Form it 2663 IInstructions for Form it 2663 Nonresident Real Tax Ny 2020

What is the Form IT 2663 Instructions For Form IT 2663 Nonresident Real Tax NY

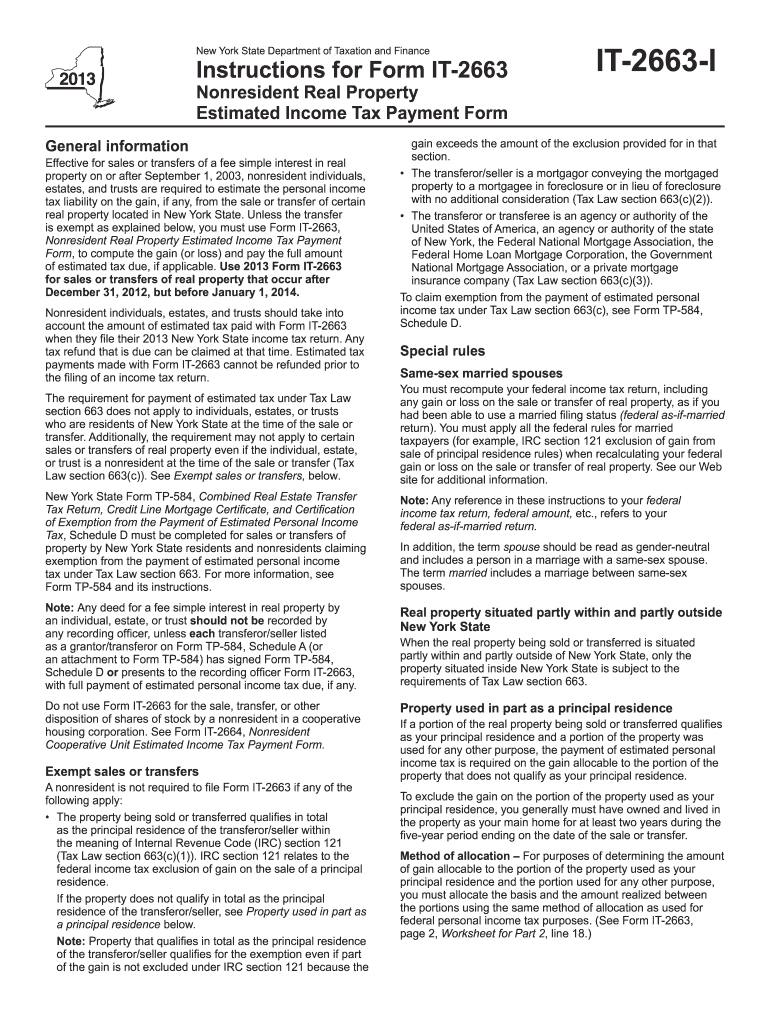

The Form IT 2663 is a tax form used by nonresident individuals who sell or transfer real property located in New York State. This form is essential for reporting the gain or loss from the sale and ensuring compliance with New York tax laws. The instructions for this form provide detailed guidance on how to accurately complete it, including the necessary calculations and required information. Understanding the purpose of this form is crucial for nonresidents to avoid potential penalties and ensure proper tax reporting.

Steps to complete the Form IT 2663 Instructions For Form IT 2663 Nonresident Real Tax NY

Completing the Form IT 2663 involves several key steps to ensure accuracy and compliance. First, gather all relevant documentation related to the property sale, including purchase price, selling expenses, and any improvements made to the property. Next, follow the instructions to fill out each section of the form, ensuring that all calculations are accurate. It is important to double-check your entries for any errors. Once completed, sign and date the form as required. Finally, submit the form according to the specified submission methods outlined in the instructions.

Key elements of the Form IT 2663 Instructions For Form IT 2663 Nonresident Real Tax NY

The Form IT 2663 includes several key elements that are essential for proper completion. These elements typically consist of the seller's information, details about the property being sold, and the calculation of the gain or loss from the sale. Additionally, the form requires information regarding any withholding tax obligations. Understanding these key components is vital for ensuring that the form is filled out correctly and that all necessary information is included.

Legal use of the Form IT 2663 Instructions For Form IT 2663 Nonresident Real Tax NY

The legal use of the Form IT 2663 is governed by New York State tax laws. This form must be used by nonresidents to report the sale of real property and to fulfill any withholding tax requirements. It is important to complete the form accurately to avoid legal issues, such as penalties or audits. The instructions provide guidance on the legal implications of the form, including the importance of compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 2663 are critical for nonresidents to adhere to in order to avoid penalties. Typically, the form must be filed within a specified timeframe following the sale of the property. The instructions outline these important dates, including any extensions that may apply. Keeping track of these deadlines ensures that you remain compliant with New York tax laws and helps avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Form IT 2663 can be done through various methods, depending on the preferences of the filer. The instructions detail the options available, including online submission, mailing the completed form, or submitting it in person at designated locations. Each method has its own requirements and processing times, so it is important to choose the one that best suits your needs while ensuring timely compliance with filing obligations.

Quick guide on how to complete form it 2663 i2013instructions for form it 2663 nonresident real tax ny

Effortlessly Prepare Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny on any device using the airSlate SignNow apps for Android or iOS and enhance any document-centric workflow today.

The easiest way to modify and electronically sign Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny with ease

- Locate Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny and click Get Form to initiate the process.

- Utilize our provided tools to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to secure your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming searches for forms, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 2663 i2013instructions for form it 2663 nonresident real tax ny

Create this form in 5 minutes!

How to create an eSignature for the form it 2663 i2013instructions for form it 2663 nonresident real tax ny

How to generate an electronic signature for your PDF file online

How to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the purpose of Form IT 2663?

Form IT 2663 is used by nonresident individuals and entities to report their New York taxable income from real property sales. Understanding the Form IT 2663 instructions is crucial to ensure compliance with New York tax laws when it comes to real estate transactions.

-

How do I fill out Form IT 2663?

Filling out Form IT 2663 requires accurate reporting of your real estate sales income and any applicable deductions. For detailed guidance, refer to the Form IT 2663 instructions to ensure you provide the correct information and adhere to all requirements set by New York tax authorities.

-

What are the filing deadlines for Form IT 2663?

The filing deadlines for Form IT 2663 are generally aligned with the date of the real estate sale. It is important to submit the form promptly to avoid penalties. Always check the New York State Department of Taxation and Finance for specific dates related to Form IT 2663 Nonresident Real Tax NY.

-

What are the benefits of using airSlate SignNow for Form IT 2663?

Using airSlate SignNow streamlines the process of electronically signing and submitting Form IT 2663, making it more efficient and secure. Our platform is user-friendly and helps you save time while ensuring compliance with Form IT 2663 instructions for Form IT 2663 Nonresident Real Tax NY.

-

Can I integrate airSlate SignNow with other accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing for efficient management of your tax documents, including Form IT 2663. This integration ensures that all your data is centralized and accessible for smooth operations when filing Form IT 2663 Nonresident Real Tax NY.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as document templates, eSignature capabilities, and real-time tracking to enhance your document management process. These tools are particularly beneficial for managing Form IT 2663 and adhering to the required instructions for Form IT 2663 Nonresident Real Tax NY.

-

Is airSlate SignNow cost-effective for small businesses?

Absolutely, airSlate SignNow offers cost-effective plans that cater to small businesses, ensuring you have access to essential features for managing documents like Form IT 2663. Our pricing is designed to provide great value without compromising on quality, making it ideal for handling Form IT 2663 Nonresident Real Tax NY.

Get more for Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny

- Request for price quote email sample pdf form

- Wavecrest management application pdf form

- Patient profile form pdf

- Bible expositor and illuminator pdf form

- How to withdraw money from axa philippines form

- Grammar for writing grade 11 answer key form

- Br 19 form

- Utah 4 h afterschool member registration form office use utah4h

Find out other Form IT 2663 IInstructions For Form IT 2663 Nonresident Real Tax Ny

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form