Form it 2105 9 Underpayment of Estimated Income Tax by Individuals and Fiduciaries Tax Year 2024-2026

Overview of Form IT 2105 9: Underpayment of Estimated Income Tax

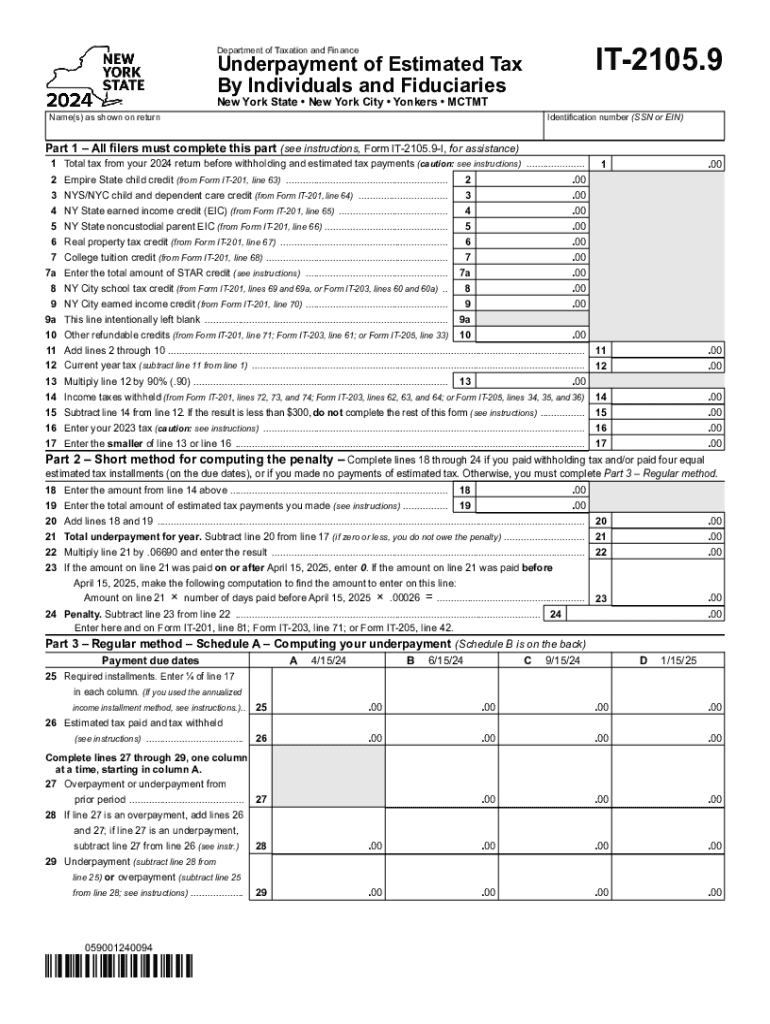

The Form IT 2105 9 is utilized by individuals and fiduciaries in the United States to report underpayment of estimated income tax. This form is essential for taxpayers who have not met their estimated tax payment obligations throughout the tax year. Understanding this form is crucial for ensuring compliance with tax regulations and avoiding penalties.

How to Complete Form IT 2105 9

Completing Form IT 2105 9 involves several steps. First, gather necessary financial documents, including income statements and previous tax returns. Next, calculate the total estimated tax liability for the year. Then, determine any payments made towards estimated taxes. Finally, fill out the form by entering the required information, including your personal details and tax calculations. Ensure all figures are accurate to avoid issues with the IRS.

Obtaining Form IT 2105 9

Form IT 2105 9 can be obtained through the official state tax website or by contacting the state tax office directly. It is also available in various tax preparation software, which can simplify the process of filling out the form. Ensure you have the latest version of the form to comply with current tax laws.

Filing Deadlines for Form IT 2105 9

Filing deadlines for Form IT 2105 9 are typically aligned with the federal tax deadlines. Generally, the form must be submitted by the same date as your income tax return. It is important to be aware of these deadlines to avoid late fees and penalties. Keeping track of state-specific deadlines is also essential, as they may vary.

Penalties for Non-Compliance

Failure to file Form IT 2105 9 or underpayment of estimated taxes can result in significant penalties. The IRS may impose fines based on the amount of underpayment and the duration of the non-compliance. Understanding these penalties can motivate timely and accurate filing, helping to avoid unnecessary financial burdens.

Examples of Using Form IT 2105 9

Form IT 2105 9 is commonly used by various taxpayers, including self-employed individuals and fiduciaries managing estates. For instance, a self-employed person who has not made sufficient estimated tax payments throughout the year would use this form to report their underpayment. Similarly, fiduciaries handling trust income may need to file this form if they fail to meet estimated tax obligations.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 9 underpayment of estimated income tax by individuals and fiduciaries tax year 772083497

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 9 underpayment of estimated income tax by individuals and fiduciaries tax year 772083497

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2105 9 feature in airSlate SignNow?

The it 2105 9 feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling users to send, sign, and manage documents electronically, reducing the need for physical paperwork.

-

How does airSlate SignNow pricing work for it 2105 9?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including the it 2105 9 feature. Users can choose from monthly or annual subscriptions, ensuring they only pay for the features they need, including advanced eSigning capabilities.

-

What are the benefits of using it 2105 9 with airSlate SignNow?

Using the it 2105 9 feature with airSlate SignNow provides numerous benefits, such as increased productivity and reduced turnaround times for document signing. It also enhances security and compliance, ensuring that all signed documents are legally binding and stored safely.

-

Can I integrate it 2105 9 with other applications?

Yes, airSlate SignNow allows seamless integration of the it 2105 9 feature with various applications, including CRM and project management tools. This integration helps businesses automate workflows and improve overall efficiency in document handling.

-

Is it 2105 9 suitable for small businesses?

Absolutely! The it 2105 9 feature in airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. It helps them manage their document signing processes without the need for extensive resources or technical expertise.

-

What types of documents can I sign using it 2105 9?

With the it 2105 9 feature in airSlate SignNow, you can sign a wide variety of documents, including contracts, agreements, and forms. This versatility makes it a valuable tool for businesses across different industries.

-

How secure is the it 2105 9 feature in airSlate SignNow?

The it 2105 9 feature is built with robust security measures to protect your documents and data. airSlate SignNow employs encryption and secure storage protocols, ensuring that all signed documents are safe and compliant with industry standards.

Get more for Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

- Completed warranty deed sample form

- Starkey encased form

- Confirmation sponsor certificate 382562203 form

- Disability insurance claim form companion life

- Subcontractor letter of commitment form

- Dol ncfll grievance form

- Pt 020b application for exemption schedule b property tax division propertytax utah form

- It proposal contract template form

Find out other Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document