Form 600s 2019

What is the Form 600s

The Form 600s is a specific tax form used primarily for reporting certain types of income and deductions to the Internal Revenue Service (IRS). It is essential for individuals and businesses to accurately report their financial activities to ensure compliance with federal tax regulations. The form is designed to capture various financial details, which may include income from self-employment, investments, and other sources. Understanding the purpose and requirements of the Form 600s is crucial for effective tax reporting.

How to use the Form 600s

Using the Form 600s involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts for deductions, and any other relevant paperwork. Next, carefully fill out the form, ensuring that all sections are completed accurately. It's important to double-check your entries for any errors that could lead to complications with the IRS. After completing the form, you can submit it electronically or via traditional mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the Form 600s

Completing the Form 600s requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, including W-2s, 1099s, and receipts.

- Start by entering your personal information, such as your name, address, and Social Security number.

- Report your income in the designated sections, ensuring all sources are included.

- List any deductions you are eligible for, providing supporting details where necessary.

- Review the completed form for accuracy, checking for any missing information or errors.

- Submit the form electronically through a secure platform or mail it to the appropriate IRS address.

Legal use of the Form 600s

The Form 600s must be used in accordance with IRS regulations to ensure its legal validity. This includes adhering to deadlines for submission and maintaining accurate records of all reported income and deductions. Failure to comply with these regulations can result in penalties or audits by the IRS. It is essential to understand the legal implications of the information reported on the form, as inaccuracies can lead to significant financial consequences.

Filing Deadlines / Important Dates

Filing deadlines for the Form 600s are critical to avoid penalties. Typically, the form must be submitted by April fifteenth of the following tax year. However, if you are unable to meet this deadline, you may request an extension, which can provide additional time for submission. It is important to stay informed about any changes to deadlines or filing requirements announced by the IRS, as these can vary from year to year.

Required Documents

To complete the Form 600s accurately, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Receipts for deductible expenses

- Bank statements for income verification

- Any additional documentation that supports your income and deductions

Having these documents ready will streamline the process of filling out the form and help ensure compliance with IRS regulations.

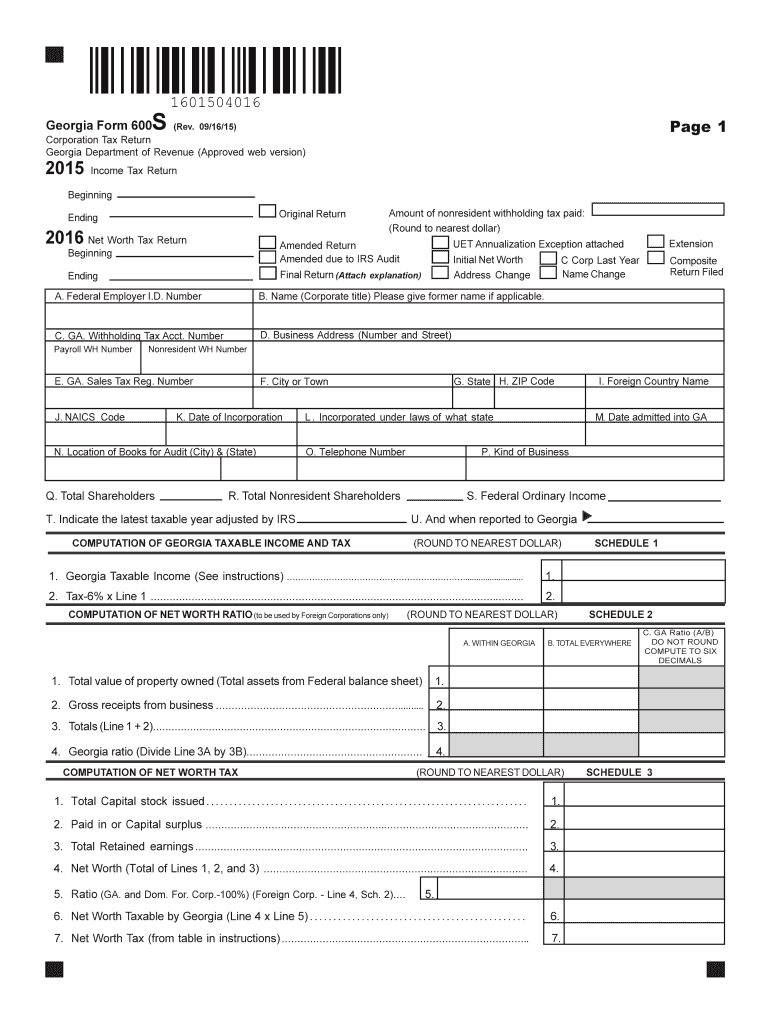

Quick guide on how to complete form 600s 2015

Complete Form 600s effortlessly on any device

Online document handling has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily locate the right form and securely save it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without complications. Manage Form 600s on any platform using the airSlate SignNow Android or iOS applications and streamline any document-based task today.

The most efficient way to alter and eSign Form 600s without hassle

- Locate Form 600s and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize essential sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills your document management needs in just a few clicks from your device of choice. Edit and eSign Form 600s while ensuring clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 600s 2015

Create this form in 5 minutes!

How to create an eSignature for the form 600s 2015

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The way to make an electronic signature for a PDF file on Android

People also ask

-

What are Form 600s and how does airSlate SignNow help with them?

Form 600s are essential documents often required by various organizations for compliance and record-keeping. With airSlate SignNow, you can easily create, send, and eSign Form 600s, streamlining your document management process and ensuring that you meet all necessary requirements.

-

What features does airSlate SignNow offer for managing Form 600s?

airSlate SignNow provides robust features for managing Form 600s, including customizable templates, secure storage, and automated workflows. These features ensure that you can efficiently handle your Form 600s while maintaining compliance and data security.

-

How much does it cost to use airSlate SignNow for Form 600s?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes looking to manage Form 600s effectively. By choosing the right plan, you can access essential tools and features at a competitive price, making it a cost-effective solution for your document management needs.

-

Can I integrate airSlate SignNow with other tools for processing Form 600s?

Yes, airSlate SignNow seamlessly integrates with a variety of applications and software, allowing you to manage Form 600s alongside your existing tools. This interoperability enhances productivity, helping your team to easily collaborate on and track Form 600s across different platforms.

-

What are the benefits of using airSlate SignNow for Form 600s?

Using airSlate SignNow for Form 600s offers numerous benefits, including increased efficiency, improved compliance, and reduced paper usage. The platform promotes faster turnaround times and enhances your team's ability to track and manage important documents.

-

Is airSlate SignNow secure for handling Form 600s?

Absolutely! airSlate SignNow prioritizes security, ensuring that all Form 600s are encrypted and protected. The platform complies with industry standards, providing you with the peace of mind that your sensitive documents are safe from unauthorized access.

-

Can signing Form 600s be done from mobile devices?

Yes, airSlate SignNow allows you to sign Form 600s from any mobile device. This flexibility ensures that you can manage and eSign critical documents on-the-go, making the process more convenient for both you and your clients.

Get more for Form 600s

Find out other Form 600s

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will