Business Tax Services BTS 2020

Understanding the Oklahoma W-4 Form 2019

The Oklahoma W-4 form 2019 is essential for employees in Oklahoma to determine the amount of state income tax to withhold from their paychecks. This form allows individuals to provide their employers with information regarding their filing status and the number of allowances they wish to claim. By accurately completing this form, employees can ensure that they are not over- or under-withheld, which can affect their tax returns.

Steps to Complete the Oklahoma W-4 Form 2019

Filling out the Oklahoma W-4 form 2019 involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select your filing status, which can be single, married, or head of household.

- Indicate the number of allowances you are claiming. This number will affect your withholding amount.

- If applicable, provide additional information for any extra withholding you wish to request.

- Finally, sign and date the form to validate your submission.

Legal Use of the Oklahoma W-4 Form 2019

The Oklahoma W-4 form 2019 is legally binding once it is signed by the employee. Employers are required to use this form to calculate the appropriate state tax withholding based on the information provided. It is important to keep this form updated, especially after significant life changes such as marriage, divorce, or the birth of a child, as these events can impact your tax situation.

Filing Deadlines for the Oklahoma W-4 Form 2019

There are no specific filing deadlines for submitting the Oklahoma W-4 form 2019, as it should be completed and submitted to your employer upon starting a new job or when you wish to change your withholding status. However, it is advisable to submit the form as soon as possible to ensure accurate withholding for the current tax year.

Who Issues the Oklahoma W-4 Form 2019

The Oklahoma W-4 form 2019 is issued by the Oklahoma Tax Commission. This state agency oversees tax regulations and ensures compliance with state tax laws. Employees can obtain the form directly from the Oklahoma Tax Commission's website or through their employer.

Examples of Using the Oklahoma W-4 Form 2019

Employees in various scenarios can benefit from using the Oklahoma W-4 form 2019. For instance:

- A single individual may claim one allowance to minimize tax withholding.

- A married couple may choose to combine their allowances for a lower withholding rate.

- Parents may claim additional allowances for dependents, which can increase their take-home pay.

Required Documents for Completing the Oklahoma W-4 Form 2019

To accurately complete the Oklahoma W-4 form 2019, you may need the following documents:

- Your Social Security number.

- Information about your filing status.

- Details regarding any dependents you wish to claim.

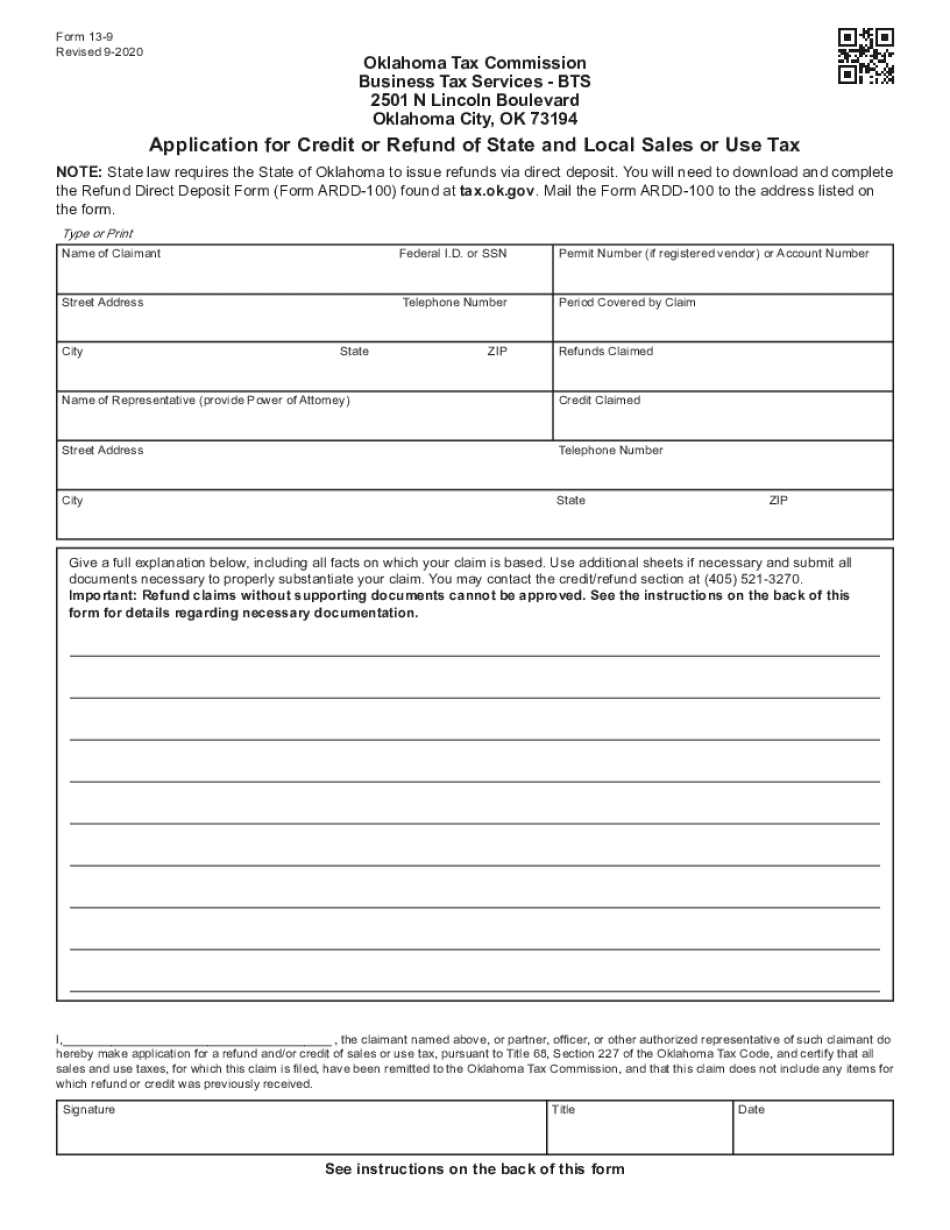

Quick guide on how to complete business tax services bts

Complete Business Tax Services BTS effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it digitally. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Business Tax Services BTS on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Business Tax Services BTS with ease

- Locate Business Tax Services BTS and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign Business Tax Services BTS and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business tax services bts

Create this form in 5 minutes!

How to create an eSignature for the business tax services bts

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Oklahoma W4 form 2019?

The Oklahoma W4 form 2019 is a state withholding allowance certificate used by employees in Oklahoma to determine their state income tax withholding. By completing this form accurately, employees can ensure the correct amount is deducted from their paychecks for state taxes. It's essential for ensuring you meet your tax obligations while maximizing your take-home pay.

-

How can I obtain the Oklahoma W4 form 2019?

You can obtain the Oklahoma W4 form 2019 from the Oklahoma Tax Commission's website or directly from your employer. Printable versions are also available online, making it easy to access the form and complete it at your convenience. If you prefer a digital option, airSlate SignNow allows you to complete and eSign the form online.

-

Why is the Oklahoma W4 form 2019 important for employees?

The Oklahoma W4 form 2019 is crucial for employees because it helps to establish how much state tax will be withheld from their paycheck. Correctly filling out this form can prevent under-withholding, which could lead to a tax bill at the end of the year. Additionally, it provides clarity on your financial standing and ensures compliance with Oklahoma state tax laws.

-

Can I eSign the Oklahoma W4 form 2019 using airSlate SignNow?

Yes, with airSlate SignNow, you can easily eSign the Oklahoma W4 form 2019. Our platform provides a user-friendly interface for signing documents electronically, ensuring that your forms are securely stored and easy to access whenever needed. This feature also streamlines the process for both employees and employers.

-

Is there a fee for using airSlate SignNow to process the Oklahoma W4 form 2019?

While airSlate SignNow offers various pricing plans, you can often start with a free trial to explore its features. The cost-effective solution allows businesses to send and eSign documents, including the Oklahoma W4 form 2019, without incurring high fees. Pricing options are competitive and scalable based on your business needs.

-

What features does airSlate SignNow offer for the Oklahoma W4 form 2019?

airSlate SignNow provides numerous features for managing the Oklahoma W4 form 2019, including document templates, secure storage, and compliance tracking. The platform also integrates seamlessly with other business applications, making it easier to manage your documentation process. This ensures that both employers and employees have a smooth experience.

-

How does airSlate SignNow ensure the security of the Oklahoma W4 form 2019?

airSlate SignNow prioritizes security with industry-standard encryption to protect your data when processing the Oklahoma W4 form 2019. The platform also complies with legal standards to ensure that your eSignatures are valid and secure. With airSlate SignNow, you can trust that your personal information remains confidential.

Get more for Business Tax Services BTS

- Guardian legal form

- Virginia bankruptcy 7 form

- Virginia district bankruptcy form

- Bill of sale with warranty by individual seller virginia form

- Bill of sale with warranty for corporate seller virginia form

- Bill of sale without warranty by individual seller virginia form

- Bill of sale without warranty by corporate seller virginia form

- Chapter 13 plan and related motions virginia form

Find out other Business Tax Services BTS

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document