Form it 2105 9 Underpayment of Estimated Income Tax by Individuals and Fiduciaries Tax Year 2023

What is the Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

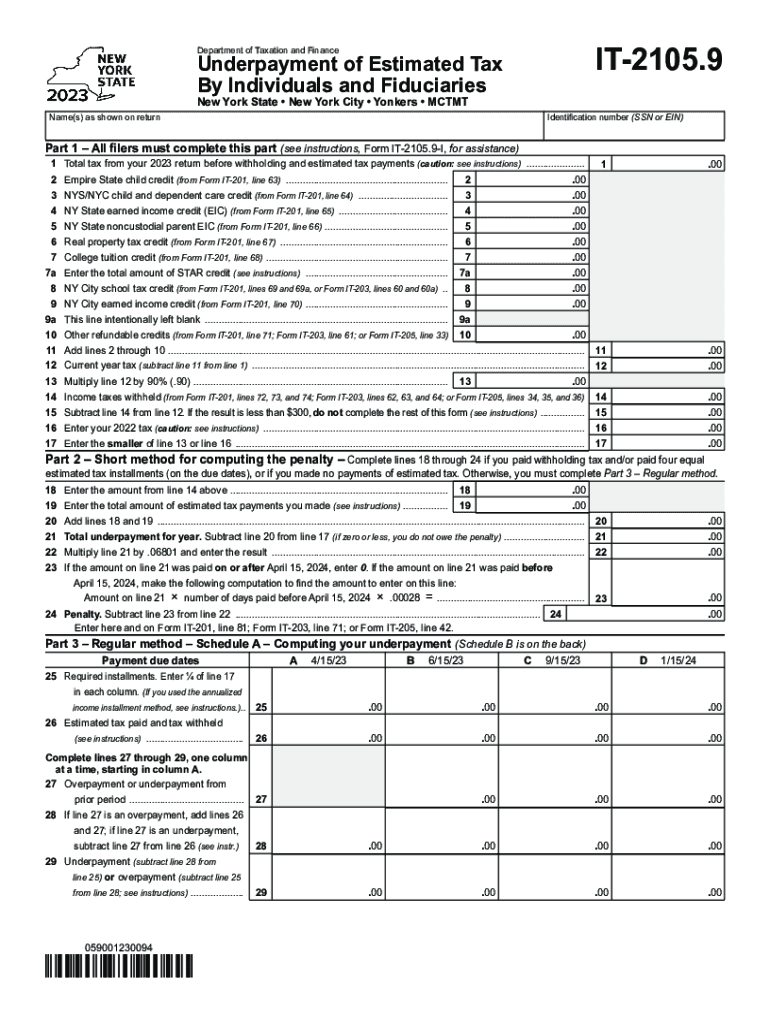

The Form IT 2105 9 is a crucial document for individuals and fiduciaries in New York who may have underpaid their estimated income tax for the tax year. This form is specifically designed to report any underpayment of estimated income tax and to calculate the penalty for such underpayment. Understanding this form is essential for ensuring compliance with state tax regulations and avoiding unnecessary penalties.

Steps to complete the Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

Completing the Form IT 2105 9 involves several key steps:

- Gather your financial information, including income, deductions, and credits for the tax year.

- Calculate your total estimated tax liability for the year.

- Determine the amount of tax you have already paid through withholding and estimated payments.

- Compare your total estimated tax liability with the amount paid to identify any underpayment.

- Fill out the form accurately, providing all required details, including your name, address, and Social Security number.

- Calculate the penalty for underpayment, if applicable, using the instructions provided with the form.

- Review the completed form for accuracy before submission.

Legal use of the Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

The legal use of the Form IT 2105 9 is to ensure that taxpayers comply with New York State tax laws regarding estimated income tax payments. This form is used to report any underpayment and to calculate penalties associated with that underpayment. It is important for individuals and fiduciaries to understand their obligations under state law to avoid potential legal consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2105 9 are critical for compliance. Typically, the form must be filed by the due date of your income tax return. If you are required to pay estimated taxes, you should also be aware of the quarterly payment deadlines. Missing these deadlines can result in penalties and interest on any unpaid taxes.

Examples of using the Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

Examples of scenarios where the Form IT 2105 9 may be necessary include:

- A self-employed individual who did not pay enough estimated taxes throughout the year.

- A fiduciary responsible for managing an estate that has income but did not account for estimated tax payments.

- Individuals who received significant income from investments or other sources that were not subject to withholding.

Who Issues the Form

The Form IT 2105 9 is issued by the New York State Department of Taxation and Finance. This department is responsible for administering the state's tax laws and ensuring compliance among taxpayers. It is essential to use the most current version of the form, as updates may occur to reflect changes in tax law.

Quick guide on how to complete form it 2105 9 underpayment of estimated income tax by individuals and fiduciaries tax year

Effortlessly Prepare Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year on any device with the airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to Modify and Electronically Sign Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year with Ease

- Locate Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2105 9 underpayment of estimated income tax by individuals and fiduciaries tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 2105 9 underpayment of estimated income tax by individuals and fiduciaries tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the cost of using airSlate SignNow for 2021 NY estimated documents?

The pricing for airSlate SignNow is designed to be budget-friendly, making it an ideal choice for businesses needing to handle 2021 NY estimated documents. Plans start at a competitive rate, allowing you to choose a subscription that fits your budget while providing essential features. This cost-effective solution ensures you can manage all your eSigning needs without overspending.

-

How does airSlate SignNow simplify the eSigning process for 2021 NY estimated forms?

airSlate SignNow simplifies the eSigning process by allowing users to electronically sign documents in just a few clicks, streamlining the handling of 2021 NY estimated forms. The platform offers templates and easy-to-use features that minimize the turnaround time for signatures, making it efficient for both senders and signers. This user-friendly experience is essential for businesses dealing with time-sensitive documents.

-

What features does airSlate SignNow offer for managing 2021 NY estimated documents?

airSlate SignNow provides a robust set of features tailored for managing 2021 NY estimated documents, including templates, customizable workflows, and real-time tracking. The platform also allows you to add fields for signatures, dates, and other important information directly to your documents. These features help ensure that your documentation is accurate and compliant with regulations.

-

Can airSlate SignNow integrate with other software for handling 2021 NY estimated documents?

Yes, airSlate SignNow offers seamless integrations with various software solutions, enhancing your workflow for 2021 NY estimated documents. This includes popular tools like Google Drive, Salesforce, and more, allowing you to manage your documents without switching platforms. These integrations improve efficiency and provide a smoother experience for users.

-

Is airSlate SignNow secure for signing 2021 NY estimated documents?

Absolutely, airSlate SignNow prioritizes security when it comes to signing 2021 NY estimated documents. The platform uses industry-standard encryption to protect your data, ensuring that all signatures and document exchanges are secure. Compliance with legal standards also adds an extra layer of trust for businesses and their clients.

-

What benefits does airSlate SignNow provide for small businesses dealing with 2021 NY estimated documents?

For small businesses, airSlate SignNow offers numerous benefits when handling 2021 NY estimated documents, including cost savings and increased efficiency. The platform enables faster turnaround times for contracts and signatures, allowing businesses to focus on growth rather than paperwork. This streamlined process helps small companies stay competitive in their respective markets.

-

How can I get support if I have questions about 2021 NY estimated documents in airSlate SignNow?

airSlate SignNow provides comprehensive support for users with questions about 2021 NY estimated documents. You can access a dedicated help center, FAQs, or contact customer support for personalized assistance. The support team is equipped to help you navigate any issues and ensure you maximize the benefits of the platform.

Get more for Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

- Transcript purchase order third circuit instructions form

- Circuit criminal appeal form

- Notice acknowledgment service by mail ao440a federal court forms on hotdocs

- Disability certification form western new england university assets wne

- Ftcc form a 14 revised 03072013 academic agreement review faytechcc

- Scope appointment form

- Application for waiver of distance city of fort pierce form

- Application government guam form

Find out other Form IT 2105 9 Underpayment Of Estimated Income Tax By Individuals And Fiduciaries Tax Year

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template