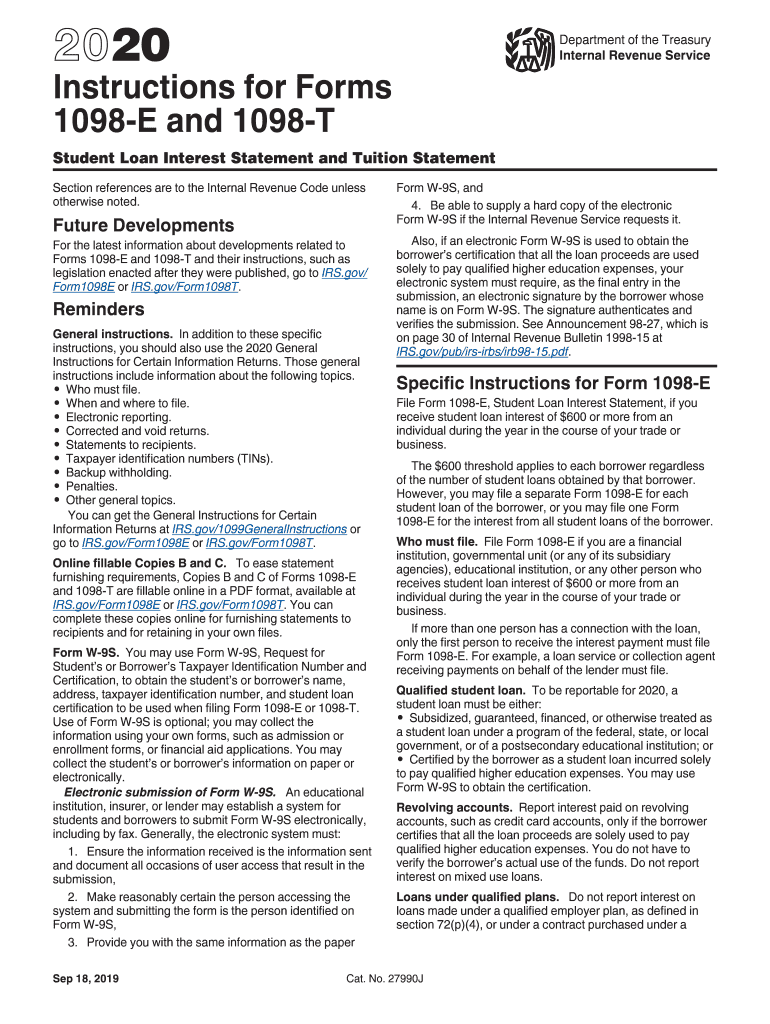

Internal Revenue Service Instructions for Forms Page 1 of 2020

Key elements of the 1098-T form

The 1098-T form is essential for students and educational institutions in the United States. It serves to report tuition payments and related educational expenses to the Internal Revenue Service (IRS). The key elements of the 1098-T include:

- Student Information: This section contains the student's name, address, and taxpayer identification number (TIN).

- Institution Information: The name, address, and TIN of the educational institution are provided here.

- Qualified Tuition and Related Expenses: This includes the amounts billed for qualified tuition and fees, which may be eligible for education credits.

- Scholarships and Grants: Any scholarships or grants received by the student during the tax year are reported in this section.

- Box 1 and Box 2: Box 1 shows the amount paid for qualified tuition and related expenses, while Box 2 indicates the amount billed for these expenses.

Steps to complete the 1098-T form

Completing the 1098-T form requires careful attention to detail to ensure accurate reporting. Here are the steps to follow:

- Gather Required Information: Collect all necessary documents, including tuition payment receipts, scholarship information, and personal identification details.

- Fill Out Student Information: Enter the student's name, address, and TIN accurately in the designated fields.

- Provide Institution Details: Input the educational institution's name, address, and TIN correctly.

- Report Qualified Expenses: Enter the total qualified tuition and related expenses in Box 1 or Box 2, depending on the method of reporting.

- Include Scholarships and Grants: Report any scholarships or grants received in the appropriate section of the form.

- Review and Submit: Double-check all entries for accuracy before submitting the form to the IRS.

IRS Guidelines for the 1098-T form

The IRS provides specific guidelines regarding the completion and submission of the 1098-T form. Key points include:

- Eligibility: The form must be issued to students enrolled in eligible educational institutions who have paid qualified tuition and fees.

- Filing Requirements: Educational institutions are required to file the 1098-T form with the IRS and provide a copy to the student.

- Deadlines: The form must be filed by the last day of February if submitted by paper or by March 31 if filed electronically.

- Corrections: If errors are found after submission, institutions must file a corrected form to rectify the information.

Filing deadlines for the 1098-T form

Understanding the filing deadlines for the 1098-T form is crucial for compliance. The important dates include:

- January 31: Deadline for educational institutions to provide the 1098-T form to students.

- February 28: Deadline for paper filing of the form with the IRS.

- March 31: Deadline for electronic filing of the form with the IRS.

Required documents for the 1098-T form

To accurately complete the 1098-T form, certain documents are necessary. These include:

- Tuition Payment Receipts: Proof of payments made for qualified tuition and related expenses.

- Scholarship Documentation: Records of any scholarships or grants awarded to the student.

- Personal Identification: The student's Social Security number or TIN for accurate reporting.

Legal use of the 1098-T form

The 1098-T form has legal implications for both students and educational institutions. It is crucial to understand its use:

- Tax Credits: The information on the 1098-T can help students qualify for education-related tax credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

- Record Keeping: Both students and institutions must keep copies of the 1098-T form for their records, as it may be required for future tax filings or audits.

- Compliance: Accurate completion and timely submission of the form are necessary to avoid penalties from the IRS.

Quick guide on how to complete internal revenue service instructions for forms page 1 of

Prepare Internal Revenue Service Instructions For Forms Page 1 Of effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the suitable form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Internal Revenue Service Instructions For Forms Page 1 Of on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Internal Revenue Service Instructions For Forms Page 1 Of with ease

- Find Internal Revenue Service Instructions For Forms Page 1 Of and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Internal Revenue Service Instructions For Forms Page 1 Of to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service instructions for forms page 1 of

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service instructions for forms page 1 of

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What are the basic 1098 T instructions for filling out the form?

The 1098 T instructions detail how to accurately fill in your form to report qualified tuition and related expenses. You'll need to include your personal information, the amount of payments received, and any adjustments from previous years. Following these instructions helps ensure that you maximize your education tax credits.

-

How can airSlate SignNow help with 1098 T instructions?

airSlate SignNow offers a user-friendly solution that streamlines the process of eSigning and sending necessary documents, including those related to 1098 T instructions. With our platform, you can easily manage and share your forms securely, ensuring you adhere to guidelines while saving time.

-

Are there costs associated with using airSlate SignNow for 1098 T instructions?

Using airSlate SignNow is cost-effective, with various pricing plans tailored for different business needs. You can choose from monthly or yearly subscriptions, making it easy to align your budget for managing 1098 T instructions and other document workflows.

-

What features does airSlate SignNow offer to assist with 1098 T instructions?

airSlate SignNow provides features such as customizable templates, easy eSignature integration, and document tracking that can simplify handling your 1098 T instructions. These tools help you efficiently manage your documentation while ensuring compliance with federal requirements.

-

How do I ensure compliance while using 1098 T instructions with airSlate SignNow?

To ensure compliance when using 1098 T instructions with airSlate SignNow, utilize our template library that adheres to IRS standards. Additionally, our platform allows you to store and manage your documents securely, safeguarding sensitive information while remaining within regulatory guidelines.

-

Can I easily integrate airSlate SignNow with other platforms for handling 1098 T instructions?

Yes, airSlate SignNow seamlessly integrates with various business applications, allowing you to manage your 1098 T instructions in conjunction with your existing systems. This interoperability enhances your workflow efficiency and ensures all related documents are easily accessible.

-

What are the benefits of using airSlate SignNow for my 1098 T instructions?

Using airSlate SignNow for your 1098 T instructions provides numerous benefits, including increased efficiency in document processing and enhanced security for personal information. Our platform's ease of use means you can focus more on your finances and less on paperwork.

Get more for Internal Revenue Service Instructions For Forms Page 1 Of

- Commercial lease assignment from tenant to new tenant west virginia form

- Tenant consent to background and reference check west virginia form

- Residential lease or rental agreement for month to month west virginia form

- Residential rental lease agreement west virginia form

- Tenant welcome letter west virginia form

- Warning of default on commercial lease west virginia form

- Warning of default on residential lease west virginia form

- Landlord tenant closing statement to reconcile security deposit west virginia form

Find out other Internal Revenue Service Instructions For Forms Page 1 Of

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online