it 2105 2018

What is the IT 2105?

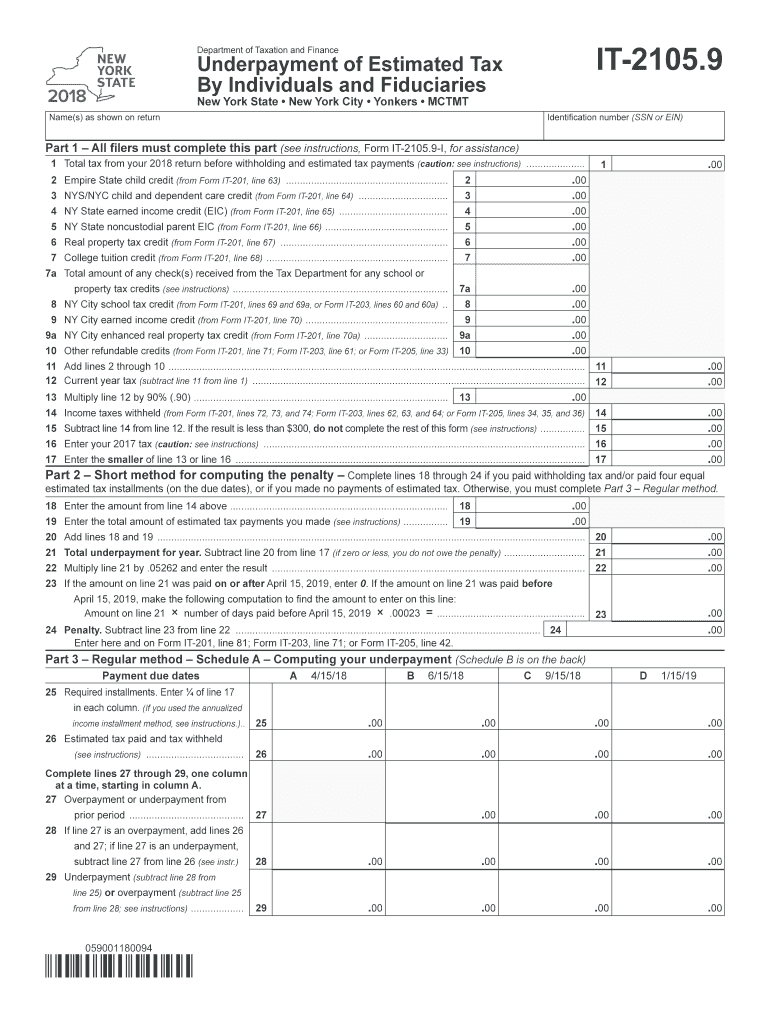

The IT 2105 is a New York State tax form used primarily for calculating the amount of estimated income tax that individuals need to pay. It is essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their annual return. The form helps ensure that individuals meet their tax obligations throughout the year, preventing any potential penalties for underpayment.

How to Use the IT 2105

Using the IT 2105 involves several steps that help taxpayers accurately estimate their tax liability. First, gather your income information, including wages, interest, and any other income sources. Next, determine your expected deductions and credits for the tax year. The form provides a structured format to input this information, allowing you to calculate your estimated tax due. It is crucial to review the instructions carefully to ensure accuracy and compliance with New York State tax laws.

Steps to Complete the IT 2105

Completing the IT 2105 requires a systematic approach:

- Begin by entering your personal information, including your name and Social Security number.

- Input your estimated income for the year, including wages and other sources.

- Calculate your total deductions and credits, which will reduce your taxable income.

- Follow the form's calculations to determine your estimated tax liability.

- Finally, submit the form according to the provided instructions, ensuring you meet the filing deadlines.

Legal Use of the IT 2105

The IT 2105 is legally binding when completed accurately and submitted on time. It is essential to ensure that all information provided is truthful and reflects your financial situation. Failure to comply with the legal requirements can result in penalties, including interest on unpaid taxes. The form must be filed in accordance with New York State tax regulations to maintain its validity.

Filing Deadlines / Important Dates

Taxpayers must be aware of key deadlines associated with the IT 2105. Generally, estimated tax payments are due quarterly, with specific dates set by the New York State Department of Taxation and Finance. Missing these deadlines can lead to penalties and interest charges. It is advisable to mark these dates on your calendar to ensure timely submission of payments.

Who Issues the Form

The IT 2105 is issued by the New York State Department of Taxation and Finance. This agency is responsible for administering state tax laws, including the collection of income taxes. The form is available through their official website and can be obtained in both digital and paper formats, making it accessible for all taxpayers.

Quick guide on how to complete it 2105 9 2018 2019 form

Effortlessly Prepare It 2105 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely keep it in the cloud. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly and without delay. Manage It 2105 on any platform using the airSlate SignNow mobile applications for Android or iOS and simplify your document-related tasks today.

How to Modify and Electronically Sign It 2105 with Ease

- Find It 2105 and click Get Form to begin.

- Use the tools we offer to complete your form.

- Mark pertinent sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal weight as a handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for submitting your form—via email, SMS, or invitation link—or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign It 2105 to ensure smooth communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it 2105 9 2018 2019 form

Create this form in 5 minutes!

How to create an eSignature for the it 2105 9 2018 2019 form

How to create an eSignature for the It 2105 9 2018 2019 Form online

How to make an eSignature for the It 2105 9 2018 2019 Form in Google Chrome

How to generate an eSignature for signing the It 2105 9 2018 2019 Form in Gmail

How to create an eSignature for the It 2105 9 2018 2019 Form straight from your smart phone

How to generate an electronic signature for the It 2105 9 2018 2019 Form on iOS devices

How to create an eSignature for the It 2105 9 2018 2019 Form on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to It 2105?

airSlate SignNow is a versatile eSignature solution that simplifies document management and signing processes for businesses. It 2105 refers to a specific document or form that can be easily handled within the SignNow platform, allowing for seamless electronic signatures and efficient workflow management.

-

How much does airSlate SignNow cost for users needing It 2105?

The pricing for airSlate SignNow varies based on the chosen plan, but it is designed to be cost-effective for businesses of all sizes. Users looking to manage documents like It 2105 can choose from different tiers, ensuring they get the features they need without overspending.

-

What features does airSlate SignNow offer for managing It 2105 documents?

airSlate SignNow offers robust features such as customizable templates, secure eSigning, and automated workflows that can signNowly enhance your experience with It 2105 documents. Users can easily track the status of their documents and ensure compliance, all in one platform.

-

Can airSlate SignNow integrate with other software for handling It 2105?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing its utility for managing It 2105 documents. These integrations allow businesses to streamline their workflows and improve productivity by connecting their existing tools with SignNow.

-

What benefits does airSlate SignNow provide for businesses using It 2105?

Using airSlate SignNow for It 2105 offers numerous benefits, including time savings, reduced paperwork, and enhanced security for sensitive documents. Businesses can improve their efficiency by automating the signing process and ensuring that all document interactions are legally binding.

-

Is airSlate SignNow user-friendly for handling It 2105?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to handle It 2105 documents regardless of their technical expertise. Its intuitive interface allows users to navigate the software confidently, ensuring quick adoption and minimal training needs.

-

How secure is airSlate SignNow when signing It 2105 documents?

airSlate SignNow prioritizes security with advanced encryption protocols and compliance with industry regulations, ensuring that your It 2105 documents remain safe. Users can trust that their data is protected throughout the signing process, providing peace of mind.

Get more for It 2105

- Florida warranty deed individual grantors title guarantee inc form

- Florida affidavit of non identity title guarantee inc form

- Gmm smime 091507indd until today mobile computer accessories were form factor specific designs that forced enterprises to

- Savaran weblog die achillesfersen von hartz iv httpsavaran form

- 100 black men of west texas inc webs form

- Da form 5008 oct 81 tripod

- Charge sheet dd form 458 may 2000 tripod

- Blank florida accident reports form

Find out other It 2105

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document