including income and expense statements.

- Fill Out the Form: Enter the required information accurately, including income, deductions, and tax credits.

- Review for Accuracy: Double-check all entries to ensure there are no mistakes or omissions.

- Submit the Form: Choose your submission method—either electronically through an approved platform or by mailing a hard copy to the appropriate tax authority.

Legal use of the Idaho 41 Form

The Idaho 41 Form is legally recognized as a valid document for reporting corporate income. To ensure its legal standing, corporations must adhere to the guidelines set forth by the Idaho State Tax Commission. This includes accurate reporting of financial information and timely submission of the form. Utilizing electronic signature solutions, such as signNow, can further enhance the legal validity of the document by ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Corporations must be aware of key filing deadlines associated with the Idaho 41 Form. Typically, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15. It is crucial for businesses to mark these dates on their calendars to avoid late filing penalties and interest charges.

Form Submission Methods (Online / Mail / In-Person)

Corporations have multiple options for submitting the Idaho 41 Form. They can file electronically using approved e-filing software, which is often the fastest method and allows for immediate confirmation of receipt. Alternatively, businesses may choose to print the form and mail it to the Idaho State Tax Commission. In-person submissions are also possible, although less common. Each method has its own advantages, and corporations should select the one that best suits their needs.

Quick guide on how to complete idaho 41 form

Complete Idaho 41 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Idaho 41 Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Idaho 41 Form effortlessly

- Find Idaho 41 Form and click on Get Form to initiate the process.

- Utilize the tools at your disposal to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Idaho 41 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idaho 41 form

Create this form in 5 minutes!

How to create an eSignature for the idaho 41 form

The best way to generate an electronic signature for your PDF online

The best way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Idaho 2016 Form 41?

The Idaho 2016 Form 41 is the state's corporate income tax return that businesses must file to report their income and calculate tax liability. Completing this form accurately is crucial for compliance with Idaho tax laws. Using tools like airSlate SignNow can help ensure that your Form 41 is filled out correctly.

-

How can airSlate SignNow help with the Idaho 2016 Form 41?

airSlate SignNow streamlines the process of preparing and signing the Idaho 2016 Form 41. With its user-friendly interface, you can easily fill out the form, collect signatures, and securely send documents. This saves time and reduces the chances of errors on your tax return.

-

Is there a cost associated with using airSlate SignNow for the Idaho 2016 Form 41?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Depending on your requirements, you can choose a plan that suits your budget while ensuring you have access to powerful features for managing the Idaho 2016 Form 41 and other documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features to enhance document management, including eSignature capabilities, templates for common forms like the Idaho 2016 Form 41, and integration with various apps. These features are designed to improve efficiency and simplify the document signing process.

-

Can I track the status of my Idaho 2016 Form 41 with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your documents, including the Idaho 2016 Form 41. You can see when the form is viewed, signed, and completed, ensuring that you stay informed throughout the entire process.

-

Does airSlate SignNow integrate with accounting software for filing the Idaho 2016 Form 41?

Yes, airSlate SignNow integrates seamlessly with popular accounting software to facilitate the filing process for the Idaho 2016 Form 41. This integration allows for an efficient workflow, minimizing the need for manual data entry and helping to ensure accuracy.

-

What benefits does using airSlate SignNow offer for filing the Idaho 2016 Form 41?

Using airSlate SignNow for submitting the Idaho 2016 Form 41 simplifies the entire filing experience, making it quicker and less stressful. The platform reduces paperwork and enhances collaboration among team members. Plus, its security features ensure your sensitive information is protected.

Get more for Idaho 41 Form

- Wi husband wife form

- Warranty deed from husband and wife to corporation wisconsin form

- Divorce worksheet and law summary for contested or uncontested case of over 25 pages ideal client interview form wisconsin

- Wi lien form 497430568

- Partial satisfaction of lien claim individual wisconsin form

- Quitclaim deed from husband and wife to llc wisconsin form

- Warranty deed from husband and wife to llc wisconsin form

- Wisconsin satisfaction judgment form

Find out other Idaho 41 Form

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template