PDF Form it 2105 9 Underpayment of Estimated Income Tax by 2021

What is the PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

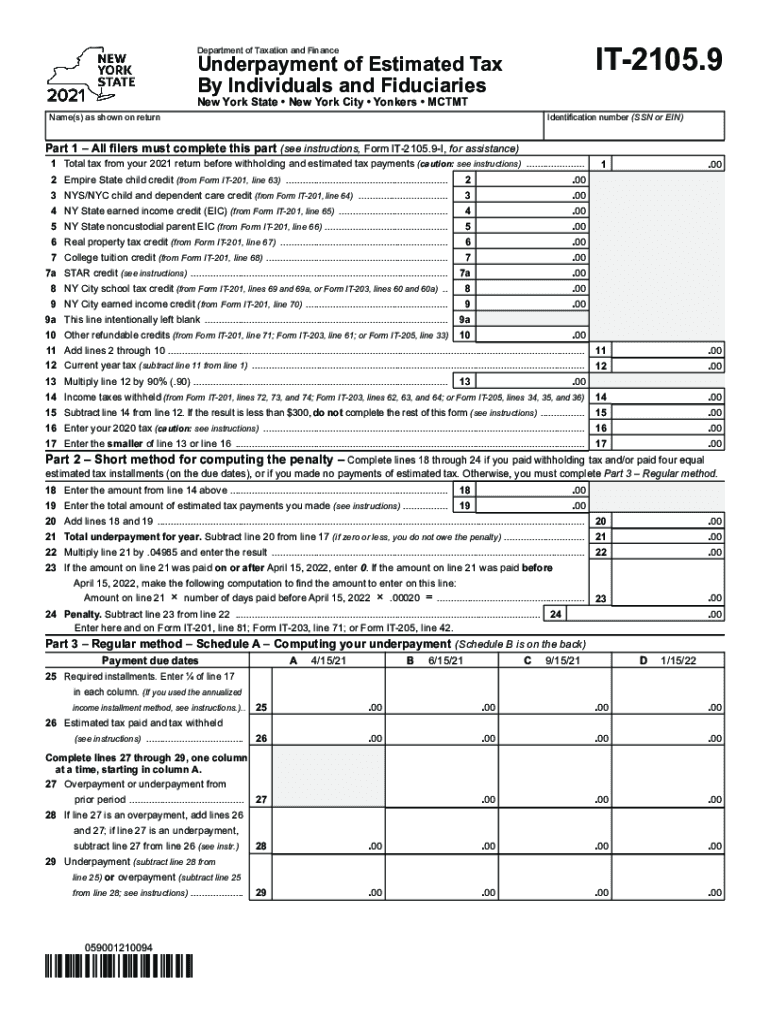

The IT 2105 9 form is a tax document used in New York State for reporting underpayment of estimated income tax. Taxpayers who do not pay enough estimated tax throughout the year may need to file this form to calculate any penalties owed. This form specifically addresses situations where the total estimated tax payments made are less than the required amount, which can occur due to changes in income, deductions, or tax credits.

How to use the PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

To use the IT 2105 9 form, taxpayers should first gather their income information for the year, including wages, self-employment income, and any other taxable income. Next, they should calculate the total estimated tax payments made during the year. The form will guide users through the process of determining if they have underpaid their estimated taxes and the amount of any potential penalty. It is essential to follow the instructions carefully to ensure accurate reporting and compliance with state tax laws.

Steps to complete the PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

Completing the IT 2105 9 involves several key steps:

- Gather necessary documents, including income statements and previous estimated tax payments.

- Fill out personal information, such as name, address, and Social Security number.

- Calculate total income and applicable deductions to determine the tax liability.

- Compare the total estimated tax payments made against the required amount.

- Complete the penalty calculation section to determine any penalties owed.

- Review the form for accuracy before submission.

Legal use of the PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

The IT 2105 9 form is legally recognized in New York State as a valid method for reporting underpayment of estimated income tax. When completed correctly, it serves as an official record for both the taxpayer and the state tax authority. Adhering to the guidelines set forth by the New York State Department of Taxation and Finance ensures that the form is used appropriately and that any penalties calculated are legally enforceable.

Filing Deadlines / Important Dates

Taxpayers must be aware of specific deadlines when filing the IT 2105 9 form. Generally, the form should be submitted by the tax deadline for the year in which the underpayment occurred. For most individuals, this is typically April 15 of the following year. It is crucial to check for any changes in deadlines or extensions that may apply, especially for those who may be affected by natural disasters or other unforeseen circumstances.

Penalties for Non-Compliance

Failure to file the IT 2105 9 form or underpayment of estimated taxes can result in penalties imposed by the New York State Department of Taxation and Finance. These penalties can accumulate over time and may include interest on the unpaid amount. It is essential for taxpayers to understand the implications of non-compliance and to take proactive steps to avoid these penalties by accurately completing and submitting the form on time.

Quick guide on how to complete pdf form it 21059 underpayment of estimated income tax by

Effortlessly Complete PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By on Any Device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without interruptions. Manage PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By on any device using the airSlate SignNow apps available for Android or iOS and streamline any document-based task today.

Steps to Modify and eSign PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By with Ease

- Locate PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By and click Get Form to proceed.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your chosen device. Edit and eSign PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By to guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pdf form it 21059 underpayment of estimated income tax by

Create this form in 5 minutes!

How to create an eSignature for the pdf form it 21059 underpayment of estimated income tax by

The way to make an e-signature for a PDF document online

The way to make an e-signature for a PDF document in Google Chrome

The way to generate an e-signature for signing PDFs in Gmail

The way to make an electronic signature right from your smart phone

The way to make an e-signature for a PDF document on iOS

The way to make an electronic signature for a PDF on Android OS

People also ask

-

What is IT2105 and how does it relate to airSlate SignNow?

IT2105 is a guide for businesses looking to streamline their document production and signing processes. By integrating IT2105 with airSlate SignNow, users can enhance their workflow efficiency by utilizing eSignatures for quick and secure document approvals.

-

What features does airSlate SignNow offer for IT2105 users?

AirSlate SignNow provides a rich set of features for IT2105 users including customizable templates, mobile access, and real-time tracking. These features ensure that businesses can manage their documents effectively while complying with IT2105 guidelines.

-

How much does it cost to use airSlate SignNow for IT2105-related services?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. By adopting airSlate SignNow for your IT2105 documentation processes, you can benefit from a cost-effective solution that scales as your business grows.

-

Can airSlate SignNow integrate with other tools under IT2105?

Yes, airSlate SignNow supports integrations with various applications commonly used in conjunction with IT2105. By integrating with tools such as CRM systems and document management software, you can enhance collaboration and document handling.

-

What are the benefits of using airSlate SignNow for IT2105 documentation?

Using airSlate SignNow for IT2105 documentation allows businesses to expedite the signing process while ensuring security and compliance. The platform's electronic signature capabilities enable faster approvals and eliminate the hassle of managing paper documents.

-

Is it secure to use airSlate SignNow for IT2105 compliance?

Absolutely! AirSlate SignNow prioritizes security and compliance, making it a trusted choice for IT2105 requirements. The platform employs advanced encryption and security protocols to protect sensitive information.

-

How easy is it to get started with airSlate SignNow for IT2105?

Getting started with airSlate SignNow for IT2105 is straightforward and user-friendly. With a simple onboarding process and extensive resources, businesses can quickly adapt to the platform and begin managing their documents more effectively.

Get more for PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

Find out other PDF Form IT 2105 9 Underpayment Of Estimated Income Tax By

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile