Nebraska Schedule Ii 2020

What is the Nebraska Schedule II?

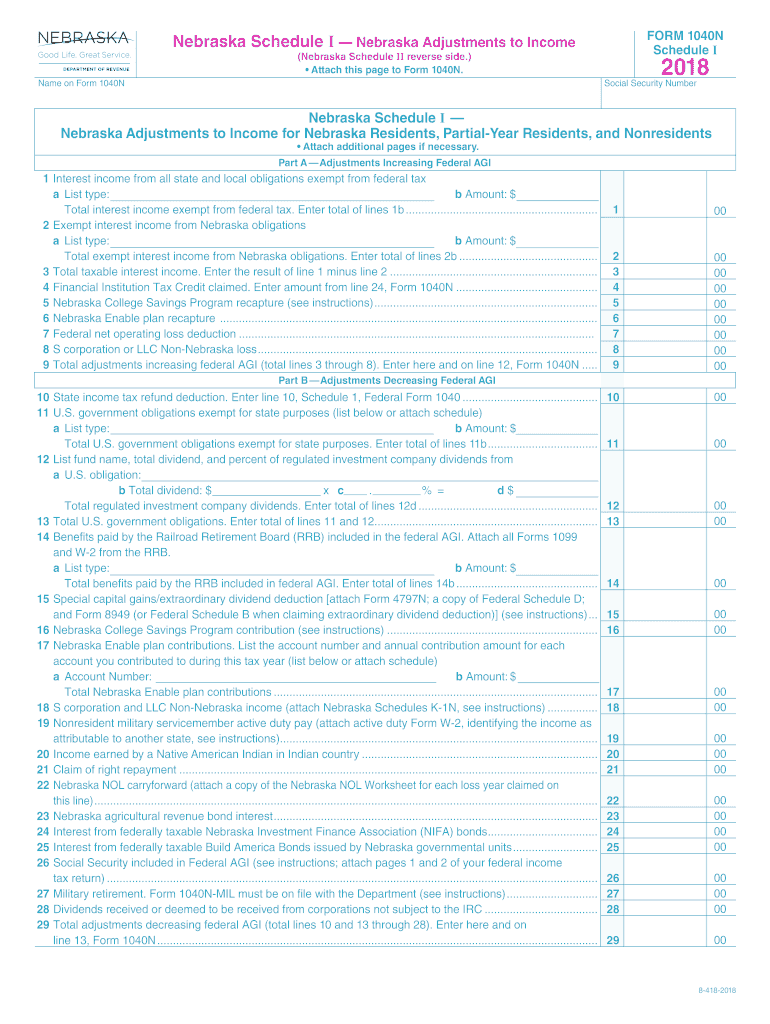

The Nebraska Schedule II is a tax form used by residents of Nebraska to report certain types of income, deductions, and credits. This form is part of the Nebraska individual income tax return process. It is specifically designed to capture adjustments to income that may not be included on the standard Form 1040N. Understanding the purpose of Schedule II is essential for accurate tax reporting and compliance with state tax laws.

Steps to Complete the Nebraska Schedule II

Completing the Nebraska Schedule II involves several key steps:

- Gather Required Information: Collect all necessary documentation, including income statements, deduction records, and any relevant tax credits.

- Fill Out Personal Information: Enter your name, address, and Social Security number at the top of the form.

- Report Income Adjustments: Carefully list any adjustments to your income on the appropriate lines of the form. This may include adjustments for retirement contributions, student loan interest, or other specific deductions.

- Calculate Total Adjustments: Sum all adjustments to determine your total income adjustment, which will affect your overall tax liability.

- Review and Sign: Double-check all entries for accuracy before signing and dating the form.

Legal Use of the Nebraska Schedule II

The Nebraska Schedule II must be completed accurately to ensure compliance with state tax regulations. Failure to provide accurate information may result in penalties or delays in processing your tax return. It is essential to follow all guidelines provided by the Nebraska Department of Revenue to maintain the legal validity of the form. Additionally, electronic submission of the form through approved e-filing systems is legally recognized.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines for the Nebraska Schedule II to avoid penalties. Generally, the deadline for filing individual income tax returns, including Schedule II, is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes in deadlines each tax year.

Required Documents

To complete the Nebraska Schedule II, you will need several documents, including:

- W-2 forms from employers showing wages and tax withheld

- 1099 forms for any additional income

- Records of deductible expenses, such as medical expenses or mortgage interest

- Documentation for any tax credits you intend to claim

Form Submission Methods

The Nebraska Schedule II can be submitted in several ways:

- Online: E-filing through approved tax software platforms is a convenient option for many taxpayers.

- By Mail: Completed forms can be mailed to the Nebraska Department of Revenue at the address specified in the form instructions.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state tax offices.

Quick guide on how to complete nebraska schedule ii

Complete Nebraska Schedule Ii effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly and efficiently. Handle Nebraska Schedule Ii on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to adjust and eSign Nebraska Schedule Ii with ease

- Find Nebraska Schedule Ii and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow addresses your requirements in document management with just a few clicks from any device of your preference. Modify and eSign Nebraska Schedule Ii and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska schedule ii

Create this form in 5 minutes!

How to create an eSignature for the nebraska schedule ii

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What are the nebr 1040n schedule 1 line 29 instructions?

The nebr 1040n schedule 1 line 29 instructions provide detailed guidelines on how to complete and file the Nebraska state tax forms properly. This includes information on what qualifies for deductions and the necessary calculations to ensure compliance with Nebraska tax laws.

-

How can I access the nebr 1040n schedule 1 line 29 instructions?

You can access the nebr 1040n schedule 1 line 29 instructions through the Nebraska Department of Revenue's official website or by consulting tax preparation software that includes state tax forms. This ensures you have the most up-to-date and accurate guidelines available for your filings.

-

What features does airSlate SignNow offer for handling the nebr 1040n schedule 1 line 29?

airSlate SignNow offers a user-friendly platform that allows you to easily fill, eSign, and send the nebr 1040n schedule 1 line 29 and other tax documents securely. Its features include template saving, document tracking, and integration with various applications to streamline tax filing processes.

-

Is there a cost associated with using airSlate SignNow for nebr 1040n schedule 1 line 29 forms?

Yes, airSlate SignNow offers various pricing plans tailored to businesses that need to manage documents, including tax forms like the nebr 1040n schedule 1 line 29. We provide a cost-effective solution that scales with your business needs, ensuring you get the best value for your investment.

-

What are the benefits of using airSlate SignNow for tax documents like the nebr 1040n schedule 1 line 29?

Using airSlate SignNow for your tax documents, including the nebr 1040n schedule 1 line 29, provides several benefits, such as enhanced security, easy document sharing, and faster signing processes. This helps you complete your tax filings more efficiently and with reduced risk of errors.

-

Can I integrate airSlate SignNow with other software for filing nebr 1040n schedule 1 line 29 forms?

Yes, airSlate SignNow seamlessly integrates with a variety of software applications, allowing for efficient document management when completing the nebr 1040n schedule 1 line 29 forms. This integration enhances your workflow by connecting your existing tools and data in one streamlined platform.

-

How do I eSign the nebr 1040n schedule 1 line 29 with airSlate SignNow?

To eSign the nebr 1040n schedule 1 line 29 with airSlate SignNow, simply upload your document, customize the signing fields, and send it out for signature. Recipients can sign from any device, making the process quick and flexible while ensuring your signed documents are securely stored.

Get more for Nebraska Schedule Ii

Find out other Nebraska Schedule Ii

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure