Form Il 1120 St 2020

What is the Form IL 1120 ST

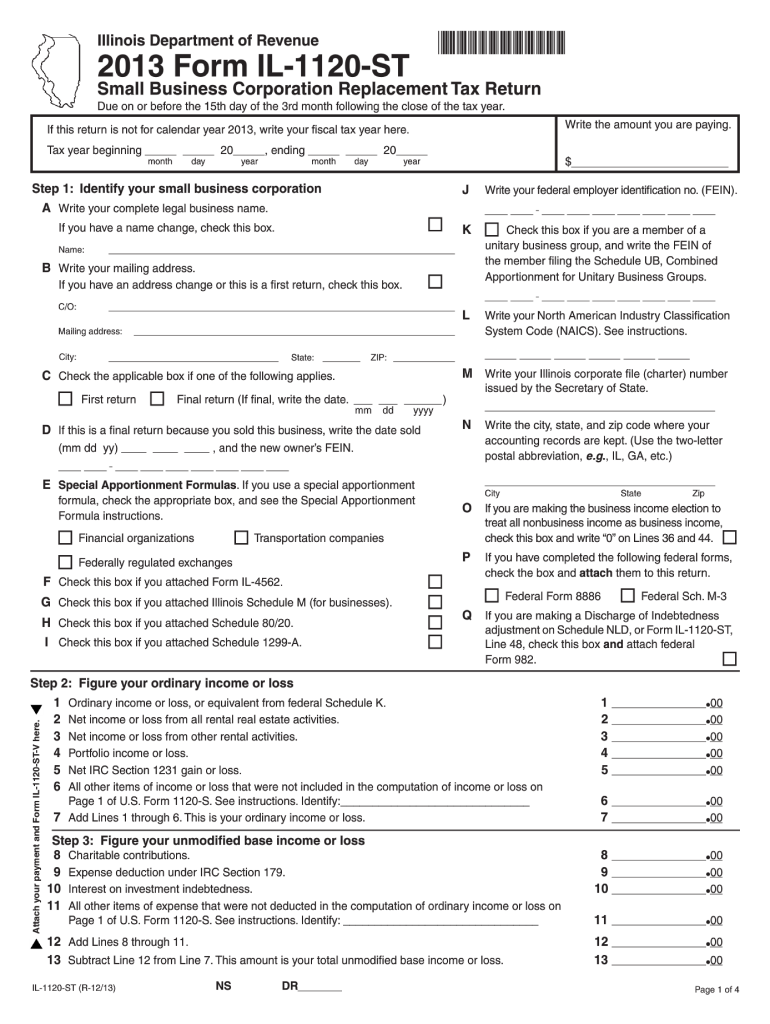

The Form IL 1120 ST is a state tax form used by S corporations in Illinois to report income, deductions, and tax liability. This form is essential for S corporations to comply with state tax regulations and to ensure accurate reporting of their financial activities. It is specifically designed for entities that have elected S corporation status under federal tax law, allowing them to pass income directly to shareholders without facing corporate income tax at the state level.

How to use the Form IL 1120 ST

Using the Form IL 1120 ST involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, fill out the form by entering the required information, such as total income, deductions, and any applicable credits. After completing the form, review it for accuracy before submitting it to the Illinois Department of Revenue. It is crucial to ensure that all information is correct to avoid potential penalties or delays in processing.

Steps to complete the Form IL 1120 ST

Completing the Form IL 1120 ST requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, including previous tax returns and current financial statements.

- Fill in the business information section, including the name, address, and federal employer identification number (EIN).

- Report total income from all sources, including sales and services.

- List all allowable deductions, such as business expenses and contributions.

- Calculate the total tax liability based on the income and deductions reported.

- Review the form for completeness and accuracy before signing and dating it.

Legal use of the Form IL 1120 ST

The legal use of the Form IL 1120 ST is governed by Illinois state tax laws. S corporations must file this form annually to report their income and pay any taxes owed. Failure to file the form correctly or on time can result in penalties, interest on unpaid taxes, and potential legal consequences. It is essential for S corporations to understand their obligations under Illinois law to maintain compliance and avoid legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form IL 1120 ST are crucial for S corporations to adhere to. Typically, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is March 15. It is important to stay informed about any changes to deadlines or requirements that may arise from state tax law updates.

Form Submission Methods (Online / Mail / In-Person)

The Form IL 1120 ST can be submitted through various methods, providing flexibility for S corporations. Options include:

- Online Submission: Corporations can file electronically through the Illinois Department of Revenue's online portal.

- Mail: The completed form can be printed and mailed to the appropriate address specified by the Illinois Department of Revenue.

- In-Person: Corporations may also choose to deliver the form in person to a local Department of Revenue office.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form IL 1120 ST can lead to significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential for S corporations to file their forms accurately and on time to avoid these consequences and maintain good standing with the state.

Quick guide on how to complete 2013 form il 1120 st

Prepare Form Il 1120 St effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Handle Form Il 1120 St on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Form Il 1120 St effortlessly

- Locate Form Il 1120 St and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form Il 1120 St and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 form il 1120 st

Create this form in 5 minutes!

How to create an eSignature for the 2013 form il 1120 st

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The best way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form Il 1120 St and who needs it?

Form Il 1120 St is a state tax form that corporations must file in Illinois. It is primarily required for businesses that operate in Illinois and seek to comply with state tax regulations. Understanding this form is essential for maintaining compliance and avoiding penalties.

-

How does airSlate SignNow help with Form Il 1120 St e-signing?

airSlate SignNow offers an efficient solution for e-signing Form Il 1120 St, enabling businesses to send, sign, and manage documents electronically. This streamlines the submission process, ensuring that forms are completed accurately and on time. With airSlate SignNow, you can easily track signatures and maintain a centralized document repository.

-

What are the pricing options for using airSlate SignNow for Form Il 1120 St?

airSlate SignNow provides flexible pricing plans designed to suit different business needs, regardless of size. Pricing typically varies based on the features required and the number of users. Investing in airSlate SignNow for Form Il 1120 St can lead to signNow time and cost savings compared to traditional paper processes.

-

What features does airSlate SignNow offer for managing Form Il 1120 St?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and audit trails specifically for managing Form Il 1120 St. These functionalities help ensure that your documents are correctly filled out, securely stored, and easily retrievable. Additionally, templates can simplify repetitive tasks, enhancing efficiency.

-

Can I integrate airSlate SignNow with other software for managing Form Il 1120 St?

Yes, airSlate SignNow integrates seamlessly with various business applications, making it easy to manage Form Il 1120 St alongside your existing workflows. Integrations with platforms like Google Drive, Salesforce, and others enhance productivity by allowing users to work within their preferred tools while managing their forms.

-

What are the benefits of using airSlate SignNow for Form Il 1120 St compared to traditional methods?

Using airSlate SignNow for Form Il 1120 St eliminates the hassles of paper-based processes, such as printing, scanning, and mailing. Its user-friendly interface facilitates quicker completion and increases accuracy through built-in validation. Overall, airSlate SignNow enhances operational efficiency and scalability for businesses.

-

Is airSlate SignNow compliant with regulations for e-signing Form Il 1120 St?

Yes, airSlate SignNow complies with all applicable regulations for electronic signatures, ensuring that your e-signed Form Il 1120 St is legally valid. The platform meets industry standards, including ESIGN and UETA, giving users the confidence that their documents are secure and compliant with legal requirements.

Get more for Form Il 1120 St

Find out other Form Il 1120 St

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors