T1159 2019-2026

What is the T1159?

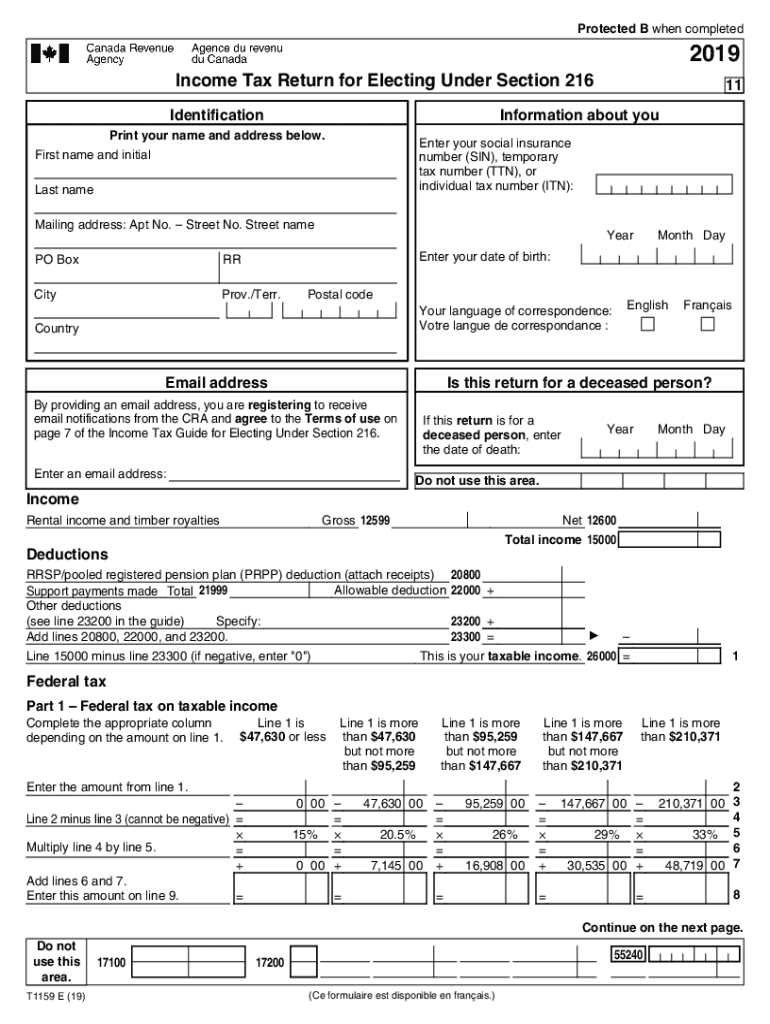

The T1159, also known as the T1159 CRA form, is a tax document used by non-residents of Canada to report income earned in Canada. This form is specifically designed for individuals who are electing under Section 216 of the Income Tax Act, allowing them to file an income tax return for rental income or other sources of income from Canadian properties. The T1159 ensures that the income is reported accurately and that the appropriate taxes are calculated based on Canadian tax laws.

How to use the T1159

Using the T1159 involves several steps to ensure accurate reporting of income. First, gather all relevant financial information, including income earned from Canadian sources. Next, complete the T1159 by providing personal details, income figures, and any applicable deductions. It is essential to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form must be submitted to the Canada Revenue Agency (CRA) for processing.

Steps to complete the T1159

Completing the T1159 requires attention to detail. Follow these steps:

- Obtain the T1159 form from the CRA website or authorized sources.

- Fill in your personal information, including your name, address, and identification number.

- Report your total income from Canadian sources, including rental income.

- Calculate any allowable deductions and credits that apply to your situation.

- Review the completed form for accuracy before submission.

Legal use of the T1159

The T1159 is legally binding when completed and submitted according to the guidelines set by the CRA. To ensure compliance, it is crucial to adhere to the legal requirements surrounding eSignatures and electronic submissions. The form must be signed by the taxpayer or authorized representative, affirming that the information provided is accurate and complete. Failure to comply with these requirements may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the T1159 is essential to avoid penalties. The deadline for submitting the T1159 typically aligns with the tax year-end for non-residents. For most taxpayers, this means filing by April 30 of the following year. However, if you are self-employed or have specific circumstances, different deadlines may apply. Always check the CRA's official guidelines for the most current deadlines to ensure compliance.

Required Documents

When completing the T1159, you will need to gather certain documents to support your income claims and deductions. These may include:

- Proof of income earned in Canada, such as rental agreements or pay stubs.

- Records of any expenses related to the income, such as maintenance costs or property taxes.

- Identification documents, including your Social Insurance Number (SIN) or Individual Tax Number (ITN).

Eligibility Criteria

To be eligible to file the T1159, you must meet specific criteria. Generally, this form is for non-residents who earn income from Canadian sources, such as rental properties or business activities. Additionally, you must have a valid identification number and be compliant with Canadian tax laws. Understanding these criteria helps ensure that you are correctly filing your taxes and meeting all legal obligations.

Quick guide on how to complete t1159

Prepare T1159 effortlessly on any gadget

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow supplies you with all the tools you require to create, amend, and eSign your documents promptly without interruptions. Manage T1159 on any gadget using airSlate SignNow’s Android or iOS applications and streamline any document-based task today.

How to amend and eSign T1159 effortlessly

- Find T1159 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign T1159 and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1159

Create this form in 5 minutes!

How to create an eSignature for the t1159

The best way to make an electronic signature for a PDF document in the online mode

The best way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is t1159e in the context of digital signing?

The t1159e is a specific document type relevant to businesses that require secure electronic signing. With airSlate SignNow, you can effortlessly eSign t1159e documents, ensuring compliance and authenticity in your transactions. Our platform simplifies the entire signing process, making it ideal for businesses of all sizes.

-

How does airSlate SignNow handle the secure signing of t1159e documents?

airSlate SignNow utilizes advanced encryption and secure access protocols to protect t1159e documents during the eSigning process. This means you can trust that your sensitive information remains confidential and secure. Our platform not only enhances security but also provides an audit trail for each signed document.

-

What features does airSlate SignNow offer for managing t1159e documents?

airSlate SignNow offers a range of features for managing t1159e documents, including customizable templates, cloud storage, and real-time tracking. These tools streamline your workflow, allowing you to send, sign, and store t1159e documents efficiently. Integration with other business applications further enhances the document management process.

-

Can I integrate airSlate SignNow with my existing systems for t1159e document management?

Yes, airSlate SignNow easily integrates with various applications and systems for smooth t1159e document management. Whether you use CRMs, LMS, or other software solutions, our platform supports seamless integration to enhance your workflow. This connectivity ensures that handling t1159e documents is a cohesive part of your business operations.

-

What is the pricing structure for using airSlate SignNow for t1159e documents?

airSlate SignNow offers competitive pricing plans tailored for businesses needing to manage t1159e documents efficiently. We provide various subscription options, including monthly and annual plans, which deliver excellent value for the features included. You can start with a free trial to explore how our solution meets your specific needs.

-

What are the benefits of using airSlate SignNow for t1159e document signing?

Using airSlate SignNow for t1159e document signing offers numerous benefits, including speed, convenience, and legal compliance. Our platform streamlines the signing process, reducing turnaround time signNowly. Additionally, electronic signatures through airSlate SignNow are legally binding, ensuring that your t1159e agreements are recognized in court.

-

Is customer support available for users of airSlate SignNow dealing with t1159e documents?

Absolutely! airSlate SignNow provides excellent customer support for all users, including those managing t1159e documents. Our knowledgeable support team is available via chat, email, and phone to assist with any inquiries or issues you may encounter. We ensure that you have the resources and support needed for a seamless experience.

Get more for T1159

- Child benefit claim form

- Schritte international neu a1 1 pdf download form

- Ontario drivers license renewal form

- Colour blindness certificate online form

- Cghs addition form

- Stopr courtesy seating form

- Alarm company operator and alarm company operator qualified manager form

- Ucc financing statement form ucc3ap iaca

Find out other T1159

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement