Form 13 9 Application for Credit or Refund of State and Local Sales or Use Tax 2021

What is the Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

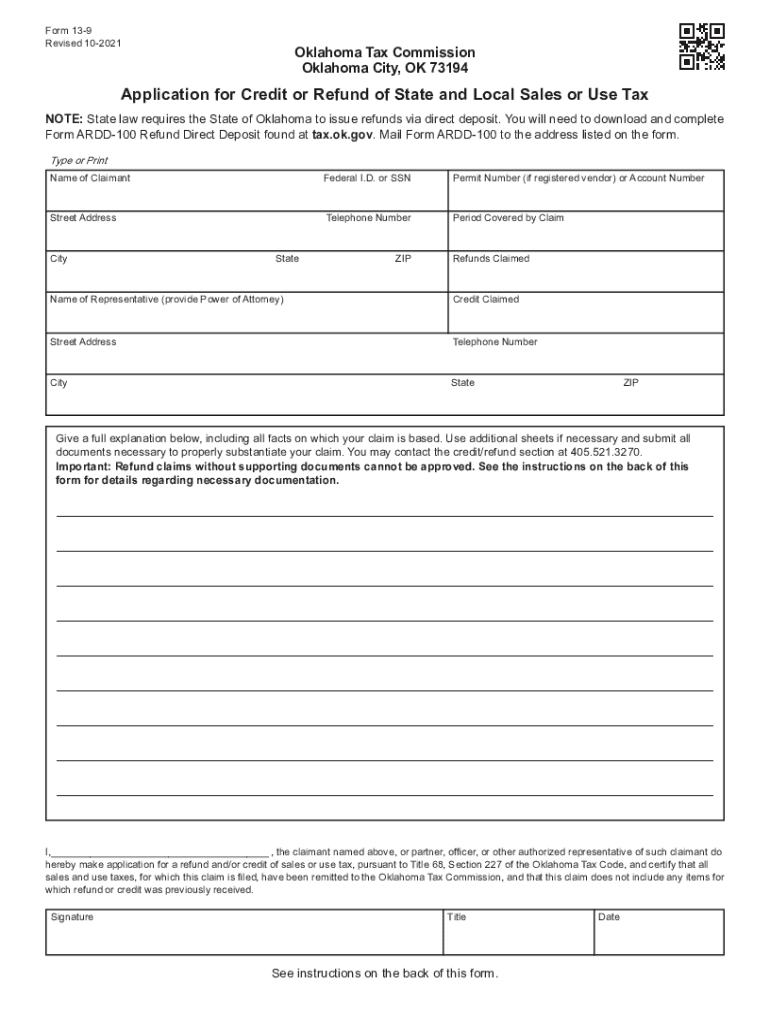

The Form 13 9 is a crucial document used in Oklahoma for individuals and businesses seeking a credit or refund for state and local sales or use tax. This form allows taxpayers to request reimbursement for sales tax overpayments or to claim credits for certain purchases that qualify under Oklahoma tax law. Understanding the purpose of this form is essential for anyone looking to navigate the complexities of sales tax refunds effectively.

Steps to Complete the Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

Completing the Form 13 9 involves several steps to ensure accuracy and compliance with state regulations. Here’s a straightforward process:

- Gather necessary documentation, including receipts and proof of tax payment.

- Provide personal or business information, including name, address, and tax identification number.

- Detail the specific transactions for which you are claiming a refund, including dates and amounts.

- Clearly indicate the reason for the refund request, ensuring it aligns with Oklahoma tax guidelines.

- Review the completed form for accuracy before submission.

Legal Use of the Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

The legal use of the Form 13 9 is governed by Oklahoma tax laws, which stipulate the conditions under which a taxpayer may request a refund. This form must be filled out accurately and submitted within the designated time frame to be considered valid. Taxpayers should be aware that improper use or submission of the form can lead to denial of the refund request or potential penalties.

Eligibility Criteria

To qualify for a refund or credit using the Form 13 9, taxpayers must meet specific eligibility criteria set forth by Oklahoma tax authorities. Generally, these criteria include:

- Having paid sales or use tax on qualifying purchases.

- Filing the form within the stipulated time limits, typically within three years of the tax payment.

- Providing adequate documentation to support the refund claim.

Form Submission Methods

The Form 13 9 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to:

- Submit the form online through the Oklahoma Tax Commission's website.

- Mail the completed form to the appropriate address provided by the tax authorities.

- Deliver the form in person at designated tax offices.

Required Documents

When submitting the Form 13 9, it is essential to include all required documents to support the refund request. Commonly required documents include:

- Receipts or invoices for purchases made.

- Proof of sales tax payment, such as bank statements or credit card statements.

- Any additional documentation that may substantiate the claim.

Quick guide on how to complete form 13 9 application for credit or refund of state and local sales or use tax

Complete Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax seamlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers a fantastic eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without unnecessary delays. Manage Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax on any platform using airSlate SignNow Android or iOS applications and streamline any document-centered task today.

How to alter and eSign Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax effortlessly

- Obtain Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax and click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax and ensure flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13 9 application for credit or refund of state and local sales or use tax

Create this form in 5 minutes!

How to create an eSignature for the form 13 9 application for credit or refund of state and local sales or use tax

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an e-signature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an e-signature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What is the Oklahoma Form 13 9?

The Oklahoma Form 13 9 is a specific document used for legal purposes in Oklahoma. It is important for businesses to understand how to properly fill out and submit this form to ensure compliance. airSlate SignNow offers an easy-to-use platform to eSign and manage the Oklahoma Form 13 9 efficiently.

-

How does airSlate SignNow simplify the Oklahoma Form 13 9 process?

airSlate SignNow streamlines the completion and submission of the Oklahoma Form 13 9 by allowing users to fill out, sign, and send the document electronically. This eliminates the need for physical paperwork and reduces processing time. Our platform is designed to enhance efficiency and ensure accuracy in your documentation.

-

Is there a cost associated with using airSlate SignNow for the Oklahoma Form 13 9?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, allowing you to choose the most cost-effective solution for managing your Oklahoma Form 13 9. Our pricing is competitive and reflects the value of the features and integrations we provide. By choosing airSlate SignNow, you invest in a solution that saves both time and money.

-

What features does airSlate SignNow offer for the Oklahoma Form 13 9?

airSlate SignNow includes features such as document templates, custom workflows, and automated reminders specifically for the Oklahoma Form 13 9. These tools enable efficient management and tracking of document statuses. The platform also supports secure cloud storage, ensuring your documents are protected and easily accessible.

-

Can I integrate airSlate SignNow with other applications for handling the Oklahoma Form 13 9?

Absolutely! airSlate SignNow seamlessly integrates with various applications including CRM systems, cloud storage services, and project management tools. This allows users to centralize their workflows around the Oklahoma Form 13 9 and reduce the time spent on administrative tasks. Integrations make it easier to manage your documents in a way that fits your existing processes.

-

What are the benefits of using airSlate SignNow for the Oklahoma Form 13 9?

Using airSlate SignNow for the Oklahoma Form 13 9 offers multiple benefits including increased accuracy, reduced turnaround time, and enhanced collaboration among team members. The platform’s user-friendly interface ensures that everyone can easily navigate and utilize the necessary features. Additionally, electronic signing enhances the security and efficiency of document transactions.

-

How secure is my information when using airSlate SignNow for the Oklahoma Form 13 9?

Security is a top priority at airSlate SignNow. When you use our platform for the Oklahoma Form 13 9, your information is protected through advanced encryption and secure cloud storage. We adhere to industry standards to ensure that your documents remain safe during the entire signing and storing process.

Get more for Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

- Warning of default on residential lease new jersey form

- Landlord tenant closing statement to reconcile security deposit new jersey form

- Name change notification package for brides court ordered name change divorced marriage for new jersey new jersey form

- Name change notification form new jersey

- Commercial building or space lease new jersey form

- Nj legal documents 497319364 form

- New jersey standby temporary guardian legal documents package new jersey form

- New jersey bankruptcy guide and forms package for chapters 7 or 13 new jersey

Find out other Form 13 9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple