Maine Form 1041me 2019

What is the Maine Form 1041me

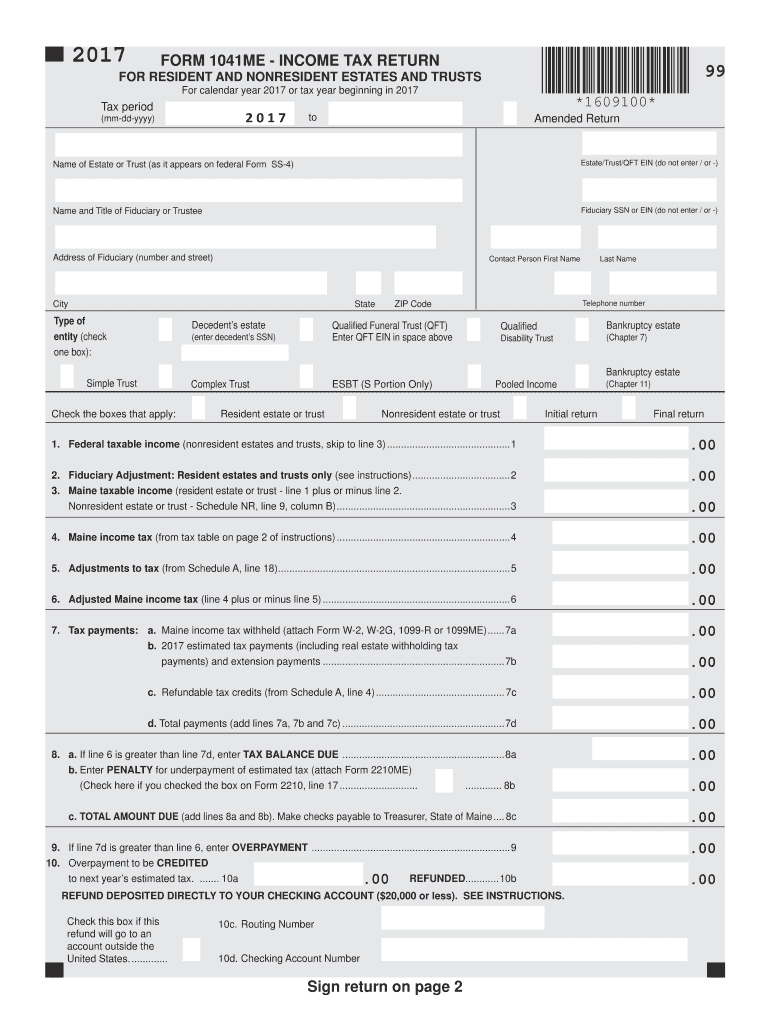

The Maine Form 1041me is a tax form specifically designed for fiduciaries of estates and trusts in the state of Maine. This form is used to report income, deductions, and credits for estates and trusts that are required to file a Maine income tax return. It is essential for ensuring compliance with state tax laws, and it helps fiduciaries accurately report the financial activities of the estate or trust they manage. The form includes various sections that require detailed information about the income generated by the estate or trust, as well as any applicable deductions.

Steps to Complete the Maine Form 1041me

Completing the Maine Form 1041me involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents related to the estate or trust, including income statements, expense reports, and prior tax returns. Next, begin filling out the form by entering identifying information, such as the name and taxpayer identification number of the estate or trust. Follow the instructions carefully to report income, deductions, and credits as required. Be sure to double-check all entries for accuracy before finalizing the form. Once completed, you can sign and date the form, ensuring it is ready for submission.

Legal Use of the Maine Form 1041me

The Maine Form 1041me is legally recognized as a valid document for reporting income and tax obligations for estates and trusts. To ensure its legal standing, it is crucial to adhere to all filing requirements set by the Maine Revenue Services. This includes submitting the form by the specified deadlines and providing accurate information. Utilizing a reliable eSignature platform can enhance the legal validity of the form by ensuring that all signatures are secure and compliant with electronic signature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form 1041me are critical to avoid penalties and interest. Generally, the form is due on the fifteenth day of the fourth month following the close of the estate's or trust's tax year. For estates and trusts operating on a calendar year basis, this typically means the form must be filed by April 15. It is important to keep track of any changes to deadlines, as extensions may be available under certain circumstances. Always verify current deadlines with the Maine Revenue Services to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The Maine Form 1041me can be submitted through various methods to accommodate different preferences. The form can be filed electronically through approved e-filing services, which can streamline the process and reduce processing time. Alternatively, fiduciaries may choose to mail the completed form to the appropriate address specified by the Maine Revenue Services. In-person submissions may also be accepted at designated tax offices. Each method has its advantages, so it is beneficial to choose the one that best fits your needs.

Key Elements of the Maine Form 1041me

Understanding the key elements of the Maine Form 1041me is essential for accurate completion. The form typically includes sections for reporting income, such as interest, dividends, and capital gains. It also requires detailed information regarding deductions, including administrative expenses and distributions to beneficiaries. Additionally, the form includes a section for calculating the tax owed or any refund due. Familiarizing yourself with these elements can help ensure that all necessary information is accurately reported.

Quick guide on how to complete maine form 1041me

Complete Maine Form 1041me effortlessly on any device

Online document administration has become favored by both businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Maine Form 1041me on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Maine Form 1041me without hassle

- Obtain Maine Form 1041me and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important parts of the documents or redact sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as an ordinary handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Alter and eSign Maine Form 1041me to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine form 1041me

Create this form in 5 minutes!

How to create an eSignature for the maine form 1041me

The way to create an electronic signature for a PDF document online

The way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to make an eSignature from your smart phone

The best way to create an eSignature for a PDF document on iOS

How to make an eSignature for a PDF file on Android OS

People also ask

-

What is the 2018 form 1041me and why is it important?

The 2018 form 1041me is the Maine Income Tax Return for Estates and Trusts. It is crucial for fiduciaries to report income, deductions, and credits accurately. Understanding this form ensures compliance with state regulations and avoids potential penalties.

-

How can airSlate SignNow help with completing the 2018 form 1041me?

airSlate SignNow streamlines the process of filling out the 2018 form 1041me by providing easy access to electronic signatures and document management. Our platform simplifies collaboration, making it easier for fiduciaries to gather necessary approvals and submit forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the 2018 form 1041me?

Yes, airSlate SignNow offers competitive pricing plans tailored to meet diverse business needs while helping with the 2018 form 1041me. With our cost-effective solutions, you can manage documents without breaking the bank. Check our pricing page for specific plans.

-

What are the key features of airSlate SignNow that assist with the 2018 form 1041me?

Key features include electronic signatures, document templates, and integration capabilities that enhance the process of preparing the 2018 form 1041me. Additionally, our robust security measures ensure that all documents remain confidential and protected.

-

Can I integrate airSlate SignNow with accounting software for the 2018 form 1041me?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, facilitating easy preparation of the 2018 form 1041me. This integration allows for streamlined data transfer, saving you time and reducing errors in your filings.

-

What benefits does airSlate SignNow offer for handling the 2018 form 1041me?

Using airSlate SignNow for the 2018 form 1041me offers the benefits of improved efficiency, reduced paperwork, and secure document sharing. Our platform ensures that the filing process is swift and straightforward, allowing you to focus on what matters—your estate or trust.

-

How does airSlate SignNow ensure compliance when using the 2018 form 1041me?

airSlate SignNow stays updated with the latest tax laws and regulations, helping you maintain compliance while handling the 2018 form 1041me. Our user-friendly interface and support services also provide guidance to ensure you meet all necessary requirements for your submissions.

Get more for Maine Form 1041me

Find out other Maine Form 1041me

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document