Ct 3 Form 2020

What is the Ct 3 Form

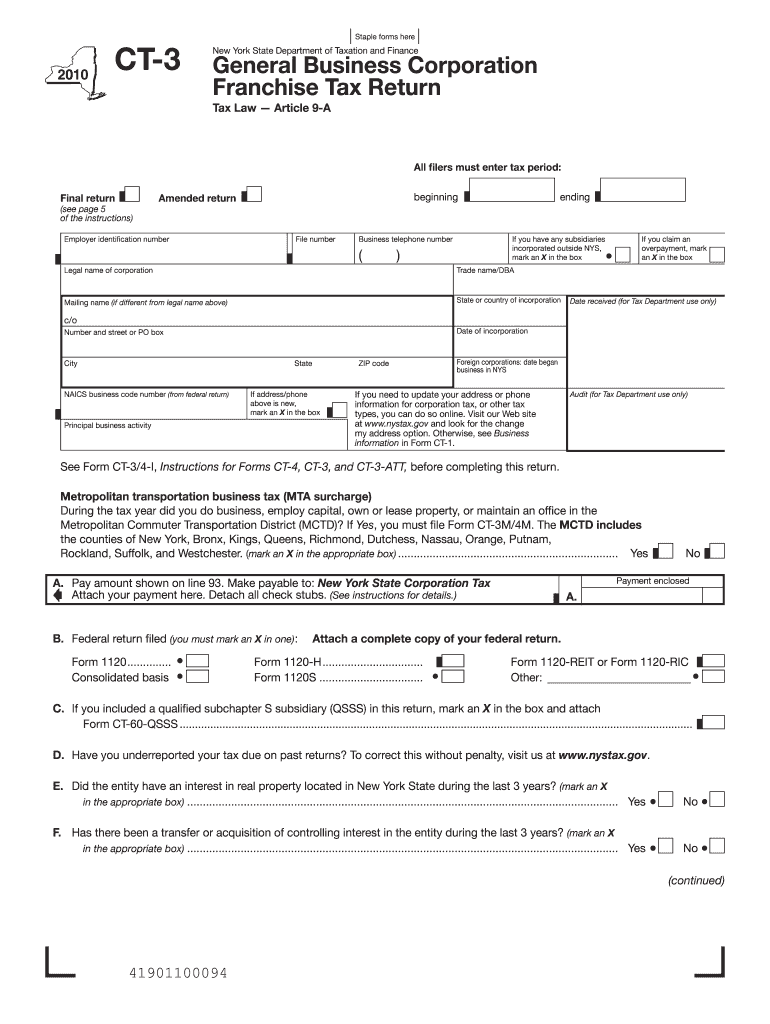

The Ct 3 Form is a tax document used by corporations in the state of New York to report income, calculate taxes owed, and claim any applicable credits. This form is essential for corporations operating within New York, as it ensures compliance with state tax regulations. The information provided on the Ct 3 Form helps the New York State Department of Taxation and Finance assess the corporation's tax liability accurately.

How to use the Ct 3 Form

Using the Ct 3 Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and expense records. Next, complete the form by entering your corporation's financial data in the designated sections. Be sure to double-check all calculations and ensure that all required fields are filled out. Once completed, the form can be submitted either electronically or by mail, depending on your preference and the guidelines provided by the state.

Steps to complete the Ct 3 Form

Completing the Ct 3 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather financial records, including income statements and balance sheets.

- Fill out the identification section with your corporation's name, address, and employer identification number (EIN).

- Report total income, including gross receipts and any other income sources.

- Deduct allowable business expenses to arrive at taxable income.

- Calculate the tax due based on the applicable tax rate for your corporation type.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Ct 3 Form

The Ct 3 Form is legally binding when completed and submitted according to New York State tax laws. It must be filled out truthfully, as providing false information can lead to severe penalties, including fines and potential criminal charges. Compliance with the legal requirements ensures that your corporation remains in good standing with state authorities.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the Ct 3 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. It is crucial to stay informed about any changes in deadlines or additional requirements that may arise.

Form Submission Methods

The Ct 3 Form can be submitted through various methods, offering flexibility for corporations. Options include:

- Electronic filing through the New York State Department of Taxation and Finance website.

- Mailing a paper copy of the form to the appropriate address provided by the state.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete ct 3 2010 form

Complete Ct 3 Form seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can quickly find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without interruptions. Manage Ct 3 Form on any platform with airSlate SignNow Android or iOS applications and ease any document-based tasks today.

The easiest way to modify and eSign Ct 3 Form effortlessly

- Find Ct 3 Form and then click Get Form to start.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Ct 3 Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct 3 2010 form

Create this form in 5 minutes!

How to create an eSignature for the ct 3 2010 form

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is a Ct 3 Form?

A Ct 3 Form is a tax return filed by corporations in Connecticut to report their income, deductions, and tax liabilities. It's essential for businesses to accurately complete this form to comply with state regulations and avoid penalties. Understanding how to properly fill out the Ct 3 Form can streamline your reporting process.

-

How can airSlate SignNow help with the Ct 3 Form?

airSlate SignNow provides a seamless electronic signing solution that simplifies the process of submitting your Ct 3 Form. With our user-friendly platform, businesses can easily prepare, send, and eSign their forms, ensuring that all necessary documentation is completed quickly and efficiently. This not only saves time but also enhances compliance with filing requirements.

-

Is airSlate SignNow cost-effective for handling the Ct 3 Form?

Yes, airSlate SignNow is a cost-effective solution for handling your Ct 3 Form. The platform offers flexible pricing plans to meet the needs of businesses of all sizes. By eliminating the need for paper, ink, and mailing costs, our service ensures that you can manage your tax forms efficiently while keeping expenses low.

-

Can I integrate airSlate SignNow with other tools for my Ct 3 Form process?

Absolutely! airSlate SignNow integrates easily with various tools and platforms, streamlining the process for managing your Ct 3 Form. Whether you use CRM systems, cloud storage services, or project management tools, our integrations enhance your workflow and ensure that all your documents are linked and accessible.

-

What are the benefits of using airSlate SignNow for the Ct 3 Form?

Using airSlate SignNow for the Ct 3 Form offers numerous benefits, including increased efficiency, enhanced collaboration, and improved security. Our platform allows multiple users to review and sign the form promptly, reducing delays in your filing process. Additionally, with encryption and secure storage, you can trust that your documents are safe.

-

Do I need any special training to use airSlate SignNow for the Ct 3 Form?

No special training is required to use airSlate SignNow for your Ct 3 Form. The platform is designed to be intuitive and user-friendly, enabling anyone to navigate its features easily. We also provide resources and support to help users get started and maximize their experience.

-

Can I track the status of my Ct 3 Form sent through airSlate SignNow?

Yes, airSlate SignNow offers comprehensive tracking features for all documents, including your Ct 3 Form. You can easily check the status of the document, see when it was viewed, signed, and completed, allowing you to stay informed throughout the process. This transparency helps you manage your filing in a timely manner.

Get more for Ct 3 Form

Find out other Ct 3 Form

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF