Form it 2105 9 Underpayment of Estimated Income Tax by Individuals and Fiduciaries Tax Year 2020

Understanding Form IT 2105 9 for Underpayment of Estimated Income Tax

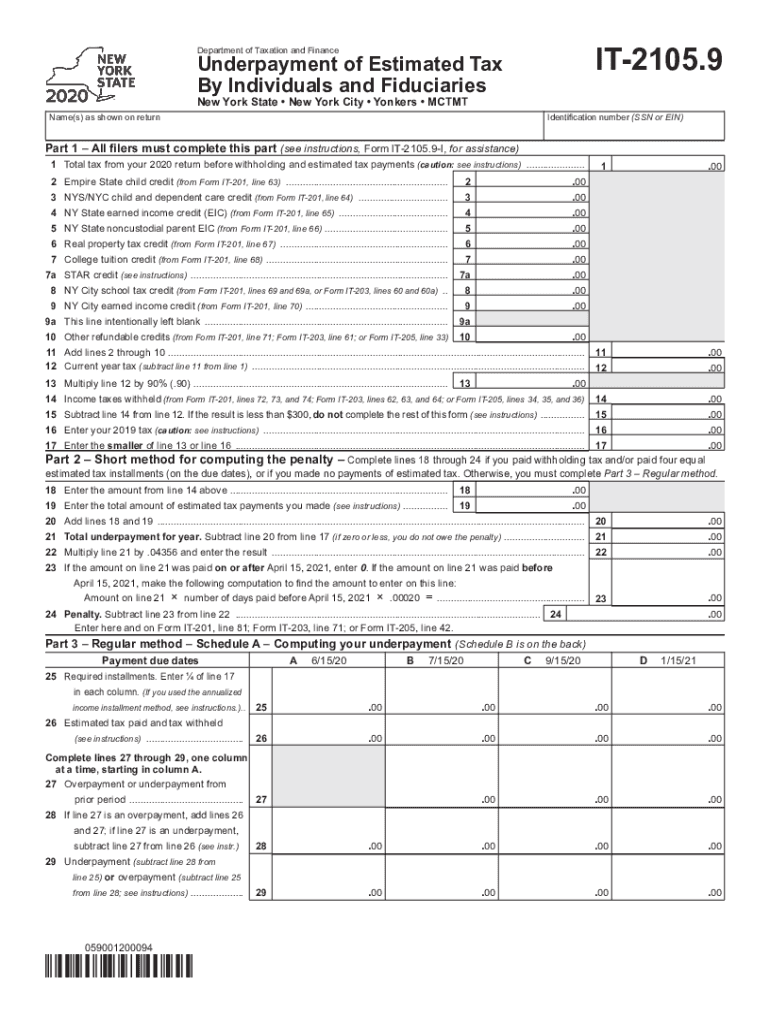

The Form IT 2105 9 is utilized by individuals and fiduciaries in New York to report underpayment of estimated income tax for a specific tax year. This form is essential for taxpayers who may not have paid enough tax throughout the year, ensuring compliance with state tax regulations. It helps to calculate any penalties due to underpayment, allowing taxpayers to rectify their tax obligations effectively.

Steps to Complete Form IT 2105 9

Completing Form IT 2105 9 involves several key steps to ensure accuracy and compliance:

- Gather necessary financial documents, including income statements and previous tax returns.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have already paid through withholding or estimated payments.

- Use the form's instructions to calculate any underpayment and the associated penalty.

- Review the completed form for accuracy before submission.

Obtaining Form IT 2105 9

Taxpayers can obtain Form IT 2105 9 through the New York State Department of Taxation and Finance website. It is available for download in PDF format, making it easy to access and print. Additionally, physical copies may be available at local tax offices or through tax professionals.

Legal Use of Form IT 2105 9

The legal use of Form IT 2105 9 is critical for ensuring compliance with New York tax laws. Filing this form correctly can prevent penalties and interest charges for underpayment. It is important to follow the guidelines set forth by the New York State Department of Taxation and Finance to maintain legal standing and avoid disputes.

Filing Deadlines for Form IT 2105 9

Timely filing of Form IT 2105 9 is crucial to avoid penalties. The form must be submitted by the designated deadline, which typically aligns with the annual tax filing dates. Taxpayers should consult the New York State Department of Taxation and Finance for the specific deadlines relevant to the current tax year.

Penalties for Non-Compliance with Form IT 2105 9

Failure to file Form IT 2105 9 or to pay the required estimated taxes can result in significant penalties. These may include interest on the unpaid tax amount and additional fines for late filing. Understanding these penalties emphasizes the importance of accurate and timely submissions.

Quick guide on how to complete form it 21059 underpayment of estimated income tax by individuals and fiduciaries tax year 2020

Complete Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents quickly without interruptions. Manage Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

The easiest method to alter and electronically sign Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year with ease

- Locate Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year and click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or hide sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 21059 underpayment of estimated income tax by individuals and fiduciaries tax year 2020

Create this form in 5 minutes!

How to create an eSignature for the form it 21059 underpayment of estimated income tax by individuals and fiduciaries tax year 2020

The best way to create an eSignature for a PDF file online

The best way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is airSlate SignNow and how does it relate to new york 2105 9?

airSlate SignNow is a user-friendly eSignature solution that allows businesses in New York 2105 9 to efficiently send and sign documents online. It streamlines the signing process, making it easy for users to manage their documentation needs quickly.

-

How much does airSlate SignNow cost for users in new york 2105 9?

The pricing for airSlate SignNow in New York 2105 9 is competitive and varies depending on the plan chosen. Businesses can select from various subscription levels, ensuring they find a cost-effective solution that fits their needs.

-

What features does airSlate SignNow offer in new york 2105 9?

In New York 2105 9, airSlate SignNow offers features such as customizable templates, advanced security options, and real-time tracking of document status. These features enhance the signing experience and protect the integrity of your documents.

-

How can airSlate SignNow benefit my business in new york 2105 9?

Using airSlate SignNow can signNowly improve your business operations in New York 2105 9 by saving time and reducing paperwork. The platform allows for faster transactions and improves customer experience with its efficient eSigning process.

-

Can airSlate SignNow integrate with other applications for businesses in new york 2105 9?

Yes, airSlate SignNow seamlessly integrates with various applications commonly used by businesses in New York 2105 9. This includes CRM systems and cloud storage solutions, ensuring that you can continue using your preferred tools without disruption.

-

Is airSlate SignNow secure for signing documents in new york 2105 9?

Absolutely! airSlate SignNow prioritizes security and complies with eSignature regulations, ensuring that all documents signed in New York 2105 9 are protected. The platform uses advanced encryption and authentication features to safeguard your data.

-

What types of documents can be signed with airSlate SignNow in new york 2105 9?

In New York 2105 9, airSlate SignNow supports a variety of document types, including contracts, agreements, and forms. This flexibility allows businesses to manage all their signing needs in one centralized location.

Get more for Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

Find out other Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template